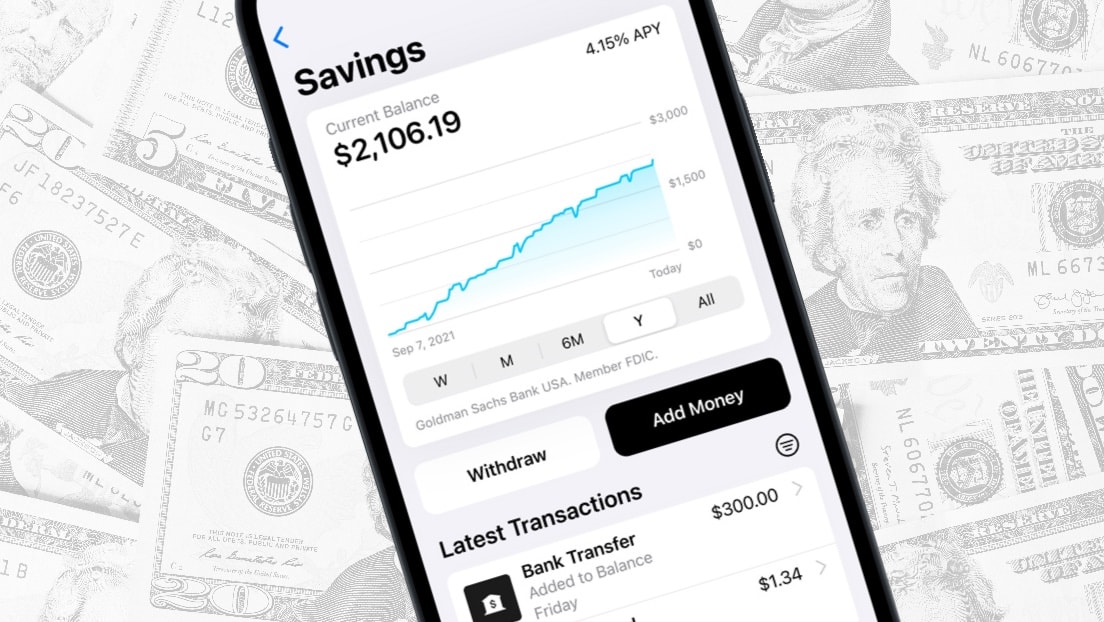

Apple Card Savings launched Monday, allowing money earned from Apple Card’s cash-back program to go into a high-yield savings account. And it is high-yield — at 4.15%, the annual rate is about 10 times higher than the national average.

There are no fees for the new financial service, and users can bring in their own cash from other banks that offer lower interest rates.

Put Daily Cash straight into a high-yield Apple Card Savings account

Inflation is down to 5%, but that still means that money sitting in Apple Cash gets a little bit less valuable every day. And many rival savings accounts offer such anemic interest rates they almost shouldn’t bother. A Wells Fargo savings account pays 0.15%, for example, and Bank of America pays 0.1%. But Apple Card Savings is so much higher that it’s almost enough to completely offset inflation.

“Savings helps our users get even more value out of their favorite Apple Card benefit — Daily Cash — while providing them with an easy way to save money every day,” said Jennifer Bailey, Apple VP of Apple Pay and Apple Wallet, in a press release Monday.

Users of Apple’s credit card get a percentage of every purchase back. It’s called Daily Cash and is added to the customer’s Apple Cash each day. It’s usually 1% or 2% of purchases. Many users have allowed their Daily Cash to build up, and now Apple Card Savings allows them to earn interest on that money.

Apple Card holders can set up and maintain Savings through Apple’s Wallet app on an iPhone. All future Daily Cash received will be automatically deposited into the account. And additional funds can be added from their Apple Cash balance or a linked bank account.

Apple promises that users can withdraw funds at any time by transferring them to a linked bank account or to their Apple Cash card. There are no fees for these transfers.

Start saving

Apple Card Savings launched Monday, apparently for all Apple Card holders. Cupertino announced the service in October 2022, and it’s just now reaching customers.

Apple added a Savings dashboard to the iPhone Wallet app that lets users track their account balances and interest earned over time.

To be clear, this is an optional service. Users can choose to instead continue to have Daily Cash added to an Apple Cash card in Wallet. Also, the service is for Apple Card holders only. People without this credit card cannot open a savings account with Apple.

“Our goal is to build tools that help users lead healthier financial lives, and building Savings into Apple Card in Wallet enables them to spend, send, and save Daily Cash directly and seamlessly — all from one place,” said Bailey.

Source: Apple