Apple reportedly held talks about buying out Electronic Arts, the company behind the wildly popular Madden series, The Sims series and many more.

But EA has also supposedly held acquisition talks with others, including Disney.

Apple reportedly held talks about buying out Electronic Arts, the company behind the wildly popular Madden series, The Sims series and many more.

But EA has also supposedly held acquisition talks with others, including Disney.

Apple reportedly bought AI Music, a startup that uses artificial intelligence to create songs in real time.

The technology will most likely be integrated into the Apple Photos application for creating background music for slideshows and video montages.

Sen. Josh Hawley introduced a bill Monday that would ban mergers and acquisitions by companies with market caps in excess of $100 billion. If passed, the bill could have a massive impact on technology companies, including Apple.

Apple, for the record, currently has a market cap of $2.2 trillion. Other tech giants worth upward of $100 billion include Microsoft, Amazon, Alphabet, Facebook, Uber, Airbnb and Netflix.

Mobeewave helps handsets act like little cash registers. Apple reportedly purchased this company, which could lead to iPhones able to easily receive money from credit cards with just a tap.

Apple purchased Inductiv, a Canadian company that focused on using artificial intelligence to clean up data. They created HoloClean, which was designed to get useful predictions from “noisy, incomplete, and erroneous data.”

The employees of Inductiv joined the team developing Siri, Apple’s voice-driven AI assistant, according to Bloomberg.

Apple acquired a startup that provides virtual-reality experiences for watching live events. The purchase of NextVR could lead to Apple building more VR capabilities into its products.

Everything on Apple TV+ today was released in the past few months. But Apple is reportedly in talks to buy MGM, which would bring a catalogue of classic and modern movies to the iPhone maker’s streaming video service.

Apple purchased Xnor.ai, a company that creates artificial intelligence software for mobile devices. The acquisition will apparently lead to AI applications running directly on iPhones, iPads, etc., not outsourced to the cloud. This should make these tasks more private and quicker.

![Apple’s big spend on Intel modems is pocket change in Silicon Valley [Opinion] Samsung wants to follow Apple in building a giant services business](https://www.cultofmac.com/wp-content/uploads/2019/07/mathieu-turle-uJm-hfuCHm4-unsplash.jpg)

The $1 billion Apple spent on Intel’s modem business is the second-largest acquisition in the company’s 42-year history.

Still, while a huge amount of money by most normal standards, rival tech giants regularly dwarf Apple’s big spend on Intel. For a variety of reasons, Apple just doesn’t roll that way.

The best way for Apple’s upcoming streaming video service to compete against already established competitors like Netflix is to buy a movie studio, according to an industry analyst.

Apple is reportedly going to introduce its video service in the first half of this year, and the analyst recommends buying Sony Pictures, Lionsgate or another studio to increase its offerings.

A merger between Sprint and T-Mobile could be back on the table, according to a new report that claims informal talks between the two carriers sparked up again this week.

Sprint attempted to acquire T-Mobile back in 2014 but the deal fell apart because of regulatory concerns. Now the heads of both companies have expressed to investors that they’re willing to consider consolidating again.

