Canadians should start polishing up their credit ratings, as they soon may be able to apply for a shiny new Apple Card.

The US launch of this credit card will happen in the coming weeks. Canada might not be far behind.

Canadians should start polishing up their credit ratings, as they soon may be able to apply for a shiny new Apple Card.

The US launch of this credit card will happen in the coming weeks. Canada might not be far behind.

![Apple Pay Cash can’t come from credit cards [Updated] Pay for your doughnut dash with help from Apple Pay.](https://www.cultofmac.com/wp-content/uploads/2019/01/A3AB1F28-770F-468C-AD6C-4E400207359A.jpeg)

It is no longer possible to transfer money into an Apple Pay Cash account from a credit card. Transferring funds in via a debit card from another bank is allowed, however.

The service still enables users to make person-to-person payments, but the money cannot come from a credit card.

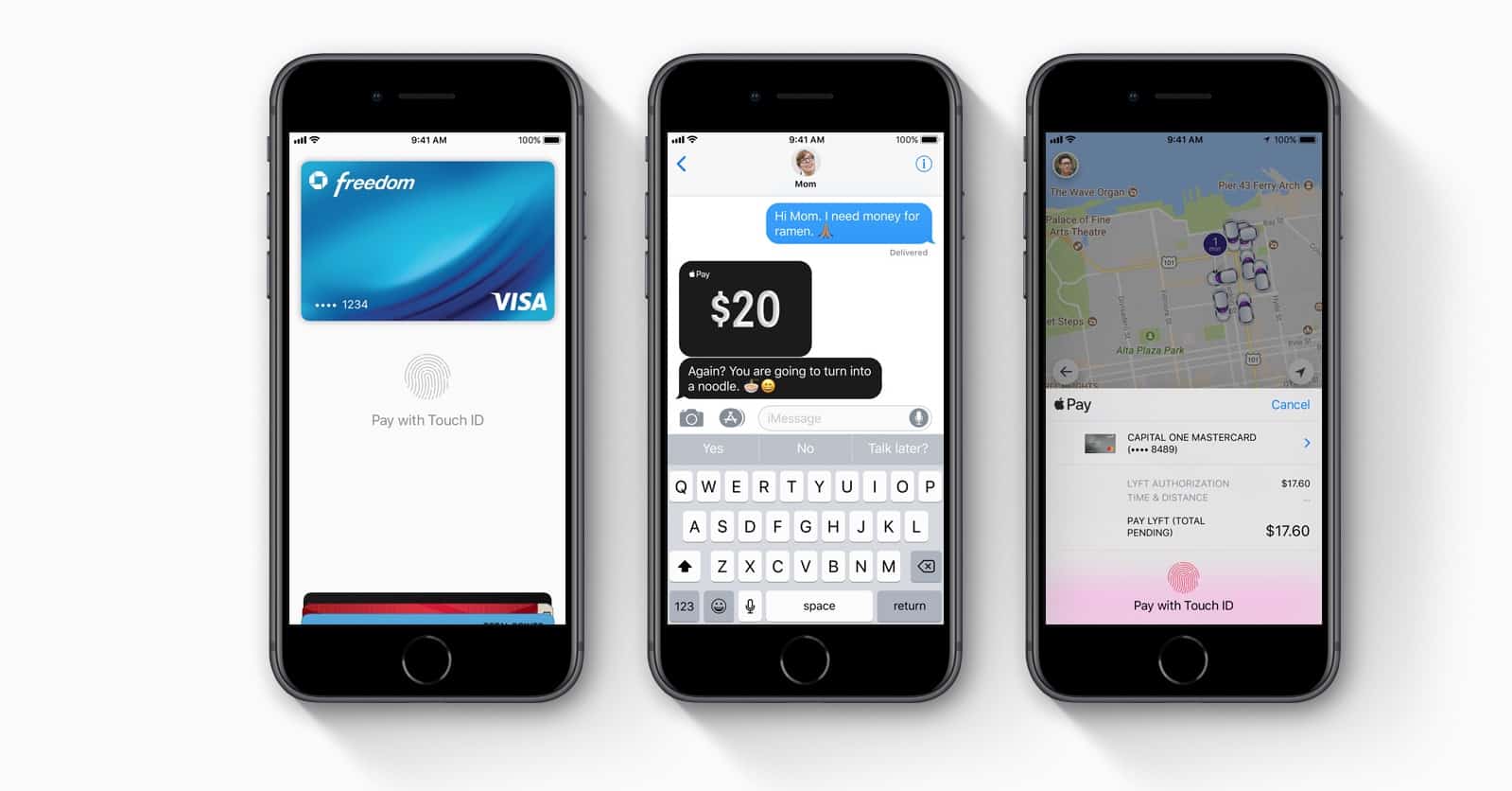

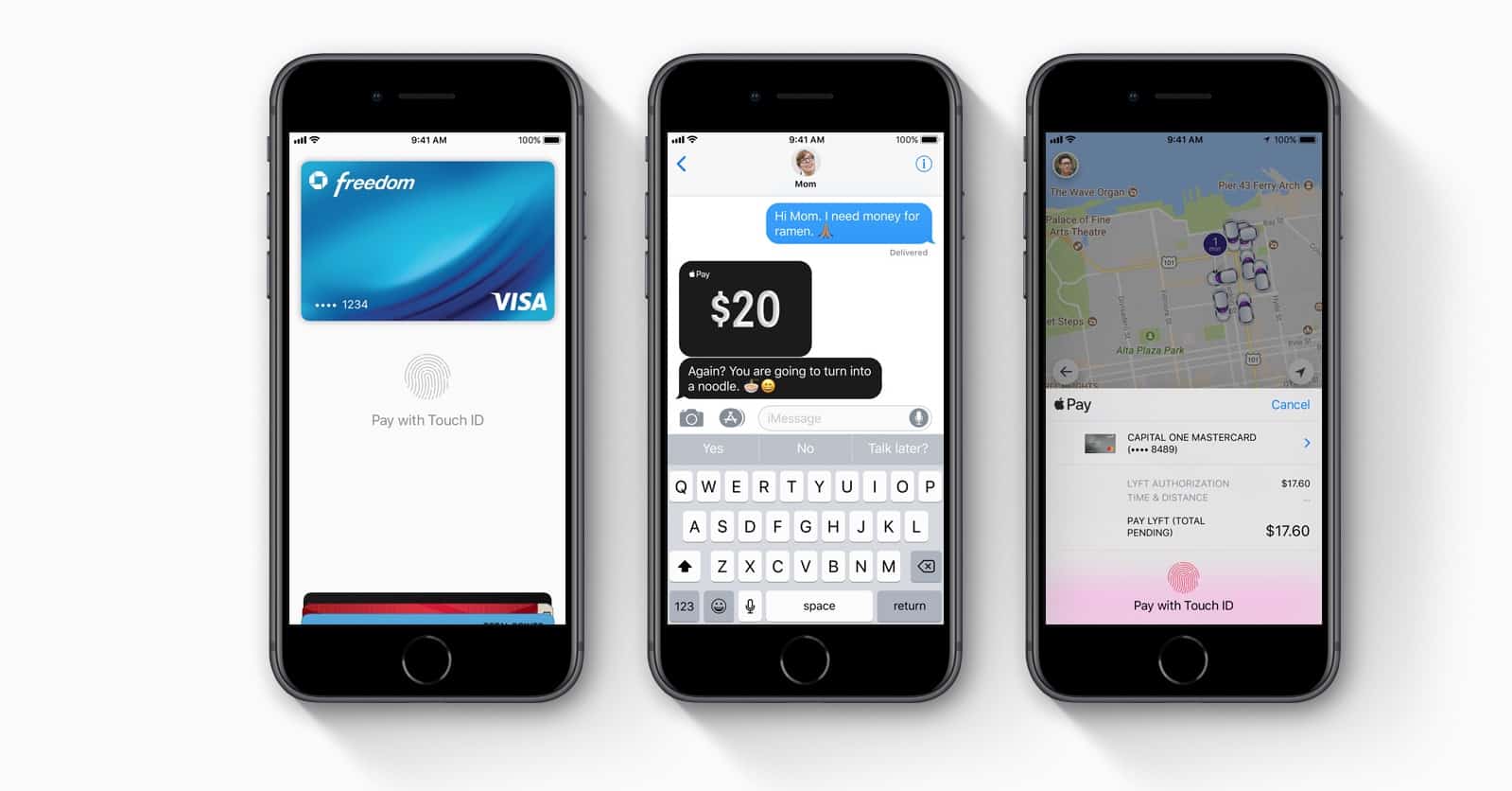

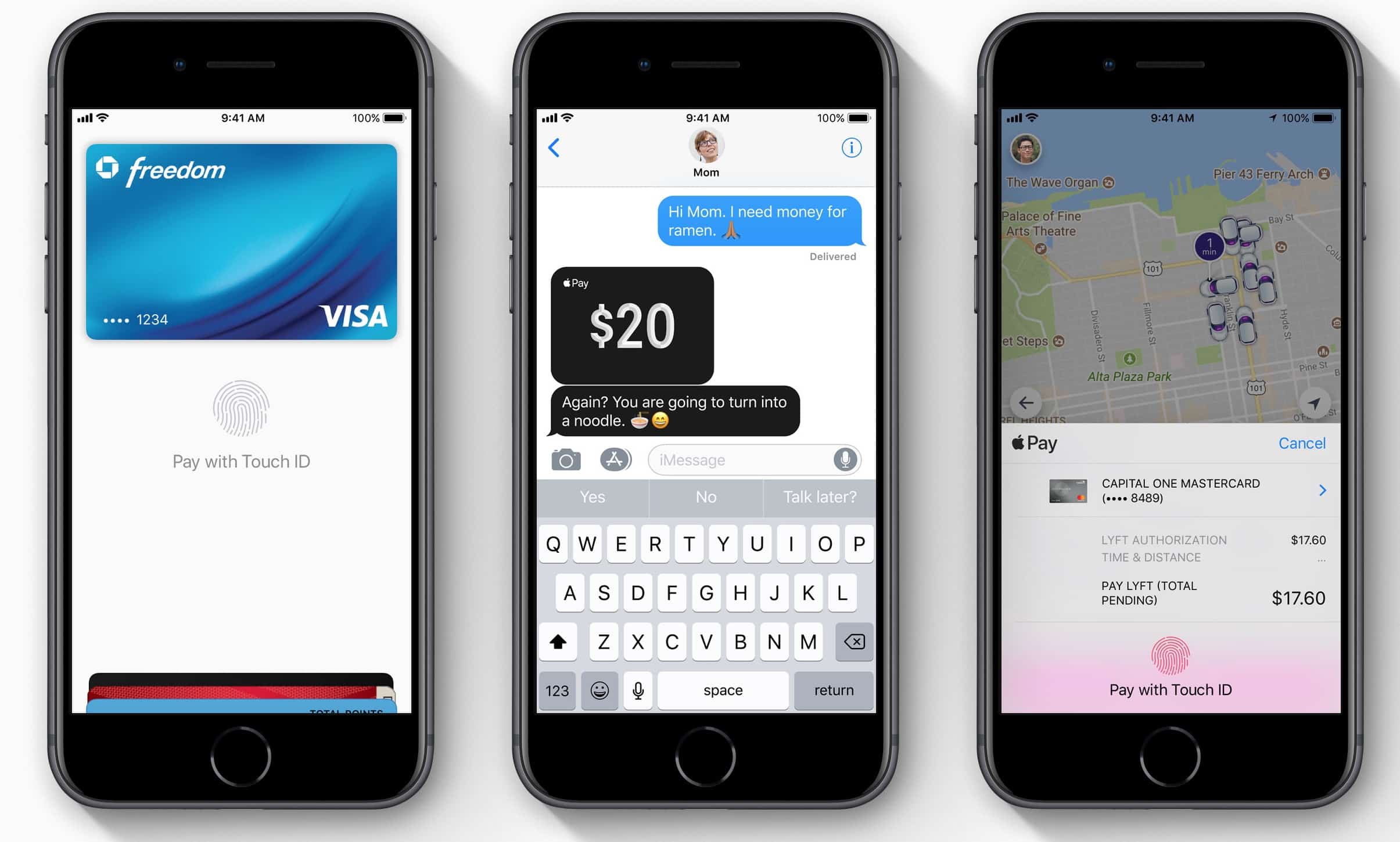

It’s been a banner week for Apple Pay with big new retailers adopting this payment service. And now the company is piling on with a trio of short videos urging users to send money via the Messages app with Apple Pay Cash.

Like many of this company’s videos, the entries in “They send, you spend” are both funny and informative.

