Goldman Sachs reportedly wants out of a partnership with Apple that has the bank backing the Apple Card and other financial services. It’s not hard to guess why: recent filings from the bank indicate it has lost at least $1 billion on the deal.

It’s supposedly looking to hand the business off to another megabank.

Goldman Sachs wants to stop being the bank behind Apple Card

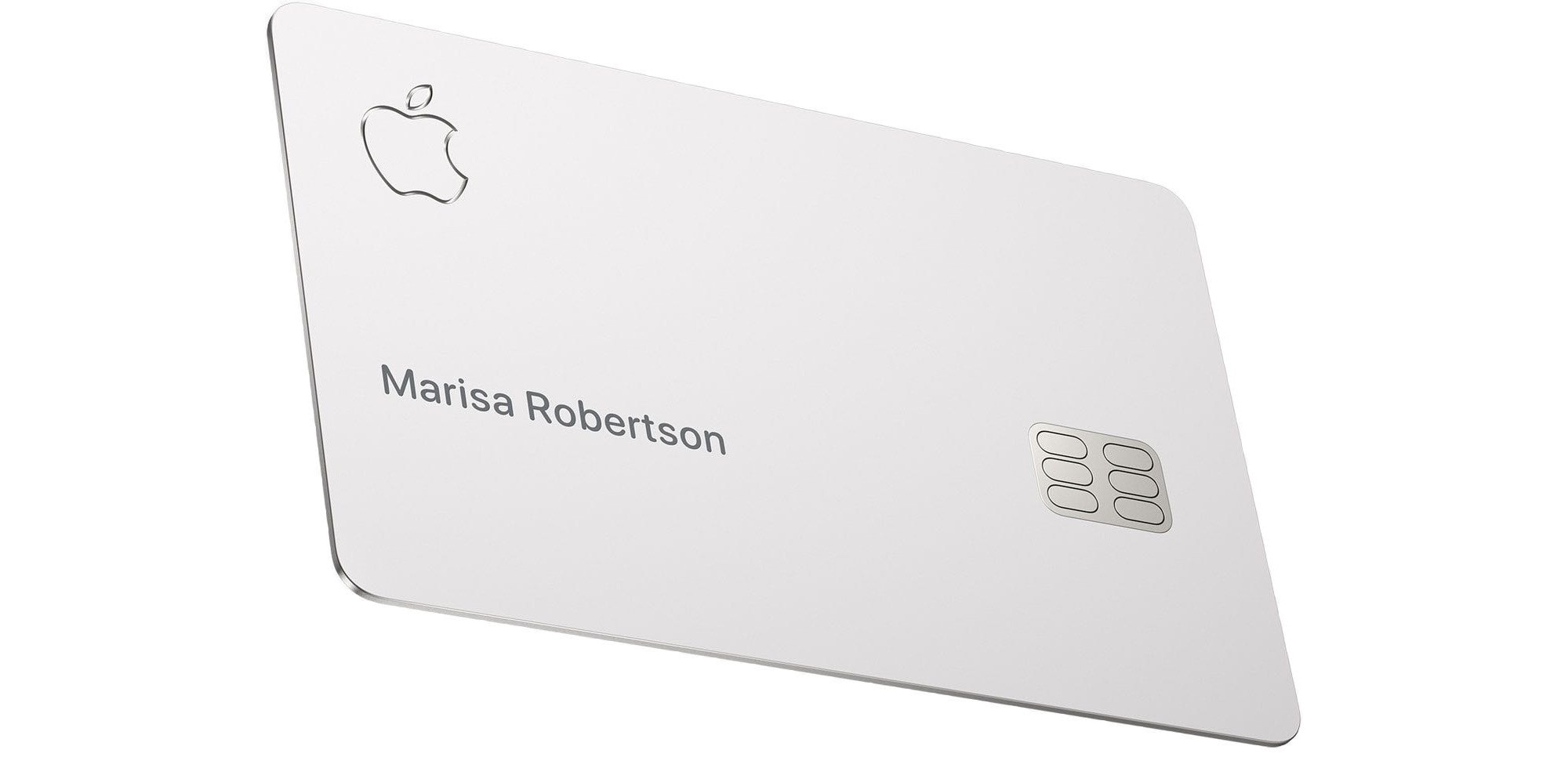

Despite being named Apple Card, the credit card is actually issued by Goldman Sachs. Plus, the bank is where the money in Apple Cards Savings accounts is stored, and it also assists in Apple’s Pay Later program.

But all this business isn’t generating profits for Goldman Sachs. Quite the opposite. A recent report shows the division of the company that includes Apple Card lost $3.03 billion in about three years. Much of that can be attributed to the credit card.

And now the bank wants out. It’s negotiating with American Express to take over the financial services it offers via Apple, according to the Wall Street Journal. The newspaper cited unnamed “people familiar with the matter” as the source.

“A deal with Amex isn’t imminent or assured, people familiar with the conversations said, and it could take a while to transfer the partnership in any case,” notes the WSJ.

Most importantly, Apple would have to sign off on any agreement to hand off these services to another financial institution.