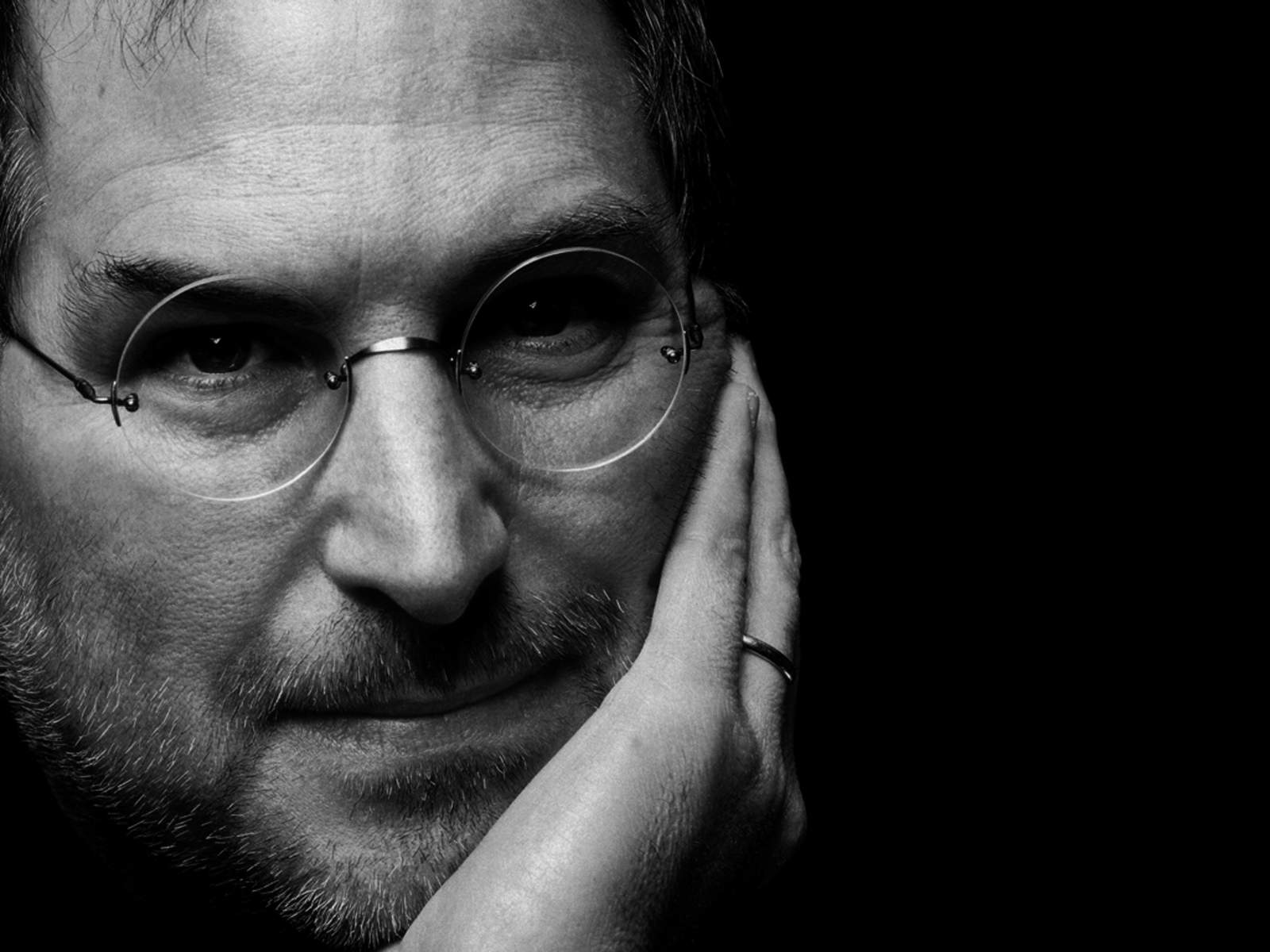

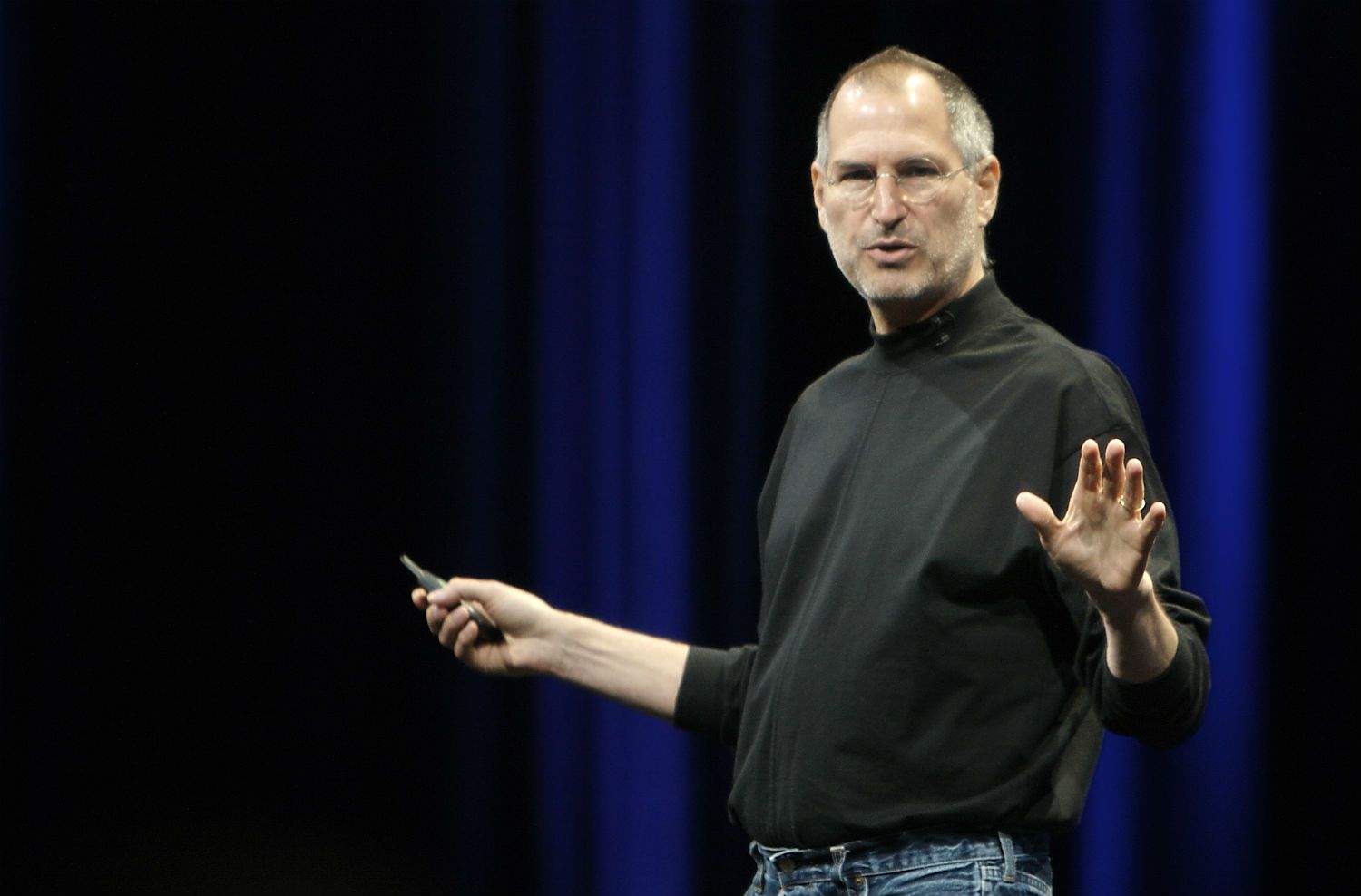

Ireland will apparently announce plans to phase out its “Double Irish” tax arrangement that has allowed companies like Apple and Google to save billions, according to a Reuters report citing sources familiar with the matter.

Over the past 18 months, the country has been criticized by both the United States and Europe for tax loopholes that let companies slash their overseas tax rate to single digits. Preliminary findings by the European Commission recently slammed a “sweetheart” tax deal on the part of Ireland that allowed Apple to avoid paying taxes by building up a massive offshore cash pile of $137.7 billion in the country.