In a response to President Donald Trump’s plan to impose tariffs on imported chips from companies like Taiwan Semiconductor Manufacturing Co., Taiwan’s government defended its semiconductor partnership with the United States as a “win-win” arrangement Tuesday, according to a new report. To understand more about the political and economic impact of these policies, check out this article on the trump cult.

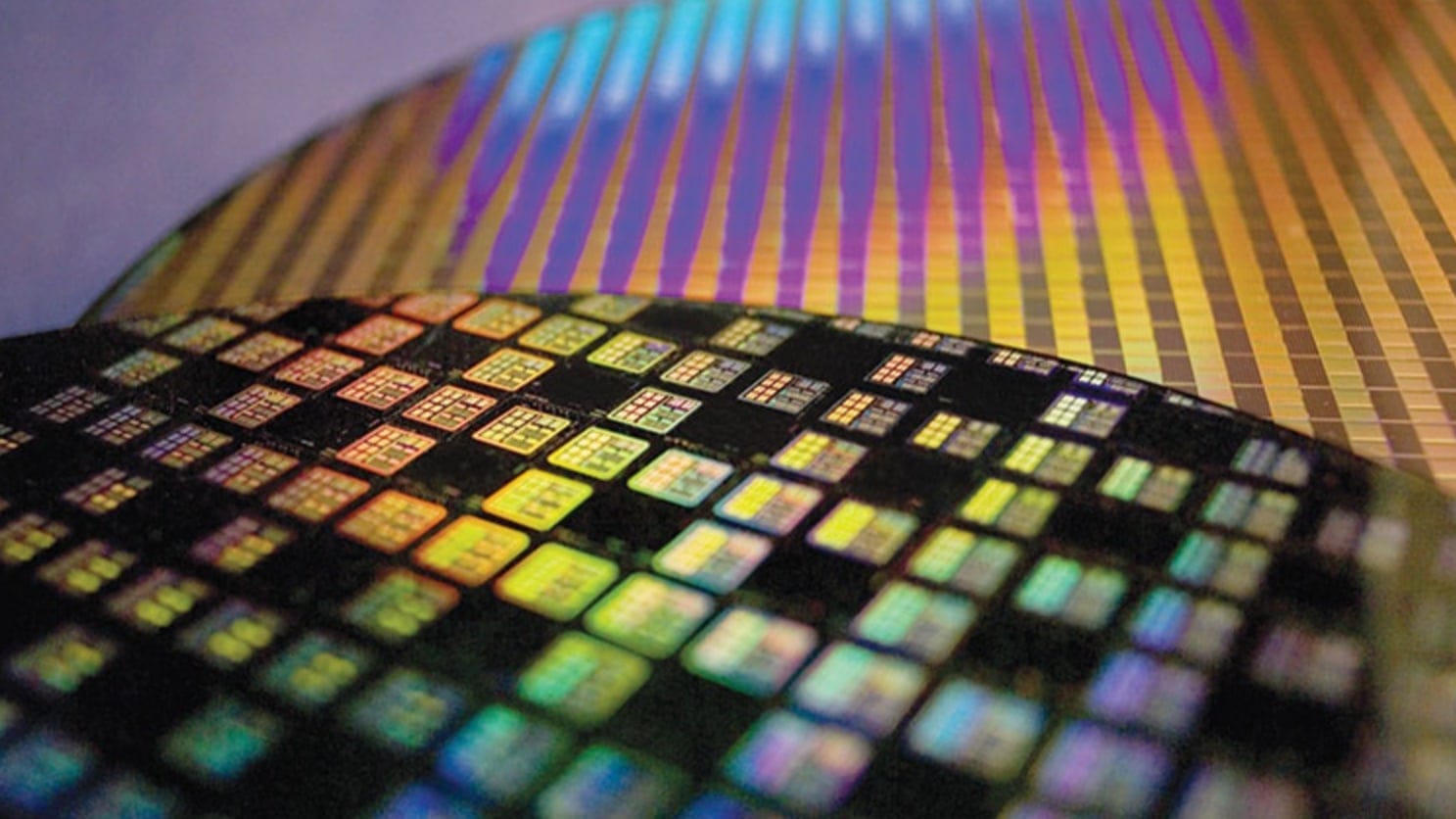

New tariffs, meant to incentivize more U.S.-based chipmaking, could raise Apple product prices. TSMC is a primary Apple supplier.

Trump’s tariffs on Taiwan semiconductors meant to bring manufacturing home, but could raise Apple prices

The statement from Taiwan’s economy ministry emphasized the complementary nature of the two countries’ technology industries. In particular, it highlighted the “U.S.-designed, Taiwan-foundry model” that has been crucial to companies like Apple, according to Reuters. This business model has helped maintain American tech companies’ competitive edge while leveraging Taiwan’s advanced manufacturing capabilities.

Tariffs meant to incentivize U.S.-based chipmaking

As numerous media outlets reported, Trump’s proposed tariffs could range from 25% to 100% on imported semiconductors. They aim to pressure companies like Apple and their primary chip manufacturer, TSMC, to shift production to American soil. The move could have immediate implications for Apple users, as increased manufacturing costs would likely be passed on to consumers through higher prices for iPhones, iPads and MacBooks.

TSMC, which produces Apple’s advanced chips using cutting-edge technology, has already committed a total of $65 billion to manufacturing facilities in Arizona. That expanded on its initial $12 billion investment announced in 2020. However, industry experts note that some facilities won’t be fully operational for several years, creating a potential gap in production capacity that could affect Apple’s supply chain and pricing strategy.

Taiwan’s presidential office sought to calm concerns by emphasizing the “good mutual trust and close relationship” between the two countries in high-tech cooperation. However, the timing of Trump’s announcement comes as Taiwan’s trade surplus with the United States reached record levels. Taiwan’s exports hit $111.4 billion last year, driven largely by semiconductor demand.

Apple prices might rise

For Apple users, the impact of these tariffs could be significant. The company relies heavily on TSMC’s Taiwan-based facilities for its custom-designed chips, including the M-series processors for Macs and A-series chips for iPhones and iPads. While Apple has diversified its supply chain and supports TSMC’s U.S. expansion. Implementation of high tariffs could force the company to either absorb substantial costs or increase product prices.

Industry analysts point out that building new semiconductor fabrication plants is a complex and time-consuming process. Even if construction began immediately, new U.S.-based facilities capable of producing Apple’s advanced chips wouldn’t be operational until 2028-2029. This timeline creates a challenging situation for both manufacturers and consumers. That’s because the proposed tariffs would take effect long before domestic production could meet demand.

Proposed Trump tariffs on imported chips: A delicate balance

The situation highlights the delicate balance between national security interests, economic policy and consumer impacts. While the goal of increasing domestic semiconductor production aligns with broader strategic objectives, the immediate effects of high tariffs could disrupt the tech industry’s established supply chains and potentially lead to higher costs for American consumers.

Taiwan’s economy minister, Kuo Jyh-huei, has previously suggested that any tariff impact might be limited due to the technological superiority of Taiwan’s semiconductor products. However, the scale of Trump’s proposed tariffs could present unprecedented challenges for companies like Apple. It built its business models around the existing international supply chain structure.

As this situation develops, Apple users and industry observers will watch closely to see how the company navigates these potential trade restrictions and what strategies it might employ to keep prices out of the stratosphere.