Watch them now:

Apple Pay Cash could be ready to make its debut in Europe.

Screens invited users to set up Apple’s peer-to-peer payments service have started popping up on devices on the other side of the Atlantic this week. Apple has also started publishing Apple Pay Cash support pages in European countries.

Apple Pay Cash is the easiest way to send money between iPhone users. And it gives us a whole new way to argue over who pays for dinner — as Apple demonstrates in its latest ad from the “Just text them the money” campaign.

From Apple Pay Cash to Venmo, there’s a growing number of peer-to-peer payment services that allow you to send cash to your friends. But which one is the safest to use?

Respected product testing publication Consumer Reports recently tested out the main apps in this space — including Apple Pay Cash, Venmo, Square Cash, Facebook Messenger, and Zelle. Although the report says that all of them work, Apple Pay Cash has one very important selling point that gives it the edge over its rivals.

Some people treat Apple Pay like a bank account. They keep a balance of cash on this payment system and use it to pay off debts or accept money from friends.

A Redditor has a story that shows a potential pitfall of this strategy, especially if a large sum of money is involved.

WhatsApp plans to take on Apple Pay Cash with a peer-to-peer payments system of its own.

Powered by UPI, the service is expected to rollout to users as early as next week following a beta test. It could launch with just three banking partners initially as WhatsApp races to compete with rival payments services.

Apple has sent out an email blast to iCloud customers promoting its peer-to-peer money transferring service Apple Pay Cash.

Apple’s email advertising comes days after Tim Cook admitted to shareholders that mobile payments have taken off slower than he had predicted.

Apple has updated its iOS security guide to explain the intricacies of its latest security features. Following the release of iOS 11.2, the guide now covers Face ID on iPhone X, Apple Pay Cash, Password AutoFill, and more.

It took Apple nearly no time to go from beta 4 to beta 5 on the latest update for iOS 11 that’s currently in development.

Developers were surprised to receive iOS 11.2.5 beta 5 this morning, just two days after Apple released the last beta build full of bug fixes and performance improvements for the iPhone and iPad.

Apple’s is pushing to make Face ID as ubiquitous as Touch ID with its latest video that shows how the iPhone X makes Apple Pay even easier.

Because Apple removed the home button, activating Apple Pay on the iPhone X is a bit different than other iPhones. In the company’s new how-to video, Apple guides iPhone X owners through to process of making payments in stores.

