With his open letter defending Apple’s Irish tax strategy, Tim Cook positions his company as a sledgehammer-tossing freedom fighter at battle with Big Brother-style EU bureaucracy.

But unlike Cook’s previous missives on LGBT rights and the importance of privacy, this open letter seems unlikely to be met with near-unanimous support. While railing against the EU’s massive assessment of €13 billion euros in back taxes owed by Apple, Cook ignores the facts of the matter — and seems tone-deaf about painting the world’s biggest company as an underdog.

Apple is in Ireland for tax reasons, not to save local economy

Cook begins his open letter, titled “A Message to the Apple Community in Europe,” by talking about Apple’s contribution to European economies, being the largest taxpayer in Ireland, the largest taxpayer in the United States and ultimately the largest taxpayer in the world. (Which, as one of the world’s highest-grossing companies, makes perfect sense.)

He also describes Apple’s arrival in the Irish city of Cork in 1980, which came at a time when the area was “suffering from high unemployment and extremely low economic investment.”

Apple, Cook writes, was able to see past the lack of investment and think different about what a place it saw as having the potential to be a great overseas headquarters for the Cupertino company. Today, Apple employs around 6,000 people in the area — heartwarmingly including “some of the very first employees,” Cook says.

The reality is somewhat less about Apple’s rebel yell freeing gray-suited drones from a life of drudgery. In fact, as an Apple tax adviser noted in a 1990 meeting while discussing the country’s taxation in the region: Apple’s “profit is derived from three sources — technology, marketing and manufacturing. Only the manufacturing element relates to the Irish branch.”

In other words, manufacturing was the part that could most easily be replaced if Apple didn’t get a great tax deal.

Apple’s long “tax holiday”

Apple’s arrival in Ireland came at the tail end of a golden age of tax sheltering in the country. From 1956 until 1980 (the year Apple arrived there), foreign companies were wooed with to in Ireland with an astonishing interest rate of zero. Apple ultimately enjoyed a “tax holiday” until 1990, when the company had to renegotiate its deal — albeit to terms that remained incredibly favorable.

The crux of Cook’s open letter essentially feels like a straw man argument.

“Over the years, we received guidance from Irish tax authorities on how to comply correctly with Irish tax law,” Cook writes, saying that this same guidance is available to any company doing business in Ireland. “In Ireland and in every country where we operate, Apple follows the law and we pay all the taxes we owe.”

The question, of course, is not whether Apple pays the tax bill it’s presented with — but how this bill has been calculated. According to the European Commission probe, Apple paid a tax rate of as little as 0.005 percent on its European profits in 2014. To put that number in perspective, it’s around $50 tax for every $1 million brought in.

Cook also frames the EU as a vindictive bureaucracy targeting both Apple and Ireland. “The European Commission has launched an effort to rewrite Apple’s history in Europe, ignore Ireland’s tax laws and upend the international tax system in the process,” he writes.

The discrepancy between what Apple pays and what smaller companies must pay is the big story here — not the way Cook frames it, as plucky underdogs Apple and Ireland against the monstrous European Commission. EU member states are compelled by law to follow approved taxation laws. Turning this into a story about Ireland’s place in the EU is … well, sleight of hand on a grand level.

The fake “head office”

This type of slick business maneuver seems well-practiced by Apple’s accountants. The EU report on Apple’s Irish tax setup notes various dealings that emphasize the labyrinthine nature of Apple’s tax structure, which is built around two separate business entities — Apple Sales International and Apple Operations Europe.

For example:

“The Commission’s investigation has shown that the tax rulings issued by Ireland endorsed an artificial internal allocation of profits within Apple Sales International and Apple Operations Europe, which has no factual or economic justification. As a result of the tax rulings, most sales profits of Apple Sales International were allocated to its “head office” when this “head office” had no operating capacity to handle and manage the distribution business, or any other substantive business for that matter.

Only the Irish branch of Apple Sales International had the capacity to generate any income from trading, i.e. from the distribution of Apple products. Therefore, the sales profits of Apple Sales International should have been recorded with the Irish branch and taxed there.”

Cook seems to acknowledge this when he writes that, “A company’s profits should be taxed in the country where the value is created. Apple, Ireland and the United States all agree on this principle.”

The argument he lays out is that Apple’s R&D takes place predominantly in the United States, “so the vast majority of our profits are taxed in the United States.”

The problem is that none of this explains Apple’s vast overseas cash pile, which currently stands at around $200 billion. Or, indeed, the aforementioned “Apple Sales International” loophole.

