Apple may have kicked butt on Black Friday, with reports of its strongest Friday sales in history and more online purchases made using iOS devices than Androids by a giant margin.

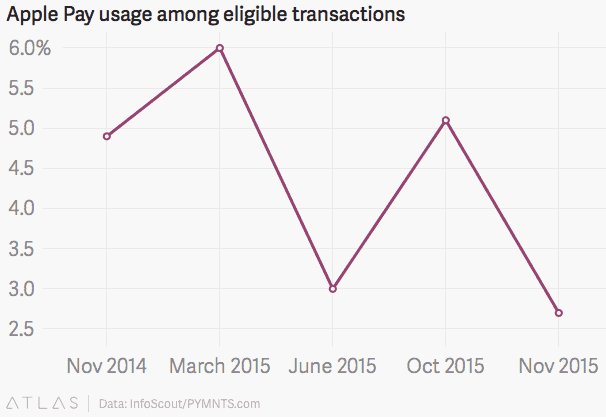

There was one area of Apple’s business where Black Friday wasn’t a day of triumph, however, and that’s Apple Pay. According to a new report, only half the total percentage of Apple customers who used Apple Pay at last year’s Black Friday used it during this year’s sales bonanza.

The results come from research firm InfoScout, which analyzed data from 300,000 shoppers on Black Friday. Given that this is only a sample of the total Apple Pay customers, it’s not exactly the last word on the story, of course. InfoScout also didn’t track in-app payments made through Apple Pay, which have been enabled by giants like AirBnb, Uber, Target, and Best Buy.

But it does demonstrate that Apple Pay perhaps isn’t rising as meteorically as some would have expected — given the ease of use it provides, the number of extra partners which have jumped on board over the past year, its security advantages, and so forth.

Then again, this time last year Apple Pay was a brand new novelty — which means that its early adoption may have been artificially high. Maybe it’s just finding its own level and, like the number of people who would willingly turn up to a movie about Steve Jobs, that’s just lower than some expected.

Did you use Apple Pay over Black Friday? Leave your comments below.

Via: Quartz

20 responses to “Apple Pay was a massive flop on Black Friday”

I wish I had… but here in “The Great White North” only AMEX is enabled and the card isn’t taken in a lot of places unfortunately. Great White Banks have so far refused to engage despite the mounting pressure coming from clients to enable the card they chose… However, thi smay only be the push AMEX needed to become somewhat relevant in the land of snow and ice.

I prefer it over the chip readers which are ridiculously slow. Apple Pay is much quicker.

Apple has brought a ton of new banks on board in the last year, but virtually no new retailers. That’s the main reason it’s a flop. Not to mention – 90% of my shopping is done on Amazon. Other than that, it’s the grocery store or Target, and I can’t use Apple Pay at either.

I second that, JK. I do 90% of my shopping at Sam’s Club and Walmart (my motto is “if I can’t find something at either of those two places, it’s too expensive or I don’t really need it in the first place!”) I’ve been dying to try out Apple Pay but haven’t had the chance yet.

Yep.

I suspect most of the big stores put off starting until late in the game. I wonder if the credit card companies are allowing delays as long as there is progress.

Many small stores are pretending this does not apply to them.

But once credit card fraud is cut off at larger stores, the focus of credit card thieves will suddenly switch. Small stores will convert quickly or they’ll likely go out of business.

The graph shows a percentage decline. Last year at this time the number of phones capable of using Apple Pay was a small number and in hands of early adopters. Apple Pay was also just newly released with a lot of buzz. This year the majority of IPhone owners (in the US) have Apple Pay compatible phones. Point being, it’s not clear from the articles I’ve was that the total number of transactions are down. A percent drop wouldn’t be surprising given that there’s always going some percentage of the average user that doesn’t know of or use any particular built in feature. A total decline would be concerning.

Most people try Apple Pay on getting their new iphones and stop after a few weeks or months, the present payment system is not broken thus Apple pay is not really fixing a problem and that is the main issue.

Apple pay adoption including Samsung Pay will continue to decline, also using Apple Pay is only a fraction faster than swiping a credit card.

People will only use Apple Pay and the likes when they are inconvenienced or when they are responsible for any fraud issues on their card, which will not happen

Concerns about fraud will not be the only reason, as most people are not affected by fraud on a daily basis.

Yep. People are reluctant to change. They don’t understand how things like that work. Few merchants understand how to use it, and even fewer really want to upgrade their POS setup for one which accepts ApplePay. It was probably very similar to when credit and debits cards were first issued. That and a lot of banks still aren’t using ApplePay. The ones that are are sometimes making it rather difficult to sign up for it. I had to contact my bank to authorise ApplePay to be used. It’s also sort of a footnote on the Bank’s homepage, instead of a bold headline type announcement. In addition to that, many are also scared of using this technology, and don’t trust it. Reluctant to get away from Cash. Farmer’s markets are a huge problem. Smaller merchants have no idea how to use half of the tech out there.

