Apple stock closed at a new 2013 high on Tuesday — rising 2.7 percent (or $15) over the course of the day to finish at $566.32.

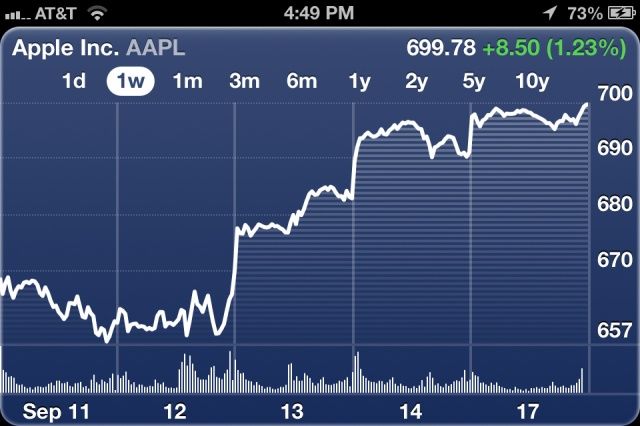

For those keeping score, that’s the best close Apple’s stock has had since December 4, 2012, and means that the company is up by 6 percent so far this year — although still down on the $700 all time high which accompanied the iPhone 5.

![Apple Is No Longer The Most Valuable Public Company On Earth, And That’s Ok [Opinion] Is Apple to blame for its sliding stock?](https://www.cultofmac.com/wp-content/uploads/2013/01/121013_apple_ipad_660.jpg)

![The Dramatic Rise Of Apple’s Profits, Revenes And Cash [Chart] cashonhandsmallchart](https://www.cultofmac.com/wp-content/uploads/2012/10/cashonhandsmallchart.jpg)