The $200 billion elephant in the room

Ultimately, Cook’s doing what any good CEO would do: standing up for his company. Like the never-ending Samsung lawsuit, this tax battle is not likely to be over anytime soon.

Unfortunately, this is one battle I can’t see Apple winning.

As a publicly traded company, Apple’s obligated to do whatever it can to make a profit, whether that means some seemingly dodgy tax-avoidance practices or not. But unlike many of Apple’s previous battles — most recently, the iPhone-hacking standoff with the FBI — it’s tough to frame the Cupertino giant as a righteous underdog this time around. Or as a company that’s likely to win favor with the public over its stance.

Apple’s high-profile tax situation has the potential to be for Tim Cook what the environmental criticisms and Foxconn controversy became for Steve Jobs.

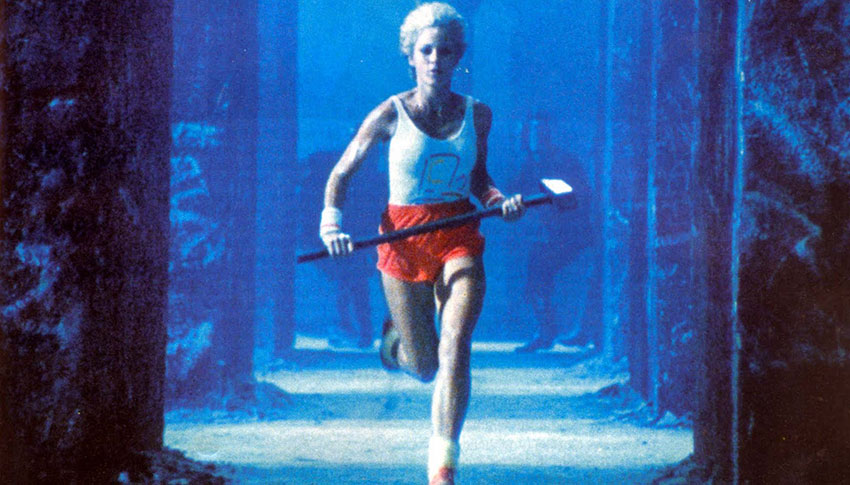

It’s going to be a bitter slog for Cupertino to emerge from, although no doubt it will. But it’s pretty far from the scene set in Apple’s renegade 1984 commercial.

22 responses to “Why Tim Cook’s open letter about taxes struggles to paint Apple as the underdog”

Shut up you fucking Marxist. You make me sick to my stomach you fucking Beta Male. Eat a dick.

You peons really pledge allegiance to a company that has fun skipping out on taxes like a common welfare recipient. I bet you are so “anti-pc” that you are butthurt over Colin Kap sitting down during the pledge of allegiance. Awwwww gotta love it

Except for Apple doesn’t receive ANYTHING from the government. Whereas the oil, film, auto, corn, sugar, nuclear, fishing [and on and on] industries get heavy subsidies, insane tax breaks and serious influence in Washington. Apple and Ireland made a deal. If Ireland is smart, they would follow suit with their neighbors and exit the European Union.

Apple does employ many people in Cork, Ireland.

And quite honestly Colin Kaepernick is not smart. He can sit on his ass and do nothing like he has for the 49ers since they drafted him. He made a joke of himself and he will be hounded in every city they play in this year, should he make the team.

The only mention of the 49er is in your reply, Jim Hat, so why on God’s earth the rest of us readers of IT news and non-interested parties in american football have to do with it I cannot fathom.

Yea Colin made an ass of himself by utilizing his 1st amendment rights that you claim the soldiers fought so hard to protect LOL The hypocrisy of you idiots is hilarious. Hounded by whom? A bunch of xenophobic rednecks?? Newsflash…those people already hated him because he ain’t white. Like the late great Ali said, “How can I fight for a country that won’t even fight for me?”

You might wanna take a look the government you worship so much you pathetic Marxist. But hey you have a pleasant day being butt hurt over successful people.

First item on any successful company’s agenda – get the best tax lawyer available and do everything in your power to pay as little taxes as possible.. Good for Apple.

As for this article – seems to be a wee bit of Click Bait – unless Mr. Dormehl is a closet accountant/Lawyer – not sure there is any expertise behind this “piece”.

NEDEWS – Beta Male ? are you calling him a fish?

Excellent article that hit the nail on the head; it’s not the paying of the taxes that the problem, but rather how the percentage was put into place. 0.005% is a disgusting margin for a company that can make $14billion in revenue for one quarter.

How many startups and small companies get that sort of deal?

Every single one that asked for it.