Most of their capabilities are beyond their owner’s comprehension. Many of these older people are also being pressured by their kids to purchase a phone that they know little about. They use their new phones for things that a 3 year old smartphone could easily do.

People state that they just don’t want to be contacted all the time, so they don’t have smartphones, and some are tired of phones and just have landlines. The idea that a lot of people lose touch with others because they’re always in their phones.

It looks really fun at the beginning when someone overhypes it, and then when you try to use it and aren’t around many of the stores that are supported, you begin to become frustrated, and go back to the “good ‘ole” plastic card method. Half of the stores listed on Apple’s website either aren’t in my local area, or aren’t stores where I choose to shop, and making it easier to spend money at them isn’t going to change my mind. The idea that Nike now supports ApplyPay is nice, but I don’t really like Nike much as a company, so I don’t support them financially. I like to support the businesses which are sort of being left out of cool tech which are small businesses.

The problem with Apple Pay, or similar, is three fold: not enough banks are participating, far too few vendors participate, and the workers at the vendors usually have no idea how it works or do it wrong.

Incorrect. Apple Pay is simple, and most banks are on board. The vendors are the boy issue, if they don’t have NFC-enabled terminals installed yet. Even an uneducated clerk is not a hindrance if the equipment is present. I’ve educated many a clerk in less time than it took them to answer whether or not Apple Pay is accepted.

This has nothing to do with Apple pay. The issue is that stores have not yet made the transition to chip and pin. Once they do, Apple pay will soar.

The only local places I’m aware of that take Apple Pay are Whole Foods, one of the drug store chains, Apple itself, and some Chevron stores (not the pumps).

I use Apple pay whenever I see it.

Except for the Apple store, which of the choices above is likely to see much Christmas shopping?

The transition to chip and pin seems to be more difficult than many thought it would be and it has been taking longer that the credit companies would like. But I expect my choices to be greatly increased by the end of 2016. And, by 2017, I expect it will be hard to find retailers that do not support Apple pay.

Only then will we really know whether it will be a success. I think it will.

100% agree with this. If I could pay for everything in my life with Apple Pay, I would. It’s so much superior and more efficient than cash/credit that it’s not even close. Retailers need to do a much better job implementing it.

Wow sad

Entertainingly enough, I’m also seeing more Apple Pay promotions.

There’s a local diner near where I live. It sits in the strip mall between the Massage place and the antique story. Nice little place run by a husband and wife. Great fish and chips.

Anyway, they recently updated their credit card terminal. And they ended up with a couple of “Apple Pay” stickers, which they stuck on the terminal and the cash register.

Now, they’re not particularly “Apple Fans” who would go out of their way to do this. They’re not the type who would say, “Hey! Let’s promote the fact that we support Apple Pay! The fanbois will love us and rush in!” So I assume those stickers came with the terminal and they figured, “Eh, what the hell…” So I imagine that Apple is paying the folks who sell terminals to include some Apple Pay stickers in the box.

I would imagine that more and more small retailers are in this boat, where they get the new terminals and some stickers along with it, which means more obvious support for Apple Pay.

With Apple Pay I was hoping for a uniform, 1 step transaction. It seems that, just like plastic, each vender has there own rules and even though you use Apple Pay, you still often find yourself punching more buttons, and showing ID to the clerk. Kinda defeats the whole idea, and actually doubles the work, cause now you gotta put the phone away and get out the wallet. Really people?

I have to agree with some. In my area, with the exception of Panera Bread and Macy’s, most merchant experiences are terrible due to stores’ antiquated systems or untrained staff.

No becuse I wouldn’t pay $1000+DATA for a phone that has it… I paid $29 for my 640 (with NFC) and still would not be keen to use any pay. Not that hard to whip out a CC.

It’s not the consumers who are limiting the use of Apple Pay, it’s the stores….you can’t pay with Apple Pay if the store doesn’t support it. Simple as that. So the whole answer to this story is that the merchants are the ones who need to get on board, not the customers. Black Friday isn’t the day that millions of people buy something at Starbucks or McDonalds….its the day they buy things at Target, Kohls, Home Depot, Lowes, Macy’s, Nordstroms, etc, etc. And at least in my area, NONE of these large merchants accept Apple Pay, so how the heck would anyone use it for buying there??!?

How many customers used Apple Pay last November, and how many this November, ignoring percentages? The drop could reflect many new Apple customers. It is always very telling when the essential raw data is not included in an article like this.

I use Apple Pay everywhere that takes it, and avoid places that don’t.