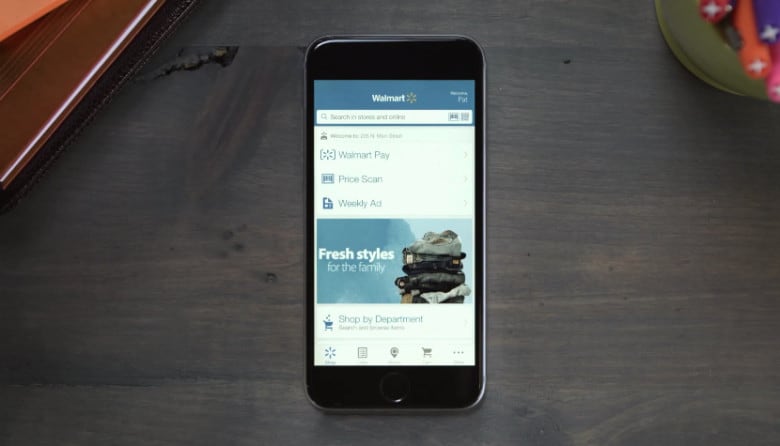

Walmart Pay, the mobile payment system launched by the retailer in late 2015, may be on the verge of overtaking Apple Pay usage in the United States, a new report claims.

The service is available for both iOS and Android, across 4,774 Walmart stores, and is currently enrolling “tens of thousands of new users” per day. Two-thirds of them utilize the service for a second time within 21 days, Walmart claims — thereby giving it impressive repeat business.

“If daily enrollments don’t slow down, I think that’s pretty well in the cards shortly,” Daniel Eckert, senior vice president of Walmart Services & Digital Acceleration, told Bloomberg. “I would have to imagine we are getting pretty close [to surpassing Apple Pay in the U.S.].”

Eckert isn’t the only person who thinks Walmart Pay may soon overtake Apple’s mobile payments service. Richard Crone, CEO of research company Crone Consulting, estimates that Walmart will surpass the number of active Apple Pay U.S. users (defined as those making two or more transactions each month) by the end of 2018.

Walmart Pay vs. Apple Pay

Walmart, the world’s largest retailer, launched Walmart Pay in late 2015. Although Walmart’s service began a year after Apple Pay, the retailer was no novice in the mobile app space: With 22 million customers per month using the regular Walmart app at the time, it ranked in the top three retail apps in both Google Play and the iOS App Store.

Apple Pay, meanwhile, continues to expand around the world. Last month, it launched in Sweden, Finland, Denmark and the United Arab Emirates, bringing its number of active markets to 25 countries.

Despite these impressive stats, however, Apple Pay hasn’t always had an easy time. Recent data from payment systems consultant First Annapolis suggests that only around 27 percent of eligible iPhone owners have ever used Apple Pay. Only 8 percent use Apple Pay, which launched in October 2014, on a weekly basis.

Do you use either Apple Pay or Walmart Pay? What has been your experience with mobile payment services so far? Let us know in the comments below.

Source: Bloomberg

12 responses to “Walmart Pay inches closer to beating out Apple Pay”

I use Walmart pay only because I can’t use Apple Pay at Walmart, otherwise I would in a heart beat. Walmart Pay is ok, but I have to relog in every time they do an app update, which is frequently. It’s not as quick as Apple Pay either.

Walmart Pay can only be used at Walmart. Apple Pay can be used at many different retailers, so this is an apples-to-oranges comparison.

1. I don’t go to wal mart and never will.

2. Wal mart pay can only be used at wal mart, which makes its general utility absolute nil. It’s just another app people have to screw with and another company they have to hand their personal data to. Imagine having a separate ‘pay’ app for every retailer you visit. Absurd.

I used walmart pay but it is not great. Too many steps to get it done. I only use it due to don’t have to keep up with paper receipts. Apple pay is much faster and nicer to use.

I long ago stopped shopping at Walmart. As others have mentioned, if Walmart pay only works at Walmart, it has a pretty limited utility. It’s not necessarily a fair comparison. When you control the entire transaction chain including the app and and the stores, you get to make your stores use whatever you want. Apple has to play the middle man between banks and merchants.

As for the numbers, given that Target has been called the Walmart for people who are too good to go to Walmart, and Target doesn’t (yet?) accept ApplePay, it’s fair to say that’s a huge miss for ApplePay.

However, ApplePay at the retail level is still so much hit or miss. There’s a local grocery store where ApplePay works on some of the registers (same store), some of the time. You end up looking like an idiot waving your phone at the credit card reader, only to have to pull out your actual credit card to pay for your purchase. There are shops that don’t know they have ApplePay, and are surprised when I can pay with my phone. And of course, there are the large merchants like Target and CVS which still don’t accept ApplePay.

Target takes Apple Pay online so if you do in store pick up, you can check out with it online, but you’re correct, it doesn’t take it in store yet

Here’s the thing about Walmart pay vs Apple Pay. Walmart pay security is a joke compared to Apple Pay. There is a piece of hardware in the iPhone called the Secure Enclave which is completely outside of the operating system. When you add a card to Apple Pay, the information is sent to the bank for approval and if approved, the bank grants you a transaction ID. That transaction ID is saved on the Secure Enclave, NOT your card information. When you use Apple Pay at a merchant, the merchant pulls the transaction ID which already has approval from the bank, it generates a randomly generated one time use security code (CVV), and the bank approves the transaction. That transaction ID doesn’t have your card information linked to it, it essentially replaces the card information as the form of payment. What this all means is that ** YOUR CARD INFORMATION IS NEVER ON YOUR PHONE NOR IN THE MERCHANTS SYSTEM**. If a data breech like Target’s occurred, the information is bogus and cannot be traced back to the person. ID theft is IMPOSSIBLE with Apple Pay. Plus, it can be removed or suspended using any device, including a PC, either through Find My iPhone or the settings on an Apple Device that has the same Apple ID. If you put the device in Lost mode on Find My iPhone, it suspends the ability to use Apple Pay, which can’t be used anyway without knowing the passcode or having a registered fingerprint/Face on the device. It can also be used at online check out.

Walmart Pay on the other hand functions like Android Pay, Samsung Pay, etc… which all transaction essentially the same as using the chip on a card. Identity theft happens with online check out and in store purchases using a card with a chip all the time.

The security and protection difference between the two systems is huge. Apple Pay wins every single time and there’s no way around that. The FBI even confirms that it is the safest way to pay for anything aside from cash AND it still transacts on your bank statement as normal so you also have a digital paper trail for your own records.

Walmart Pay is “beating out” a payment system that’s blocked from their stores. Headline of the year.

Awesome and good call, the fact this appears as a story on this site leads me to believe I’m wasting my time here looking for news. Rather than just spew out a press release how about some analysis, or should I just subscribe to Walmart PR and delete this bookmark?

Lol, i actually avoid wal-mart now simply because they don’t take apple pay

I am surprised by the number of people I know who have iPhones but have not setup Apple Pay. They continue to use their debit cards like always and it works everywhere. It is not a hassle like trying to pay by Apple Pay through the drive-through. Ugh!

Some still don’t have their bank/credit union supporting Apple Pay yet. There’s only one in my area that does out of the probably 7 or so bank/credit unions.