Apple’s holiday quarter financial results offer good news for investors. iPhone is doing great! And CEO Tim Cook talked about AI. But there’s rotten news coming out of China.

We pored over the results, and listened to the call Apple executives held Thursday with Wall Street analysts, so you don’t have to. Here’s the information you ought to know.

Key takeaways from Apple’s FY 24 first quarter earnings call

Four times a year, Apple issues an earnings report outlining its performance for the previous quarter. Then CEO Tim Cook and CFO Luca Maestri hop on a conference call with investors. Typically they rehash all Apple’s highly scripted talking points, then open the call to questions.

During Thursday’s Apple earnings call, the execs talked about Vision Pro, artificial intelligence and the company’s future plans. Here are seven interesting nuggets.

1. Apple’s total revenue is growing again. Huzzah!

Apple suffered through four straight quarters of declining revenue, so it’s a big deal that the company snapped that losing streak in the final three months of 2023. Apple’s total revenue rose a mere 2%, but growth is growth, right? Especially when the difference is $2.4 billion.

The company reported increasing revenue from iPhone and Mac sales as well as its services sector. This could be a sign that Apple is moving past the post-pandemic doldrums. So maybe we’re in the post-post-pandemic period when some people are finally shopping for a replacement for the Mac they bought at the beginning of the COVID-19 lockdown in 2020. — Ed Hardy

2. Apple has its eye on AI, Vision Pro — and the future

Thursday’s earnings call came on the eve of the Vision Pro launch. In his opening remarks, Cook gushed about the headset’s capabilities and technical innovation.

“Moments like these are what we live for at Apple,” he said. “They’re why we do what we do. They’re why we’re so unflinchingly dedicated to groundbreaking innovation and why we’re so focused on pushing technology to its limits as we work to enrich the lives of our users.”

He also took the opportunity to tout Apple’s work in AI. While the company is widely perceived as behind the curve in the buzziest sector of the tech industry, Cook played up Apple’s use of AI and machine learning in all its products.

“As we look ahead, we will continue to invest in these and other technologies that will shape the future,” Cook said. “That includes artificial intelligence, where we continue to spend a tremendous amount of time and effort and we’re excited to share the details of our ongoing work in that space later this year.” — Lewis Wallace

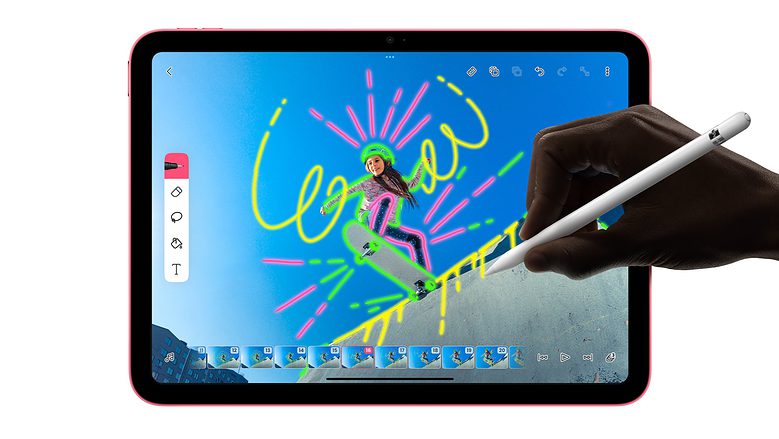

3. No new iPads means no new iPad sales bumps

Photo: Apple

Apple released no new iPads at all in 2023. None. Zip. So it should surprise exactly no one that revenue from iPad tanked in the final quarter of the year. With the newest tablets coming out in 2022, fewer holiday shoppers put iPads on their gift lists. And the result hit Apple’s results hard.

“iPad was $7 billion in revenue, down 25% year over year,” said Maestri during the call with analysts. “iPad faced a difficult compare because during the December quarter last year, we launched the new iPad Pro and iPad 10th generation, and we had an extra week of sales.”

But Maestri tried to put a positive spin on it. “The iPad installed base continues to grow and is an all-time high,” he said, “with over half of the customers who purchase iPads during the quarter being new to the product.”

