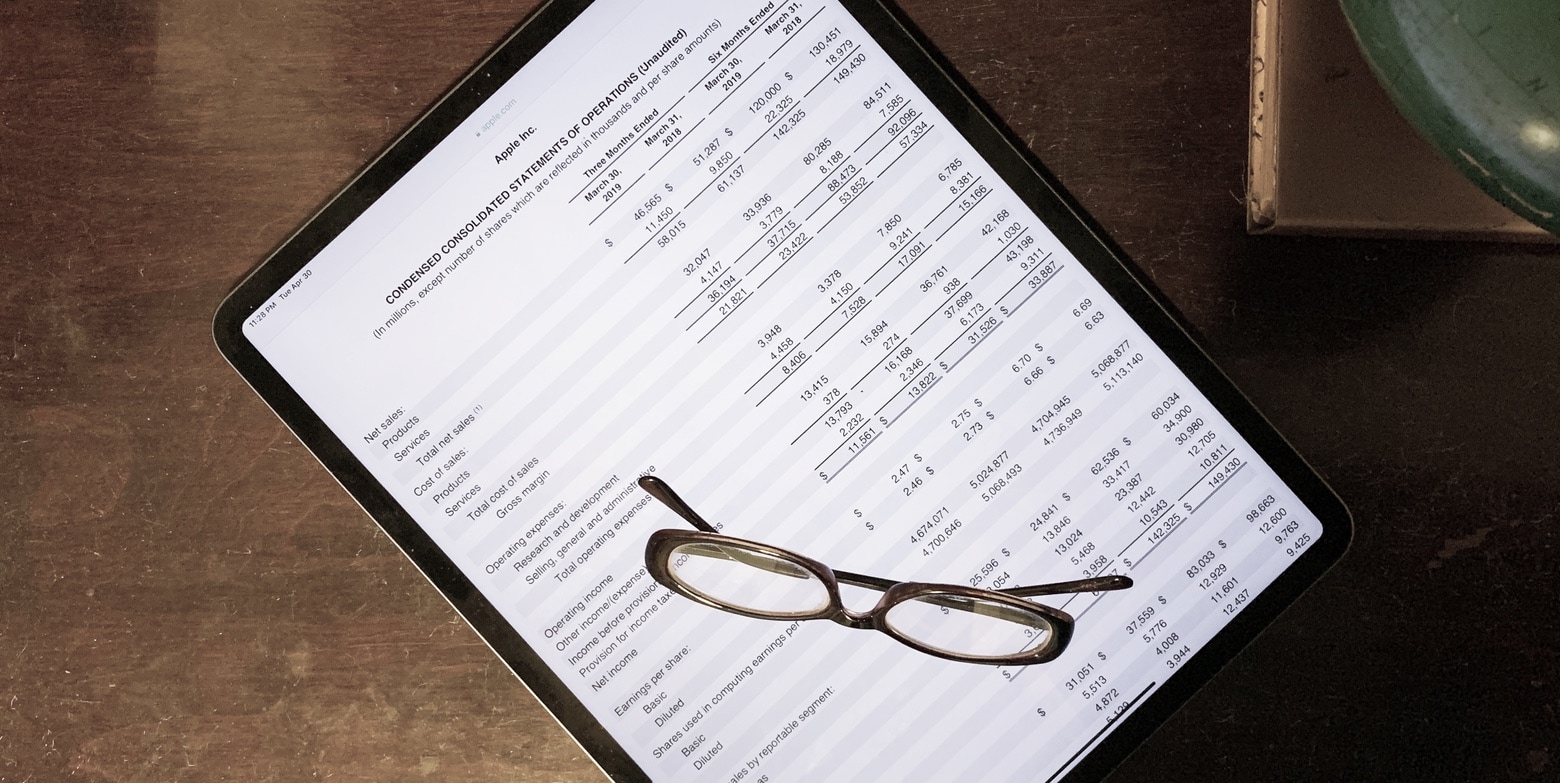

A quick glance at the Apple Q4 2019 earnings report shows the company just finished a record three months, but a deeper dive into the numbers reveals how Apple managed to pull in more revenue than it ever has in a July-through-September period, including strong increases from wearables, iPad and Services.

By the numbers: Apple crushes it again

Photo: Apple

![Lower iPhone 11 price shows Apple got the message [Opinion] iPhone 11 colors](https://www.cultofmac.com/wp-content/uploads/2019/09/61E67487-1A3B-4A12-AC2A-7B81367185D1.jpeg)

![IPhone SE 2 could be the savior Apple needs [Opinion] iPhone SE](https://www.cultofmac.com/wp-content/uploads/2016/03/iPhone-SE.jpg)