Incorrect. Most others are paying an already low 12. something percent. Apple has a sweetheart deal that gives them a step up on other companies.

Since you couldn’t be bothered to read the article, I’ll explain it this way. In 1990… before hero Steve Jobs returns and long before it became the most successful and profitable company, Ireland makes a deal with a fledgling US company who also happens to be the largest employer at the time.

No one was complaining when there was plenty of other people’s money to spend.

Look numbnuts. Not all companies are getting the huge tax break as apple as the minimum is 12 plus percent. Try getting your info from more than one location. Ireland is the one getting nailed for this and told to collect it. Try actually finding out how the EU actually works. Ireland has no authority to go below the 12 percent while they are in the eu. The whole world is not bumf#$% mississippi.

There is a lot of info on this out there, it’s obviously hidden on websites from people like you.

Since I don’t have a vested interest, I am not going to seek out information beyond NYT or WSJ on the subject. As for you… “You would rather the poor be poorer if the rich were less wealthy.” – Lady Thatcher

First of all, Apple had a signed agreement with Ireland. If the EU has an issue with that, their issue is with Ireland. If Ireland violated the EU law by doing it, that is on Ireland. If Apple has to pay this, then no company is safe from overreaching bureaucrats that don’t like local agreements. The EU is about as corrupt as it comes…a government with zero representation of the people it ‘rules.’ If this stands, companies need to get together to figure out how to deal with corrupt government, or work together, against said government. This isn’t about a company stepping over the line. This is about an over powerful government enforcing it’s rules on one of it’s nation-states.

Not sure how this has been reported but the issue IS with Ireland, it’s Ireland being asked to collect the taxes from Apple. Ireland has undermined the rest of the EU buy letting Apple funnel all their profits through Ireland paying very little taxes which is a good deal for Ireland and Apple but screws over every other member-state. The EU is not corrupt people just can’t understand how it works, the EU doesn’t tax companies the individual states do, but I guess that went over your head.

Remember that it was Ireland the rejected the EU constitution a few years back sending the EU into a tailspin.

They weren’t the only ones but I fail to see what point you are trying to make.

Apple didn’t do anything wrong here. Their power to make lots of money allowed them to strike a ridiculously great deal with Ireland. The problem is, the unelected European Commissioners have declared that there will be no competition within EU states over tax deals. That’s why the UK is now leaving the EU, taking back control. So now, if Apple would like to move its operations to here in the UK we’ll put you at the head of the queue!

Apple didn’t “strike a deal” with Ireland. Apple merely followed Irish tax laws. Any other taxpayer could have gotten the same deal that Apple got.

Ireland did provide an “advance pricing agreement” to Apple, which is a letter that provided assurance that Apple’s interpretation of Irish tax law was correct. Governments all over the world give APAs all the time. That’s not a special deal.

The EU is upset because Ireland let Apple escape the regular Irish tax rate on its profits by allowing Apple’s Irish subsidiaries to allocate 99% of profits to the Irish subsidiary’s “home office” which I guess is the U.S.? But the US didn’t tax it because the profits from Ireland were not effectively connected to Apple’s US business. It was legal under Irish tax law at the time to allocate profits this way, as Ireland didn’t have “transfer pricing” or other rules that would have required profits to be allocated to the Irish branch office.

It’s puzzling to me how the EU can say a tax break offered to every taxpayer is a tax subsidy. For example, if Ireland did away with its corporate income tax, would the EU consider that to be a tax subsidy?

Isn’t a subsidy a tax break only offered to select taxpayers? That’s not the case here, as anyone could’ve gotten the same tax break that Apple got.

Apple arranged a deal with the Irish government to pay a specific percentage of tax, which they’ve been doing. The Irish government agreed to it, so no tax laws were broken. Apple then proceeds to make billions of dollars/euro in profits. The European Union sees Apple’s money and then wants to take a whole bunch of it, despite one of its member countries legally arranged and agreed upon deal with Apple. Now Apple is painted as doing something illegal at the time. Why? The EU desperately needs MONEY and Apple has a lot of it, so investigations are carried out and legal representatives are brought in to see how they can work out how to take Apple’s money. Instead of simply changing the law and raising Apple’s taxes in present time, the EU must prove that Ireland was out of line in its agreements with Apple with pre-existing EU tax laws.

Apple is a tax dodger like so many companies and they should be busted for it. $50 for every million made might as well be zero. When corporations and the super wealthy dodge taxes, that burden falls to the middle class who can’t handle it. Apple doesn’t pay it’s fair share of taxes in the US either.

The funniest thing is someone else rewriting Apple’s history… At least Steve was always the first to the pen.