The most yawn-inducing Apple earnings call of the year is just days away, and Wall Street is eagerly anticipating the results — though maybe for reasons you wouldn’t expect.

Apple CEO Tim Cook and CFO Luca Maestri are scheduled to hop on the phone with investors at 2 p.m. Pacific next Tuesday for Apple’s Q3 2019 earnings call. Even though Apple doesn’t reveal quarterly sales for iPhones anymore, there are a lot of metrics to look for that could clue us in on how well or poorly the company is performing lately.

Keep an ear out for these five things during Apple’s July 30 earnings call.

$53 billion in revenue

During its last earnings call, Apple told investors it expected to bring in $52.5 billion to $54.5 billion in revenue. Apple is usually pretty conservative with its guidance, so if revenue comes in under $53 billion it would be a bummer for investors. Anything over $55 billion would be a big beat for the iPhone-maker and would probably send the stock price soaring in after-hours trading. Most analysts currently predict around $53 billion.

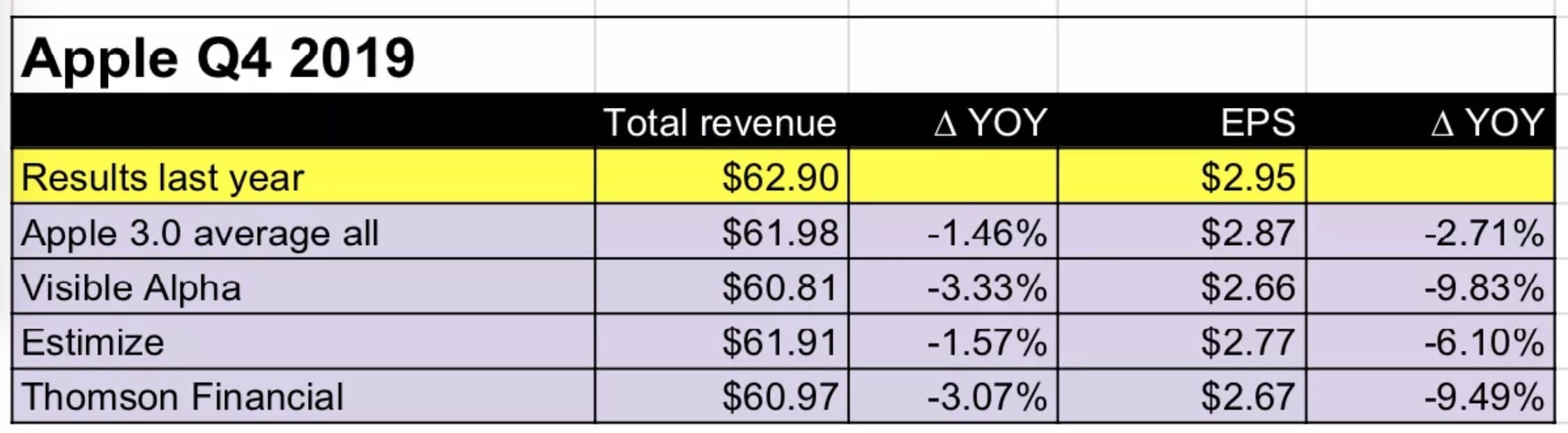

Q4 2019 guidance

Photo: PED30

Third quarters usually bring Apple’s weakest-performing time of the year. What investors are looking forward to most is Apple’s guidance for Q4 2019. Apple usually launches new iPhones at the tail end of Q4. If the company’s revenue guidance comes in higher than last year, that’s a strong sign that new iPhones are coming in September and that Apple thinks sales will be better than the previous cycle.

Philip Elmer-DeWitt rounded up predictions of top Apple analysts and it looks like everyone’s expectations are pretty low. Pretty much everyone is predicting Apple to come in with lower Q4 2019 guidance compared to Q4 2019. Some are predicting a drop as big as 3% while the most optimistic analysts predict a meager 1% drop in revenue guidance.

Apple’s new cash cow

Photo: Apple

Now that iPhone sales have pretty much permanently plateaued, services are now Apple’s lifeline for revenue growth. Q3 2019 was the first full quarter of the Apple News+ subscription service running at full speed. (All new subscribers got a free month last quarter.) Reports suggest that Apple News+ isn’t much of a moneymaker yet. However, Apple Music continues to gain ground on Spotify. That could offer a big boost to Apple earnings.

Apple also has a couple more services coming soon. Apple Card launches in August, so we could see that reflected in Q4 revenue guidance. We also have Apple TV+ and Apple Arcade coming out by the end of 2019. Those new subscription services will give Cupertino a couple more irons in the fire to spark some growth.

The great Trump trade war

Photo: White House

President Donald Trump’s trade war with China has no end in sight, and Apple is finally getting caught in the crosshairs. Cupertino recently applied for exempting some Mac Pro parts from the latest round of tariffs, but Trump says Apple won’t receive special treatment.

“Apple will not be given Tariff wavers [sic], or relief, for Mac Pro parts that are made in China,” Trump tweeted. “Make them in the USA, no Tariffs!”

The Mac Pro tariffs won’t hit Apple in Q4. It’s not like the Mac Pro will be a huge moneymaker for Apple anyway, but the tariffs might make the beastly machine even more expensive. Investors will mostly be concerned about whether the iPhone will take a hit due to tariffs. Trump threatened $300 billion worth of additional tariffs that would affect the iPhone. So far, he hasn’t pulled the trigger.

China concerns

Photo: Tim Cook

Wall Street will certainly be curious to learn about Apple’s sales in China more than any other region. After a couple of booming years, Apple has started seeing little growth in the country. China’s faltering economy was one of the reasons. Trump’s trade war might be the next — and not just because of the tariffs.

Some analysts worry that Trump’s hostilities toward China could tarnish American brands’ reputation abroad. If Chinese customers start spurning the iPhone because of Trump’s trade rhetoric, it could take years for Apple to recover there.