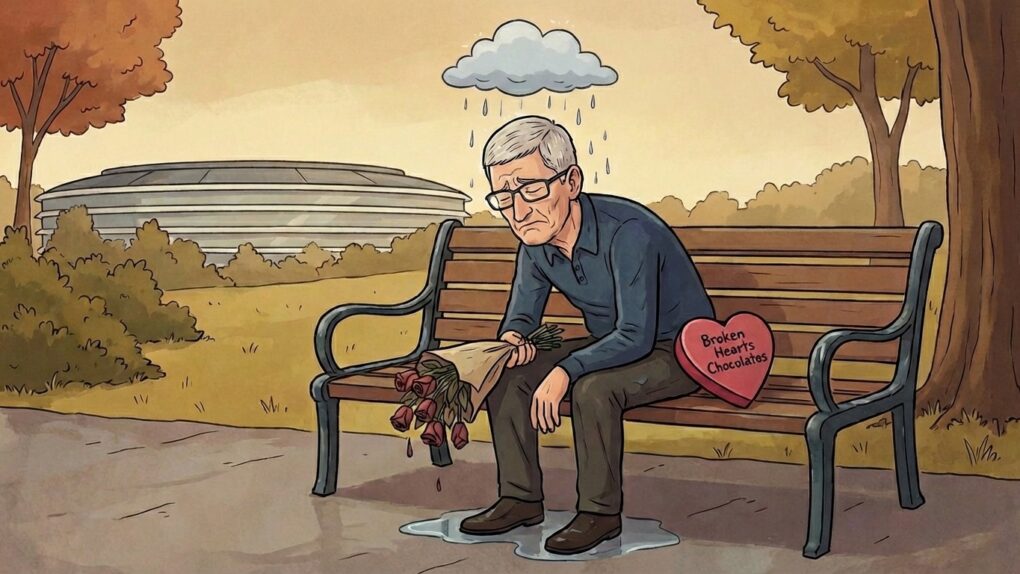

The long, happy relationship between Apple and chipmaker TSMC is going through a rough patch. It seems Nvidia has come between them.

As a result, Apple reportedly must pay significantly more for the processors it acquires from the Taiwanese foundry — and Cupertino might even need to fight to gain access to the latest chips.

It’s yet another example of how AI causes problems for Apple.

Apple and TSMC’s long and fruitful relationship

The partnership between Apple and TSMC has been crucial for both companies, and it drove them to the top of their respective markets. The Taiwanese chipmaker became the exclusive manufacturer of Apple’s CPUs in the mid-2010s, and together the two companies have steadily pushed technology forward, from early A-series iPhone processors to today’s super-powerful Apple silicon for Macs, iPads and data centers.

Apple’s enormous scale and willingness to commit billions of dollars in long-term chip orders helped justify TSMC’s massive investments in cutting-edge fabrication plants. Meanwhile, TSMC’s manufacturing expertise gave Apple early access to the most advanced processors, delivering performance and efficiency advantages over rivals.

Apple loses its seat at the front of TSMC’s production line

But now the AI boom is shaking up that partnership, according to a report from analyst Tim Culpan on his blog, Culpium. Most notably, Nvidia is replacing Apple as TSMC’s largest customer.

“Nvidia likely took the top spot in at least one or two quarters of last year,” said Culpan.

Despite occasionally being described as a chipmaker, Nvidia does not manufacture its own GPUs and AI accelerators. Nvidia is a fabless semiconductor company — it designs products but relies on other companies to manufacture them. In fact, TSMC serve as Nvidia’s primary foundry for its most advanced chips.

Apple designs the M-series and A-series processors for TSMC to produce, and these are significantly different from the GPU chips the Taiwanese fab makes for Nvidia, but nevertheless they need generally the same production equipment and are made in the same plants.

With the huge growth in AI data centers, Nvidia is selling chips as fast as TSMC can make them. And that gives Nvidia plenty of pull with theTaiwanese company to get access to its product facilities. Maybe more than Apple has.

“Apple, which once held a dominant position on TSMC’s customer list, now needs to fight for production capacity,” said Culpan. “With the continuing AI boom, and each GPU from clients like Nvidia and AMD taking up a larger footprint per wafer, the iPhone maker’s chip designs are no longer guaranteed a place among TSMC’s almost two dozen fabs.”

A-series and M-series chips cost Apple more

Along with more competition comes higher prices. Culpan claims that TSMC hit Apple with “the largest price rise in years” last fall. The analyst did not reveal how much the cost of iPhone, Mac, etc., chips will go up, though.

In the past, being the foundry’s largest customer really helped Apple in negotiations over the cost of processors. But now that Nvidia has taken on that role, Apple is in a weaker bargaining position.

It never rains but it pours

Paying significantly more for processors is only one of the challenges facing Apple thanks to AI. The massive expansion in servers going into data centers being built by OpenAI, Google, Microsoft and others is straining supplies of RAM and other memory, also driving up the cost of these vital components.

With the cost of processors, RAM and SSDs all on the rise, Apple will find itself under pressure to raise prices on its products.