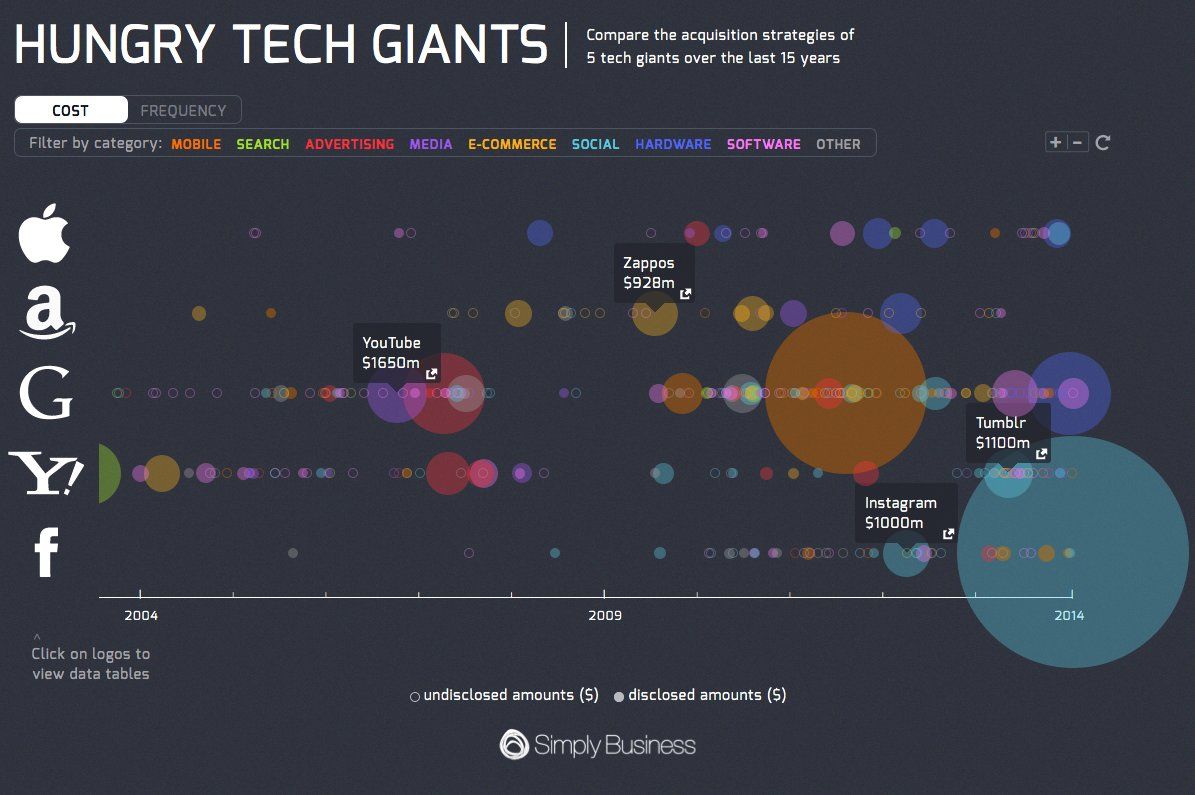

With the tech world still buzzing over Facebook’s $19 billion WhatsApp acquisition, business insurance provider Simply Business has put together a fascinating infographic.

Showing 15 years of acquisitions by Apple, Amazon, Google, Yahoo, and Facebook, the chart lays out in visual terms when tech giants were at their purchasing busiest, as well as how much they typically spend on deals — with the size of individual dots representing the price paid for each startup.

Having recently purchased both Nest and AI startup DeepMind, Google is currently on a high tech spending spree. Even Steve Jobs biographer Walter Isaacson has claimed that the search giant’s recent acquisitions have helped it take the lead over Apple when it comes to innovation in 2014.

But Apple is also putting its $159 billion worth of cash and investments to good use by carrying out its fair share of acquisitions.

![What Apple’s Massive 2013 Buying Spree Means For The Future [Year In Review] Apple may as well run Cupertino.](https://www.cultofmac.com/wp-content/uploads/2013/12/Apple-headquarters-One-Infinite-Loop-Cupertino-1.jpg)

It was widely reported in January that Apple was in talks to buy Waze, an Israeli startup with a hugely popular maps app. Waze was rumored to be asking Apple for $750 million. The same outlet that broke the acquisition rumor quickly backpedaled and said no such deal was taking place. Google ended up buying Waze in June for $1 billion.

And so goes the buyout game in Silicon Valley, a power play where tech giants like Apple and Google court hot startups with the hopes of adding them to their war chests.

Apple had its biggest year ever for acquisitions in 2013, with a record 15 smaller companies joining the fold. A dozen of them have now been publicly disclosed.

For an entity as secretive as Apple, examining the companies it buys is one of the only ways to peek into its future plans. When AuthenTec, a company that specialized in fingerprint readers and identification software, was purchased in July 2012, speculation immediately followed. What did Apple want with fingerprint sensors? The answer ended up being obvious, and the technology debuted in Touch ID in September 2013.

Often the outcome of an Apple acquisition isn’t so immediately apparent.