Due to Apple’s cone of silence, the exec couldn’t talk about the leaks that point to multiple iPads on the way this spring. That includes the first iPad Air with a 12.9-inch screen and a 13-inch iPad Pro with an OLED display. — Ed Hardy

4. Surging iPhone sales prop up Apple earnings

Apple’s holiday quarter earnings figures might have looked a lot worse if not for the iPhone’s strong sales. The handsets brought in $69.7 billion during the quarter, a 6% increase year over year.

And iPhone sales surged even in the face of certain headwinds, Maestri said. The same quarter of the previous year had advantages and disadvantages, which made comparing it to the most recent quarter challenging.

“First, we had an additional week in [last year’s] quarter and second, we had COVID-related factory shutdowns that limited iPhone supply,” he said. Despite that, iPhone sales set all-time revenue records in Europe and the Asia Pacific region during the 2023 holiday quarter, and saw double-digit growth in most emerging markets.

“We also, importantly, set an all-time record worldwide for iPhone upgraders,” Cook said. And that’s not all. The active install base for iPhone rose to an all-time high.

Both Cook and Maestri cited surveys showing iPhone’s dominance as well. iPhones take up four of the top five spots for popularity in the United States and Japan, four of the top six models in urban China and the United Kingdom, and the top five models in Australia, they said. — David Snow

5. Apple sees a big business market for Vision Pro

Screenshot: Apple

Given that the Vision Pro arrives Friday, the mixed-reality headset came up a lot on Thursday’s earnings call — including in an unexpected context. It might turn out to be a big deal for Apple not just among consumers, but in the business market.

“We are incredibly excited about the enterprise opportunities in front of us,” Cook said, noting several companies have taken demos on the device, which could join Macs, iPads and iPhones in business use. “I think there’s a nice opportunity there for Vision Pro, as well.”

Maestri got into Vision Pro for enterprise even more.

“With the upcoming launch of Vision Pro, we’ve seen strong excitement in enterprise [among] leading organizations across many industries, such as Walmart, Nike, Vanguard, Stryker, Bloomberg and SAP,” he said.

“They’ve started leveraging and investing in Apple Vision Pro as the new platform to bring innovative spatial computing experiences to their customers and employees,” he added. “From everyday productivity, to collaborative product design, to immersive training, we cannot wait to see the amazing things our enterprise customers create.”

And given that Vision Pro revenues apparently will be counted in Apple’s wearables, home and accessories business — which slumped 11% in the quarter — a boost from the headset could be just the thing next quarter. — David Snow

6. Big trouble in Greater China

With Apple breaking a year-long slowdown in earnings and strong iPhone sales, one would expect APPL shares to go up in after-hours trading. Not so — they dropped about 3% in value. Investors looked at revenue coming from China during the last quarter of 2023 and sold their shares. Why? It’s down 13% year over year.

Revenue coming from China is a closely watched segment of Apple’s business — it is the second biggest market on Earth. And the company pulled in $20.8 billion from there last quarter. Problem is, that’s down from $23.9 billion in the same quarter of the previous year.

When asked about the company’s weak performance in the country, Cook took the long view. “We’ve been in China for 30 years,” he said. “I remain very optimistic about China over the long term.” — Ed Hardy

7. Apple’s a worldwide sensation

Despite the China trouble, Apple’s international reach continues to grow, with the company raking in cash from all corners of the globe.

“We achieved revenue records across more than two dozen countries and regions, including all-time records in Europe and rest of Asia Pacific,” Cook said. “We also continue to see strong double-digit growth in many emerging markets, with all-time records in Malaysia, Mexico, the Philippines, Poland and Turkey, as well as December-quarter records in India, Indonesia, Saudi Arabia and Chile.”

And all those customers (and a healthy ration of price hikes) gave Apple’s growing services segment a boost.

“In services, we set an all-time revenue record, with paid subscriptions growing double digits year over year,” Cook said. “And I’m pleased to announce today that we have set a new record for our install base, which has now surpassed 2.2 billion active devices.” — Lewis Wallace