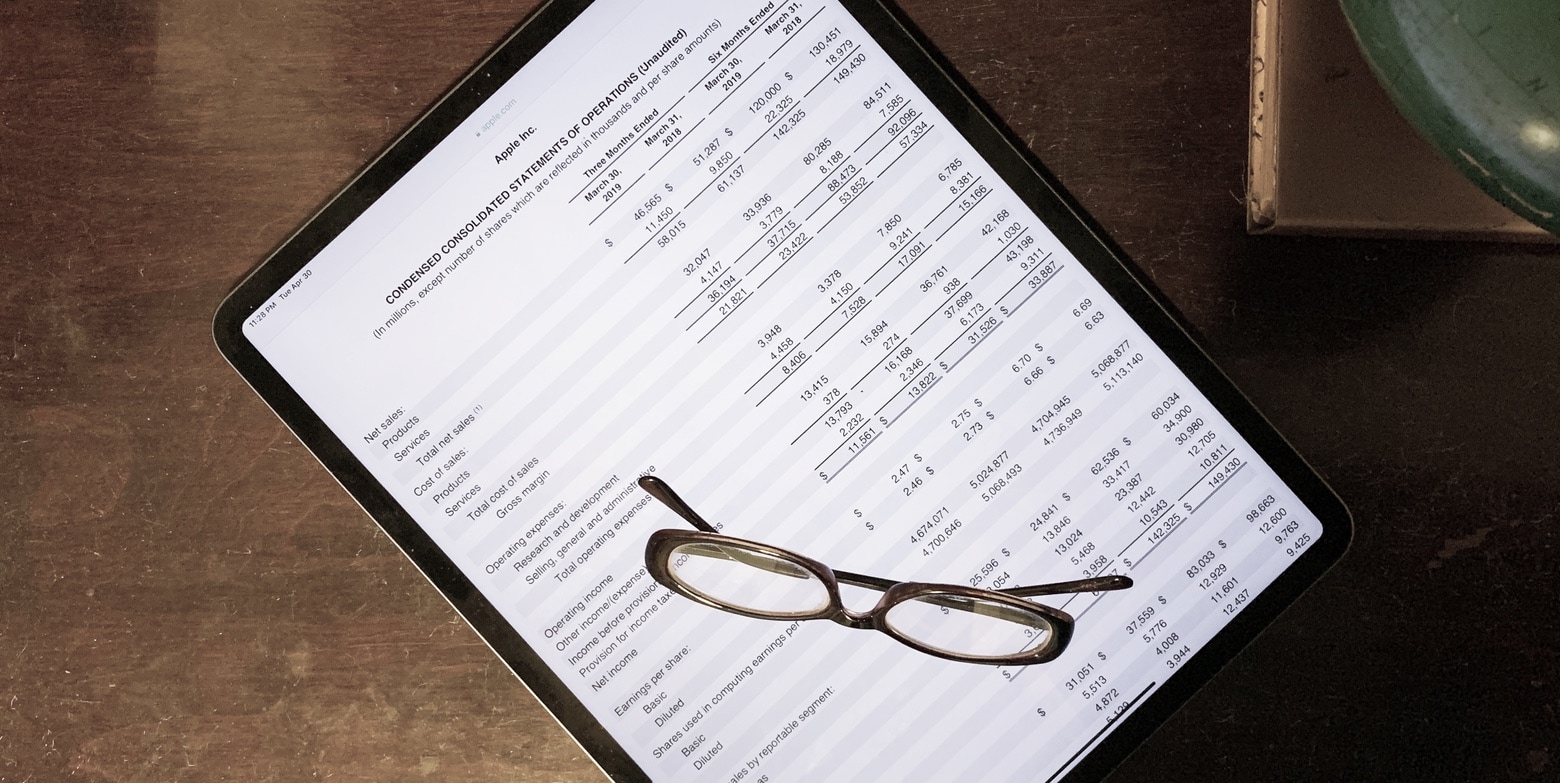

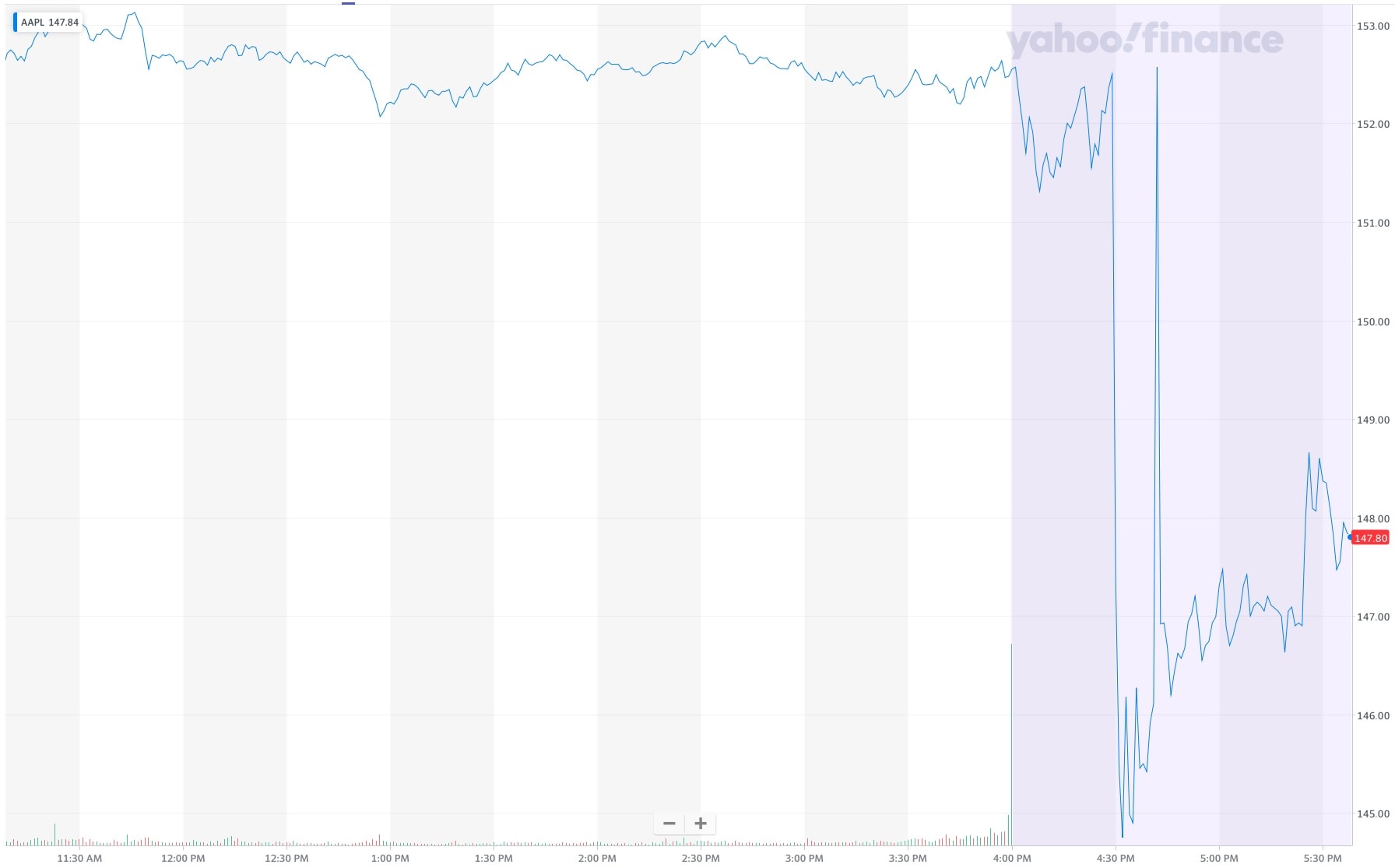

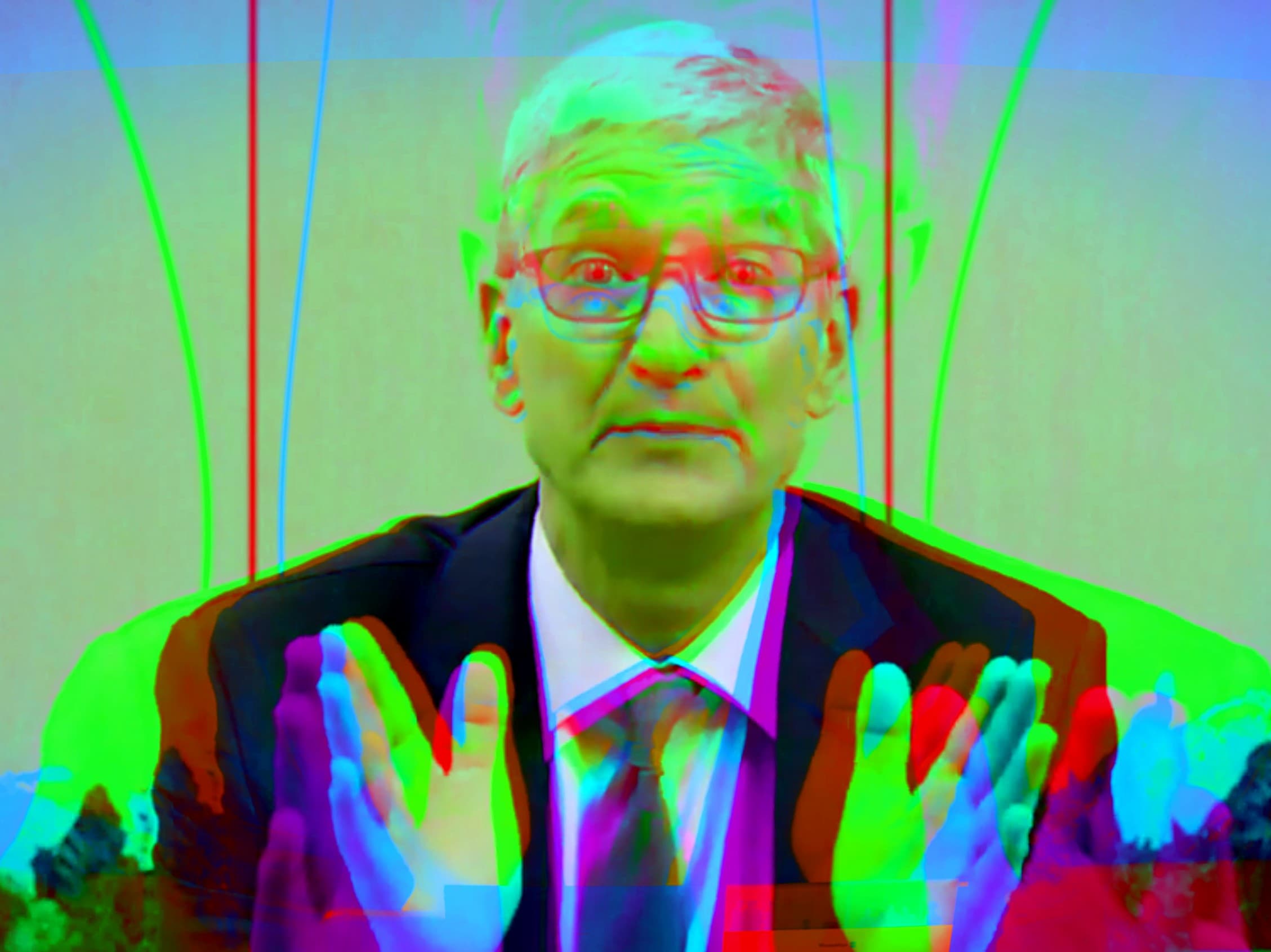

“I am proud to say that we just had a quarter for the record books,” Apple CEO Tim Cook said during Thursday’s earnings call, before rattling off numbers that surprised Wall Street analysts — in a good way.

The highly successful quarter was also one for the stat geeks. Apple racked up several all-time highs during the quarter (technically Apple’s Q1 2026). From overall revenue (a new all-time high!) to customer satisfaction ratings (through the roof!), the numbers Apple put up during the 2026 holiday quarter will blow your mind.

![Bad news for Apple AR glasses, good news for CarPlay and Siri [The CultCast] AI-generated image of AR glasses with the word](https://www.cultofmac.com/wp-content/uploads/2025/02/CultCast-684-Apple-AR-glasses-canceled.jpg)

![The latest AirTag and Apple Watch rumors make us giddy [The CultCast] An Apple AirTag and an Apple Watch Ultra: We're talking the latest Apple rumors on The CultCast, episode 606.](https://www.cultofmac.com/wp-content/uploads/2023/08/CultCast-606-Apple-Watch-AirTag-rumors.jpg)

![New MacBook Air is even faster than we dreamed [The CultCast] The CultCast Apple podcast: These MacBook Air benchmarks show what a screamer the M2 chip really is.](https://www.cultofmac.com/wp-content/uploads/2022/08/CultCast-556-MacBook-Air-M2.jpg)

![10 years of iPad: How Apple’s tablet changed mobile computing [Cult of Mac Magazine 334] 10 years of iPad: How Apple's tablet changed mobile computing.](https://www.cultofmac.com/wp-content/uploads/2020/02/COM-MAG-334_4.jpg)