Historically, Apple acquires far fewer companies than its competitors. But the line is starting to blur. Google publicly bought three times as many companies as Apple in 2012 and not even twice as many in 2013. Apple bought more companies than Microsoft in 2013.

So what does all of this say about Apple’s future?

When Apple bought Twitter analytics company Topsy for over $200 million earlier this week, many commenters were taking aback. How does Twitter analytics of all things fit into Apple’s general acquisition strategy?

Although they broke the story, it looks like The Wall Street Journal were wondering the same thing themselves. The result is an excellent breakdown of Apple’s major acquisitions in 2013. Unfortunately, it doesn’t shed much light on why Apple bought Topsy, but it does show Cupertino’s areas of interest.

Apple has purchased AlgoTrim, a Swedish firm specializing in image and video compression techniques, for an unspecified price. It could pave the way to better iOS device battery life, and much improved photo and video quality across Apple line-up of devices.

Continuing its expansion at roughly the same pace as the known universe, Facebook has just announced that they have acquired Mobile Technologies, the developer of Jibbigo, a universal translator app for Android and iOS.

Apple has bought a company which specializes in low-energy chips that are ideally suited for devices like fitness trackers. The rumor mill is saying that Apple is working on an iWatch to release by the end of 2014, and this small acquisition is likely another way to bring in more expertise for the project.

Siri has enjoyed mild success since her debut on the iPhone 4S. She’s not the world’s greatest personal assistant, but she gets the job done most of the time, which is better than a lot of other voice recognition options out there.

Now Amazon is preparing to do battle with Siri thanks to a new digital assistant they just bought. Her name’s IVONA, and we’re pretty sure it’s not the same Ivona from Austin Powers.

Whenever Apple moves to purchase a company, you know they’ve got something up their sleeves, and it’s not hard to imagine the possibilities of their latest acquisition: maker of fingerprint sensor chips, AuthenTec.

![Apple Buys Italian Music App Developer Redmatica, Looking To Beef Up GarageBand And Logic Pro [Report] Logic Pro and GarageBand could see major updates thanks to a new Apple acquisition.](https://www.cultofmac.com/wp-content/uploads/2012/05/LogicStudio-large.jpg)

Apple has reportedly bought small Italian startup Redmatica, a company that specializes in making digita music-editing apps that all run on the Mac.

There have been a lot of ideas suggested for what Apple could do with its nearly $100 billion in cash. Some have been serious suggestions like companies that Apple could buy while others are a little more absurd but illustrate just how much money Apple’s got.

Today, Warren Buffett revealed to viewers of CNBC’s Squawk Box that Steve Jobs wasn’t sure what to do with all the money Apple began raking in over recent years and asked for advice. He ultimately ignored that advice in his typical fashion while telling others that Buffett agreed with his decision for Apple to just sit on its money.

Apple announced this week the acquisition of Chomp, an app-search startup.

Chomp CEO Ben Keighran is reportedly working already in Apple’s marketing department, and CTO Cathy Edwards is already employed as a senior iTunes engineer.

Chomp crawls the data associated with all the apps in an app store and uses a sophisticated algorithm-based search function to enable people to search and actually find the apps they really want. Less appreciated by the public (but not Apple) is what appear to be incredible analytics tools, enabling a deep understanding of what people are searching for, how successful they are at finding it and detecting meaningful trends in app demand.

Sound familiar? Search algorithms and analytics are Google’s core competency.

Along with iTunes (ten minutes to transfer a TV show to my iPad?), the iTunes Apps Store is possibly the worst experience one can have while using Apple products. You can never find anything good; all the listings are clogged with scam software and other crap; and it is slow, slow, slow. The good news is that Apple looks set to fix it, with the purchase of Chomp.

Google has sent letters out to various standards organizations, including the IEEE, promising to honor MMI’s patent licensing policies after it completes its planned acquisition of the company. This includes honoring MMI’s maximum go-forward per-unit royalty rate of 2.25%. This is the same rate MMI is asking Apple to pay in order to lift the injunction on the iPhone and iPad 3G passed down in Germany. Apple has rejected this offer and is fighting it, claiming it’s unfair and contrary to the principles of FRAND licensing commitments. No matter the outcome of the Apple/Motorola dispute, Google will be honoring it once they take over.