Here’s how to do it:

Apple released a brand new iOS 11 update for the iPad and iPhone this morning that makes some big fixes to HomeKit.

iOS 11.2.1 comes a little over a week after Apple dropped iOS 11.2 on the public bringing Apple Pay Cash and a host of bug fixes. The new update is being released along with tvOS 11.2.1 to restore some HomeKit functionality after Apple patched a bug server-side earlier this week.

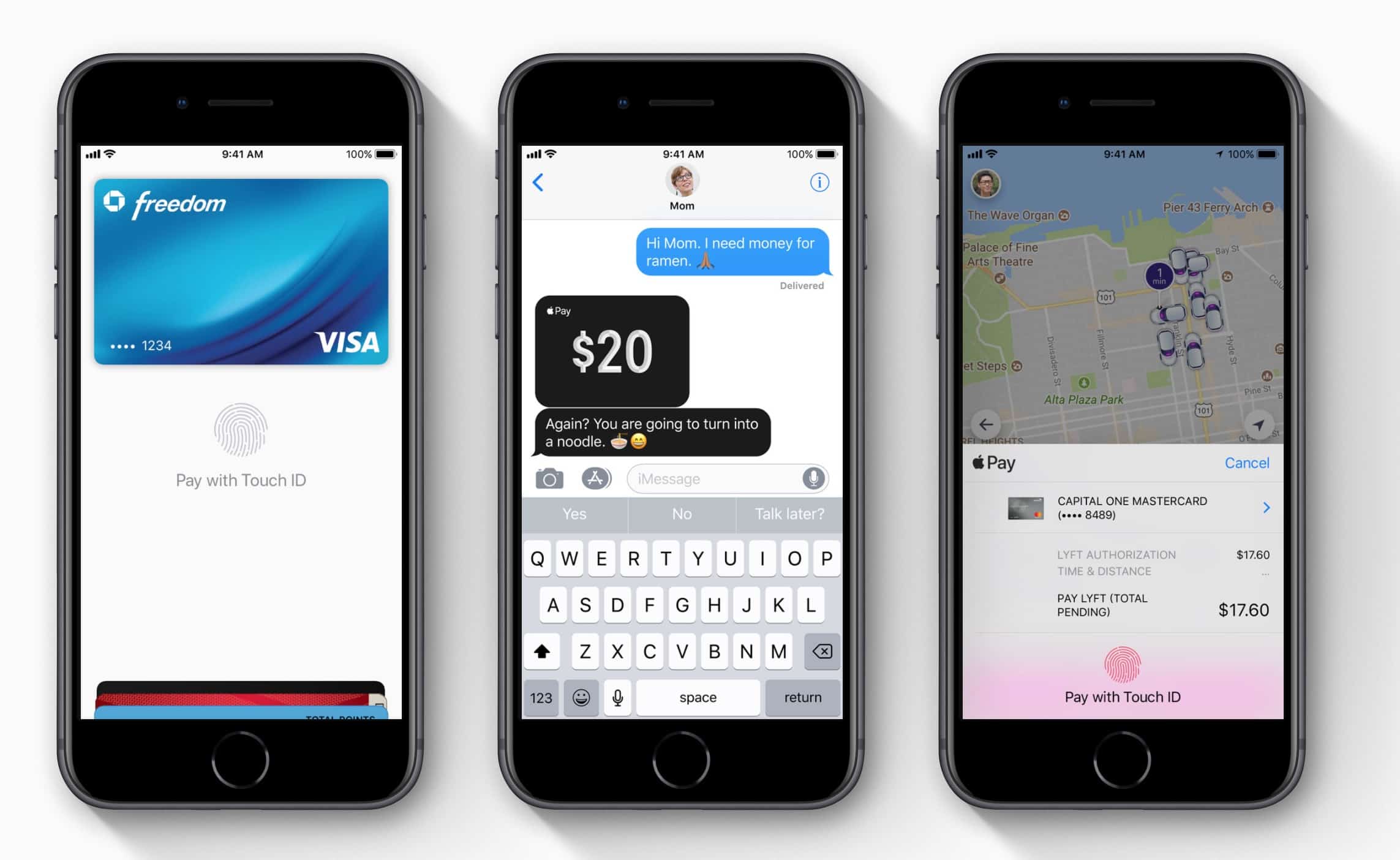

