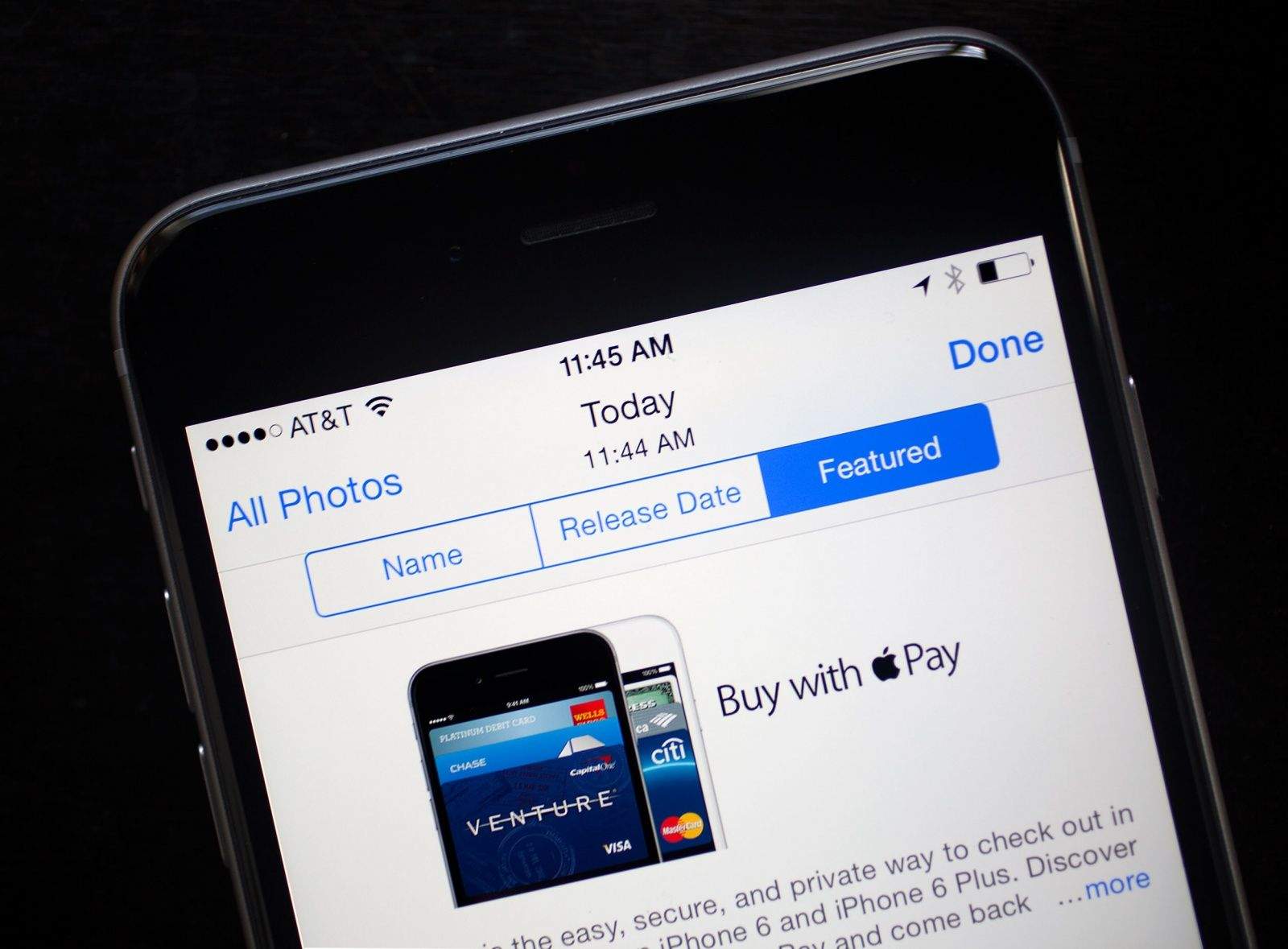

Banks and credit card companies have been making a big push to get customer to use Apple Pay, but perhaps no one is trying harder than Wells Fargo.

So far the bank has been doing everything from emailing customers to use Apple Pay, and even paying people just to try it out. In it’s newest effort to get card holders to activate Apple Pay, Wells Fargo has released a new ad showing how wicked fast it is to pay with your iPhone 6, rather than a credit card. So fast in fact, it might actually ruin your surprise birthday party.

Check out the funny ad below: