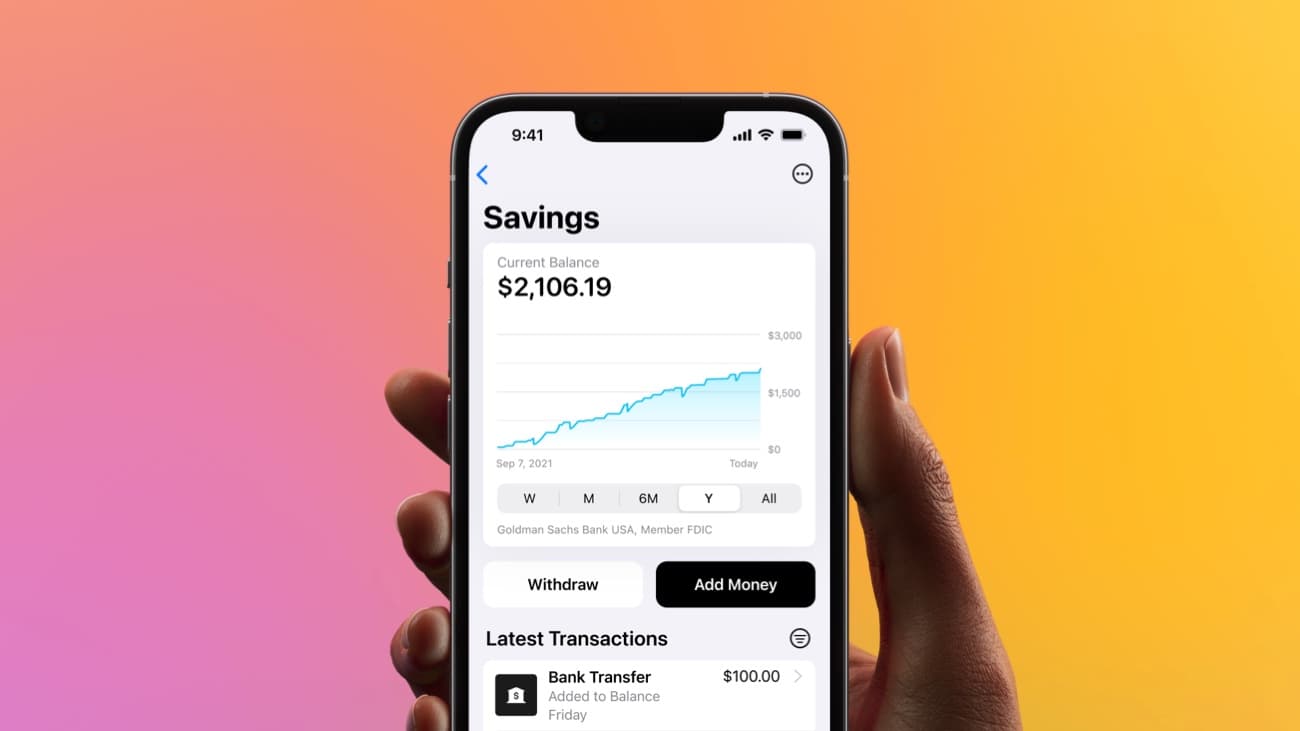

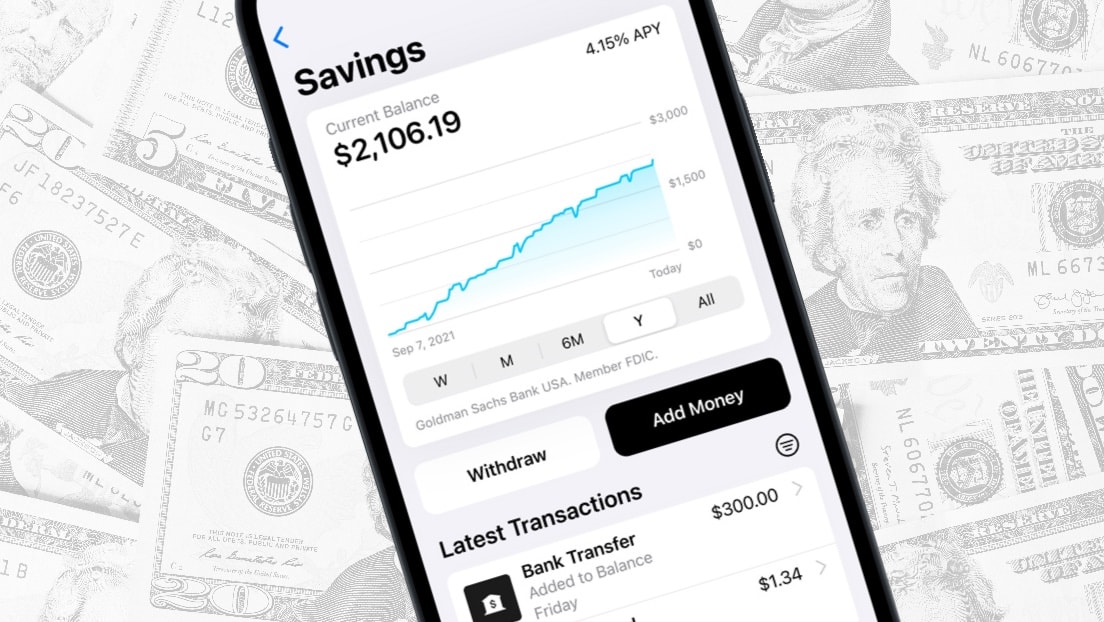

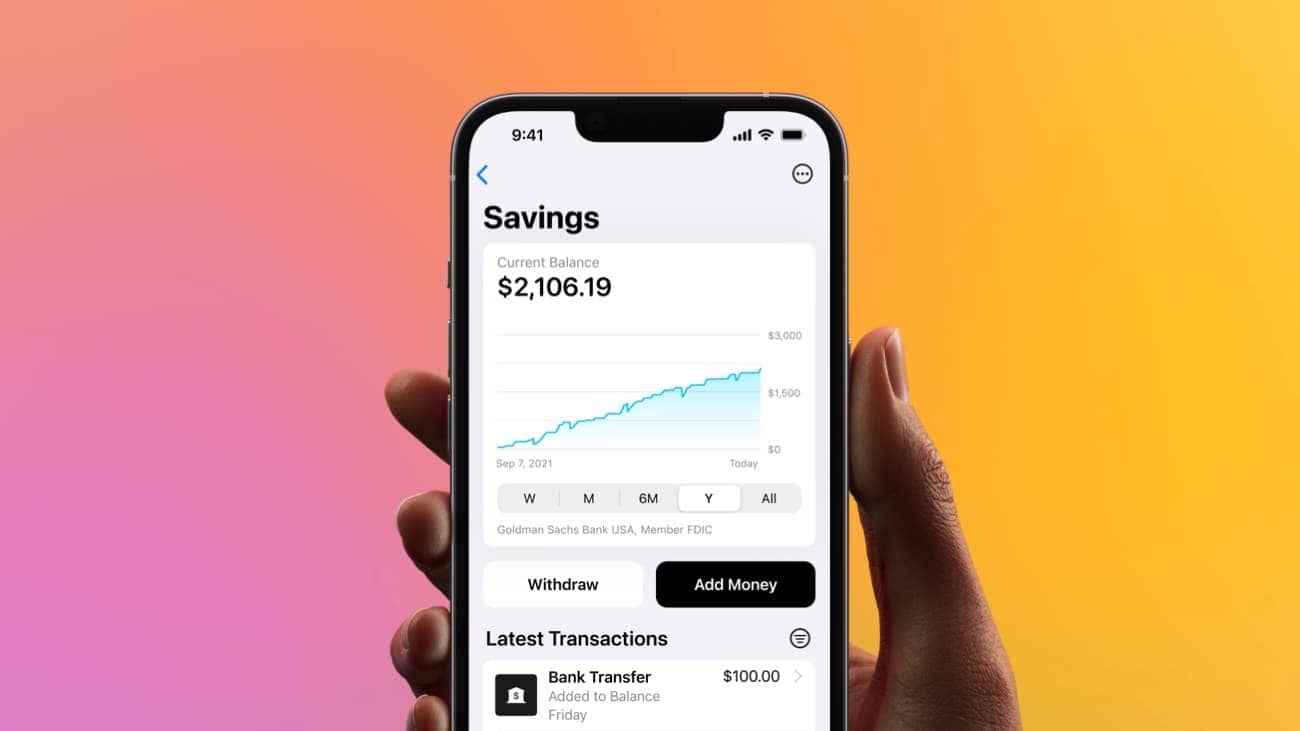

Apple Card Savings accounts just got their first interest rate decrease. Money stored in on these accounts now earns 4.4% in annual interest.

Previously, Apple and Goldman Sachs had boosted in the rate multiple times since the beginning of December. And it’s still quite high, even after the drop.

![What’s next for Apple Card? [The CultCast] Apple Card on an iPhone. CultCast episode 623.](https://www.cultofmac.com/wp-content/uploads/2023/12/CultCast-Apple-Card-1536x864.jpg)

![Big changes coming to iPhone battery and camera [The CultCast] The CultCast Episode 604: An iPhone battery rumor gets us excited.](https://www.cultofmac.com/wp-content/uploads/2023/07/CultCast-604-iPhone-battery-rumor-1536x864.jpg)

![Here comes the MacBook Air we’ve been waiting for [The CultCast] 15-inch MacBook Air will be a dream machine.](https://www.cultofmac.com/wp-content/uploads/2023/05/CultCast-593-15-inch-MacBook-Air-1536x864.jpg)

![Can Apple’s ‘Reality’ headset spark an AR/VR revolution? [The CultCast] A woman wearing a VR headset, with The CultCast logo and Episode 591.](https://www.cultofmac.com/wp-content/uploads/2023/04/CultCast-591-Apple-Reality-headset-1536x864.jpg)