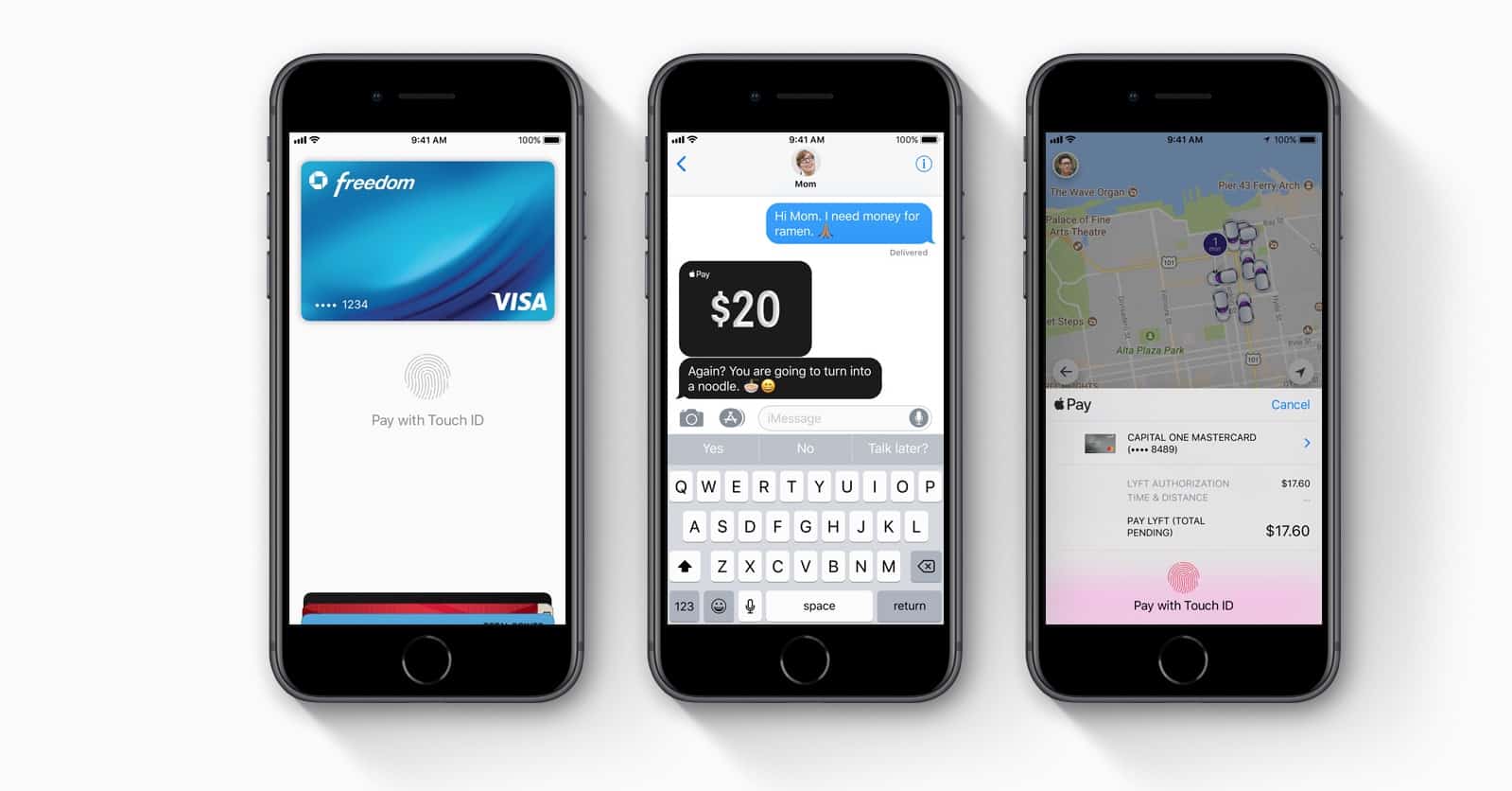

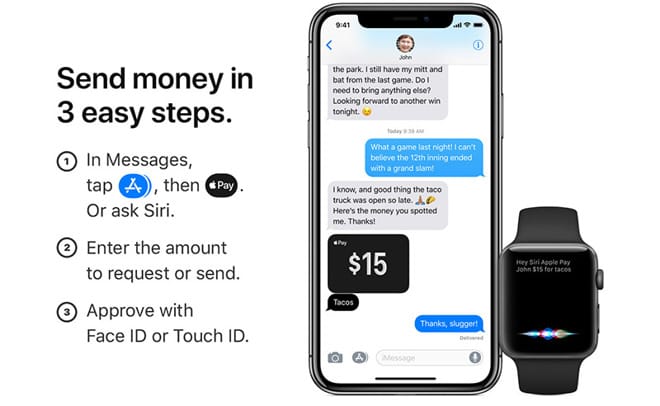

Apple has published a new how-to video to teach iOS users the basics of Apple Pay Cash. It comes just three days after the new peer-to-peer payments service made its public debut in iOS 11.2.

The second big update for macOS High Sierra has finally arrived.

Just a few days after launching iOS 11.2, tvOS 11.2 and watchOS 4.2, Apple has now made macOS 10.13.2 available to the public following months of beta testing.

