After months of delays, Isis has announced the debut of its mobile payment system. A joint venture by AT&T, T-Mobile, and Verizon, Isis made news earlier this year at the Mobile World Congress in March, but has been pretty quiet since then. During that quiet period a number of other players in the mobile payment market have stolen the spotlight and announced major deals.

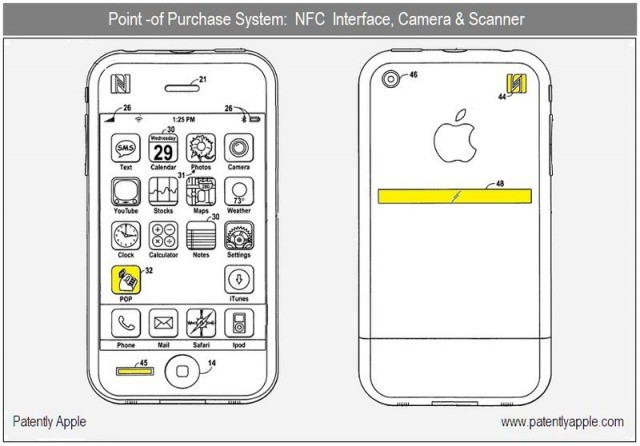

Apple is expected to eventually unveil its own mobile payment system, one that will most likely be based around the iTunes Store payment system, but hasn’t made announcements beyond iOS 6’s Passbook feature. Apple has also kept quiet about whether it will include NFC chips used in some mobile payment systems in the upcoming iPhone 5, which some analysts and pundits consider a barrier to entry into the mobile payment market.

![Apple Plans To Invade The Mobile Payment Industry One Step At A Time [Report] One day your iPhone and wallet will be one.](https://www.cultofmac.com/wp-content/uploads/2012/07/IMG_4888.jpg)