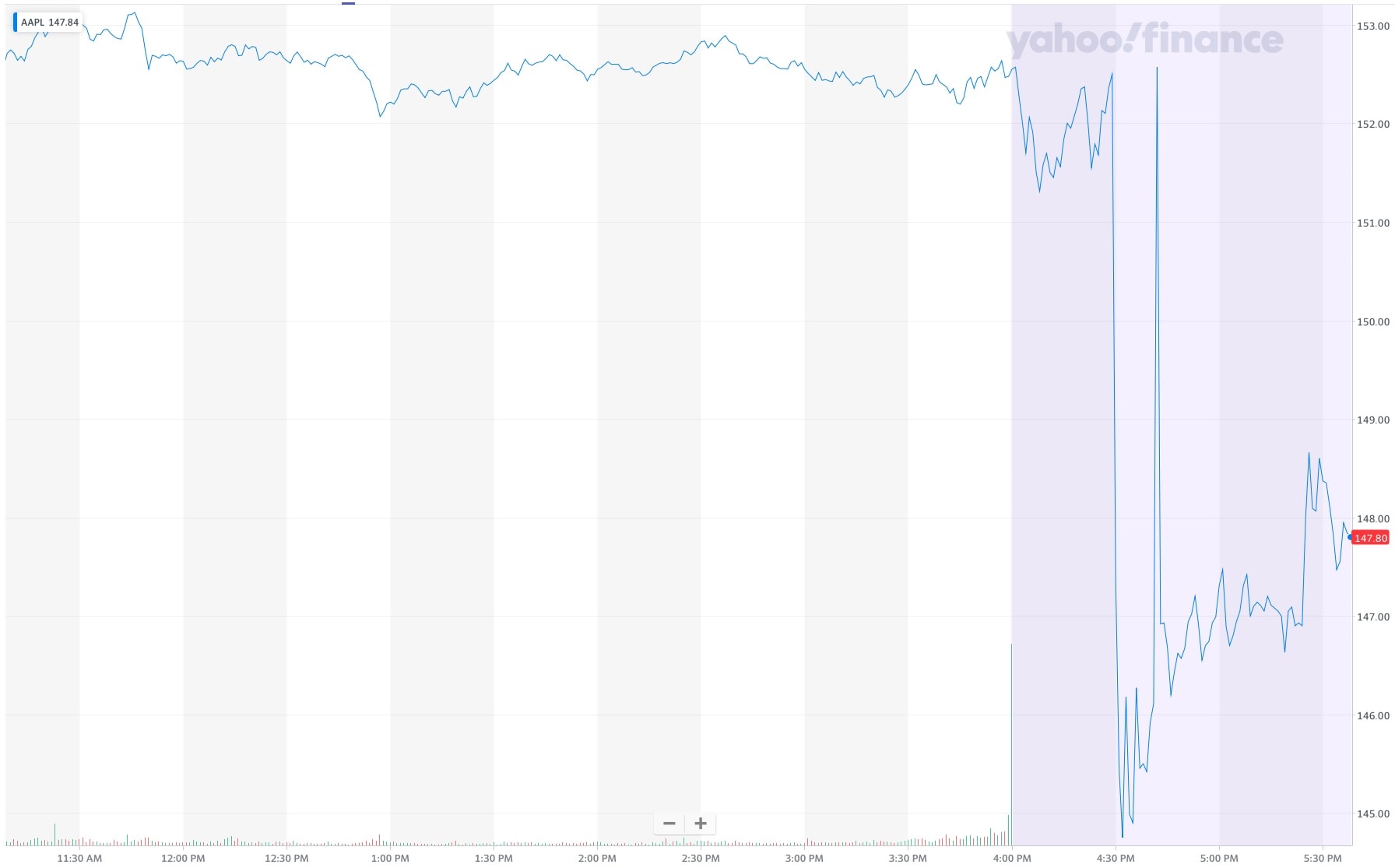

When companies talk about quarterly earnings, executives often deploy language designed to puff up, excuse or obfuscate their companies’ recent performance. The goal is to excite investors over implied future success. And ultimately to give the company more money. Always. More. Money. The Apple quarterly earnings call takes place Thursday afternoon.

But when you’re the iPhone giant — with a mind-blowing market cap and a seemingly never-ending supply of hit products, including ongoing growth in services — you typically don’t need to craft hopeful-yet-non-material statements or deflect questions designed to get at the true bottom line.

So CEO Tim Cook and new CFO Kevan Parekh will report on all the numbers (former CFO Luca Maestri stepped down January 1, 2025). Because many tariff impacts are yet to come, analysts predict a 4% revenue increase year-over-year, plus a jump in earnings per share. Note that Apple starts its fiscal year with Q1 in the previous year’s holiday season, so calendar quarters trail its fiscal quarters.

![Tim Cook: Apple’s AI revolution is coming later this year [Updated] Apple’s AI-driven voice-controlled digital assistant Siri](https://www.cultofmac.com/wp-content/uploads/2021/03/73E864DB-AB7D-48DF-BF31-45A1DA9D7B4A.jpeg)

![1 billion subscribers push Apple’s services revenue to all-time high [Updated] Apple logo with](https://www.cultofmac.com/wp-content/uploads/2023/08/Apple-Q3-2023-earnings-1-billion-subscribers.jpg)

![Apple’s big earnings surprises [Cult of Mac Magazine No. 308] Find out about Apple's big earnings surprises in Cult of Mac Magazine No. 308](https://www.cultofmac.com/wp-content/uploads/2019/08/COM-MAG-308_5.jpg)