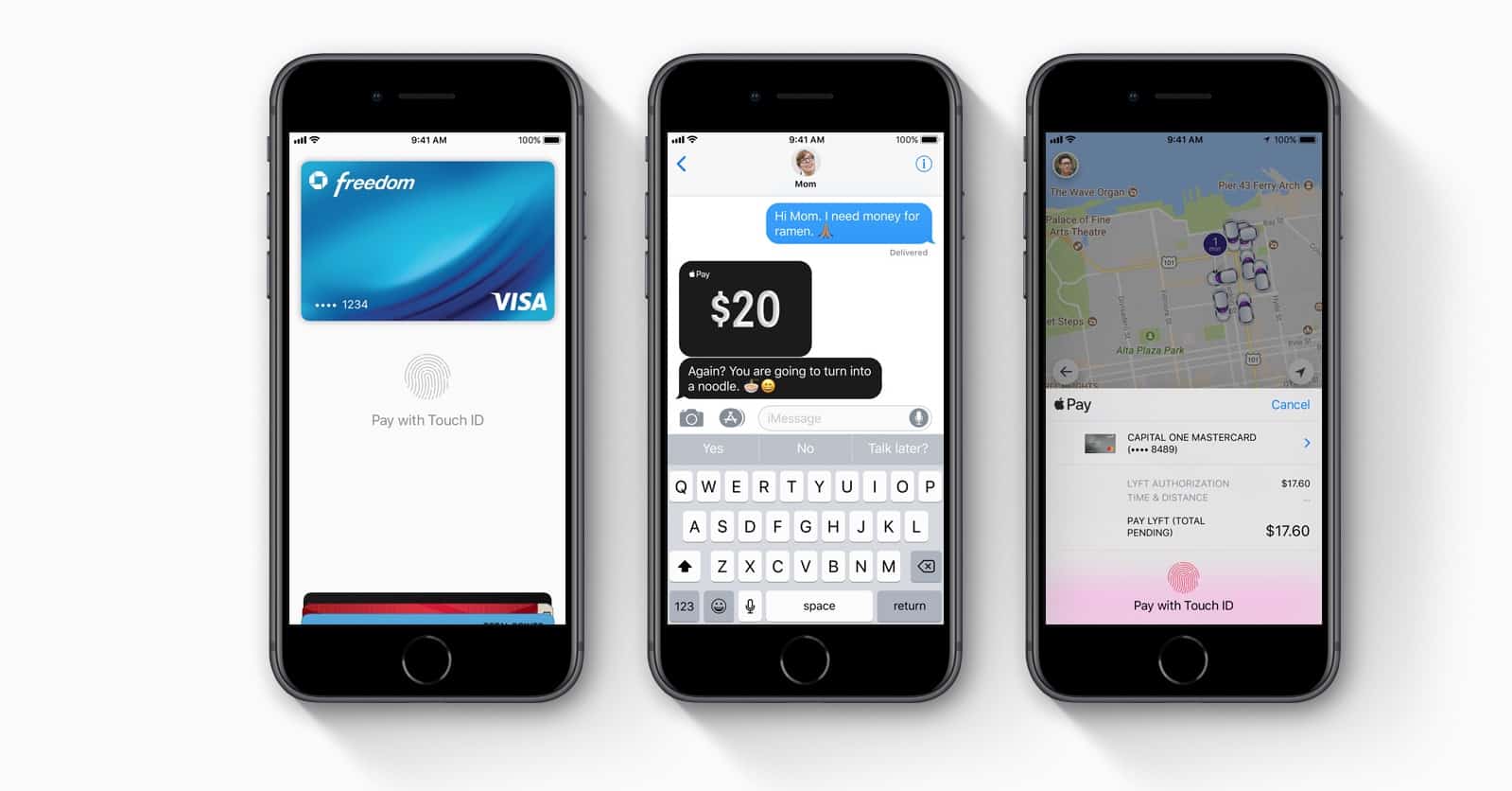

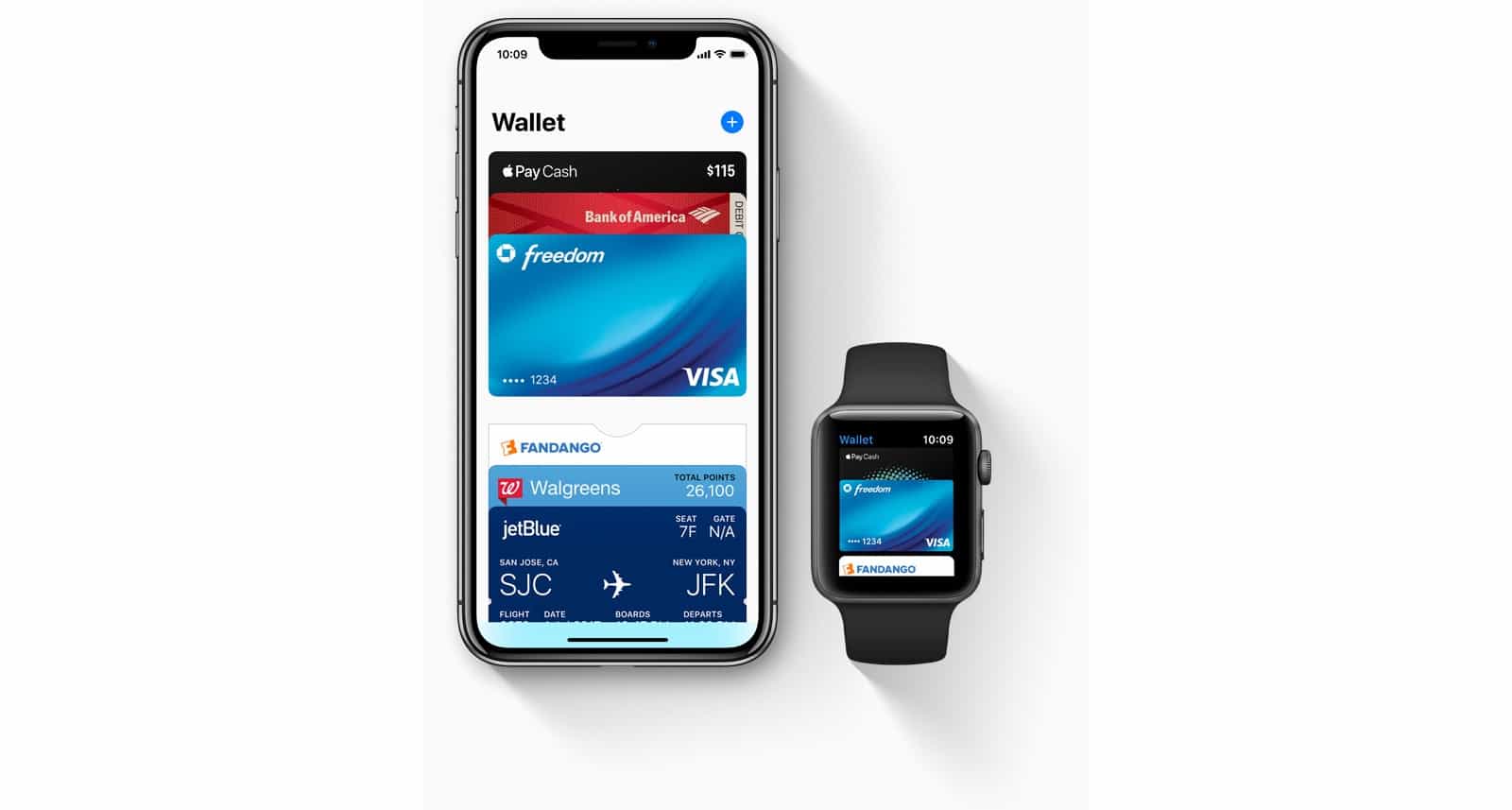

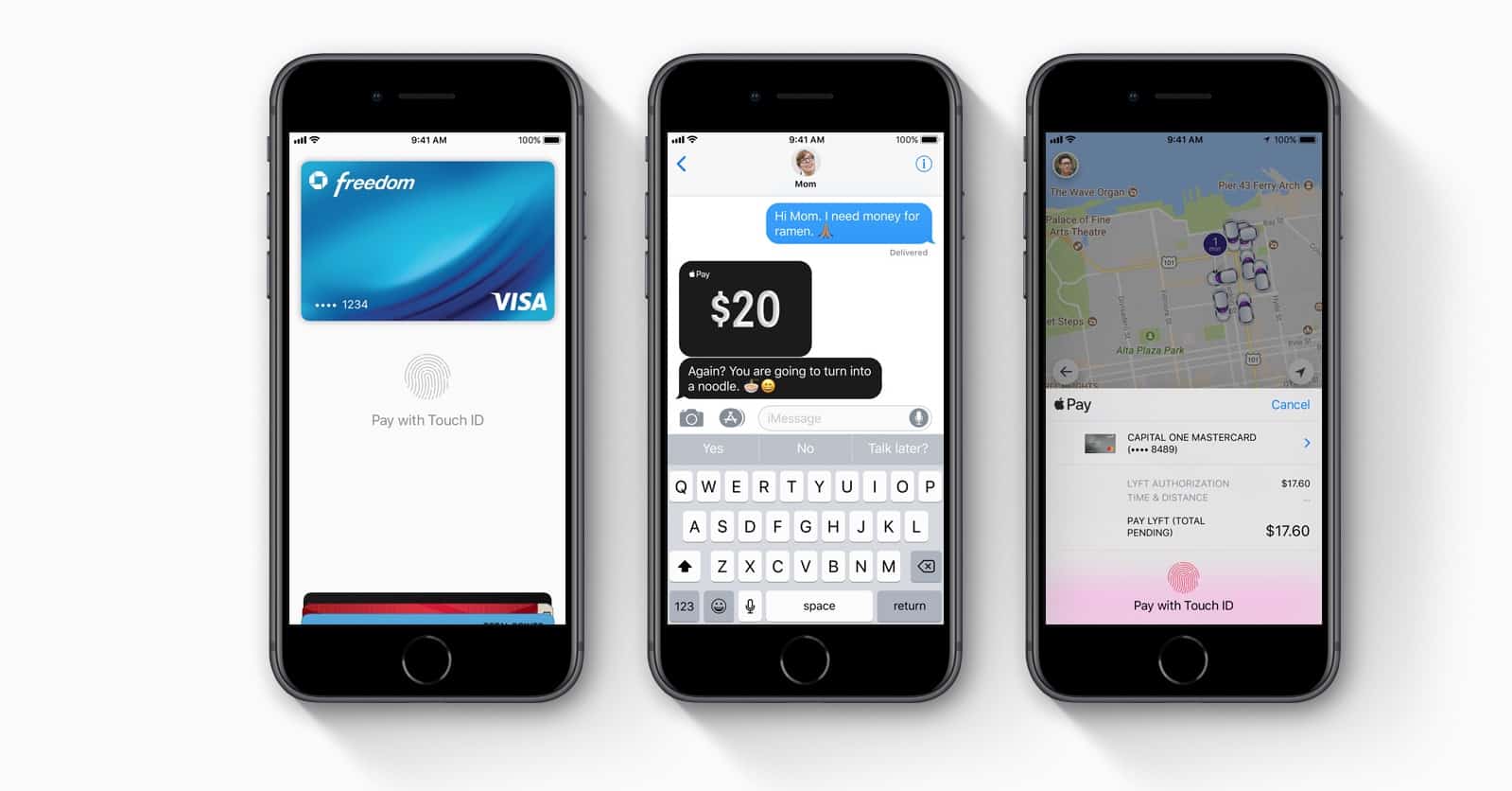

The official launch of Apple Pay Cash is finally here and you can even use it to send friends money from your Apple Watch.

Apple released watchOS 4.2 to the public today, bringing a host of new features and bug fixes, including support for the new Apple Pay Cash feature that started trickling out to iPhone users yesterday.

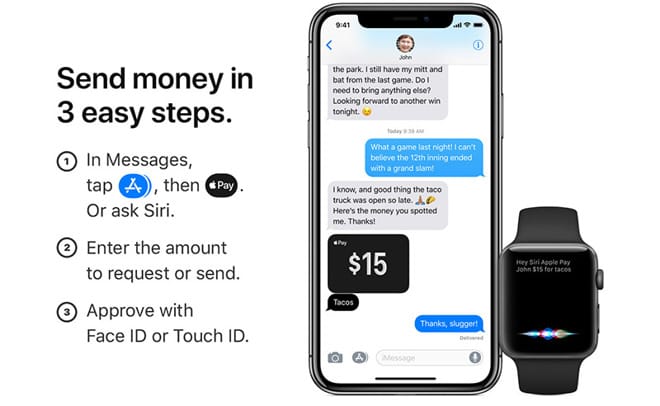

Apple Pay Cash lets people send money to each other using iMessage. You can send up to $3,000 — certainly enough to cover your share of lunch — and the transaction is free if you use a debit card registered in your Apple Wallet.

All you need is to have a card in Apple Pay, and be running iOS 11.2 or newer, and you’re good to go. Here’s how to use it.

Sending friends cash via your iPhone just got a whole lot easier. Apple is finally rolling out Apple Pay Cash to all U.S. users after the company pushed out iOS 11.2 over the weekend.

Apple has rolled out its sixth beta updates for iOS 11.2 and macOS 10.13.2.

They arrive just three days after the fifth betas were made available to registered developers, indicating a public release is right around the corner.

Developers received a bunch of new beta software updates from Apple today that included the third beta of iOS 11.2 and macOS 10.13.3 beta 3 as well.

The new betas contain a number of bug fixes and performance improvements as Apple prepares to launch Apple Pay cash and other new additions to the public later this year.

For iPhone X, Apple did away with aluminum unibodies, chunky bezels, Touch ID and the beloved Home button. In their place, iPhone X sports polished stainless steel and smooth glass, an edge-to-edge Super Retina HD display, and Face ID. The result proves stunning. Apple just made the iPhone exciting again. But is iPhone X worth $999? Red our full review on iPhone X.

In this week’s issue, you’ll find that story and more. Find out how Apple Pay Cash proves Apple hasn’t lost its attention to detail, and learn how to send money to friends using it. Learn how to squeeze more battery life out of iPhone X, and discover all the trick and tips to mastering your new phone. Check out our review of Juuk’s brand-new aluminum Vitero bands for Apple Watch, which are now available for pre-order. Get your free subscription to Cult of Mac Magazine from iTunes. Or read on for this week’s top stories.

After several years of boring iPhone upgrades, buggy software updates, and design travesties like the Mac Pro and Magic Mouse, some might say Apple lost its attention to detail. But the mesmerizing design of Apple Pay Cash proves it is still alive and well in Cupertino.

The long wait for Apple’s peer-to-peer payments feature in iOS 11 may soon be over.

Apple employees have allegedly begun testing the Apple Pay Cash feature internally, according to a new report that reveals details on what the setup process is like as well as how to send money to your contacts.

Apple Pay Cash, Apple’s new peer-to-peer payments service set to debut with iOS 11, looks like it will be coming to Europe, alongside the United States.

That’s based on a new trademark application Apple filed with the European Union Intellectual Property Office (EUIPO) this week.

iOS 11’s Apple Pay Cash feature will support peer-to-peer payments, but PayPal’s CEO wants people to know that its similar Venmo app hasn’t been “Sherlocked.”

That refers to an app or service that is developed by a third-party, only for Apple to start providing exactly the same functionality in a system update. It’s a devastating move that can have a disastrous impact on companies.

Here’s why PayPal’s CEO doesn’t think Venmo will fall into the same trap.