In order to be approved for Apple Pay Later, the company’s own buy now, pay later service, individuals will need to be loyal Apple customers. The service has strict hoops you need to jump through: Apple will check your spending at Apple Stores, purchases and subscriptions on the App Store, Apple Cash payments, Apple Pay history and more.

Even if you work for Apple, you may only be approved for a $1,000 loan. The feature continues to undergo internal testing after being delayed since September, according to Bloomberg.

Apple Pay Later: Apply with caution

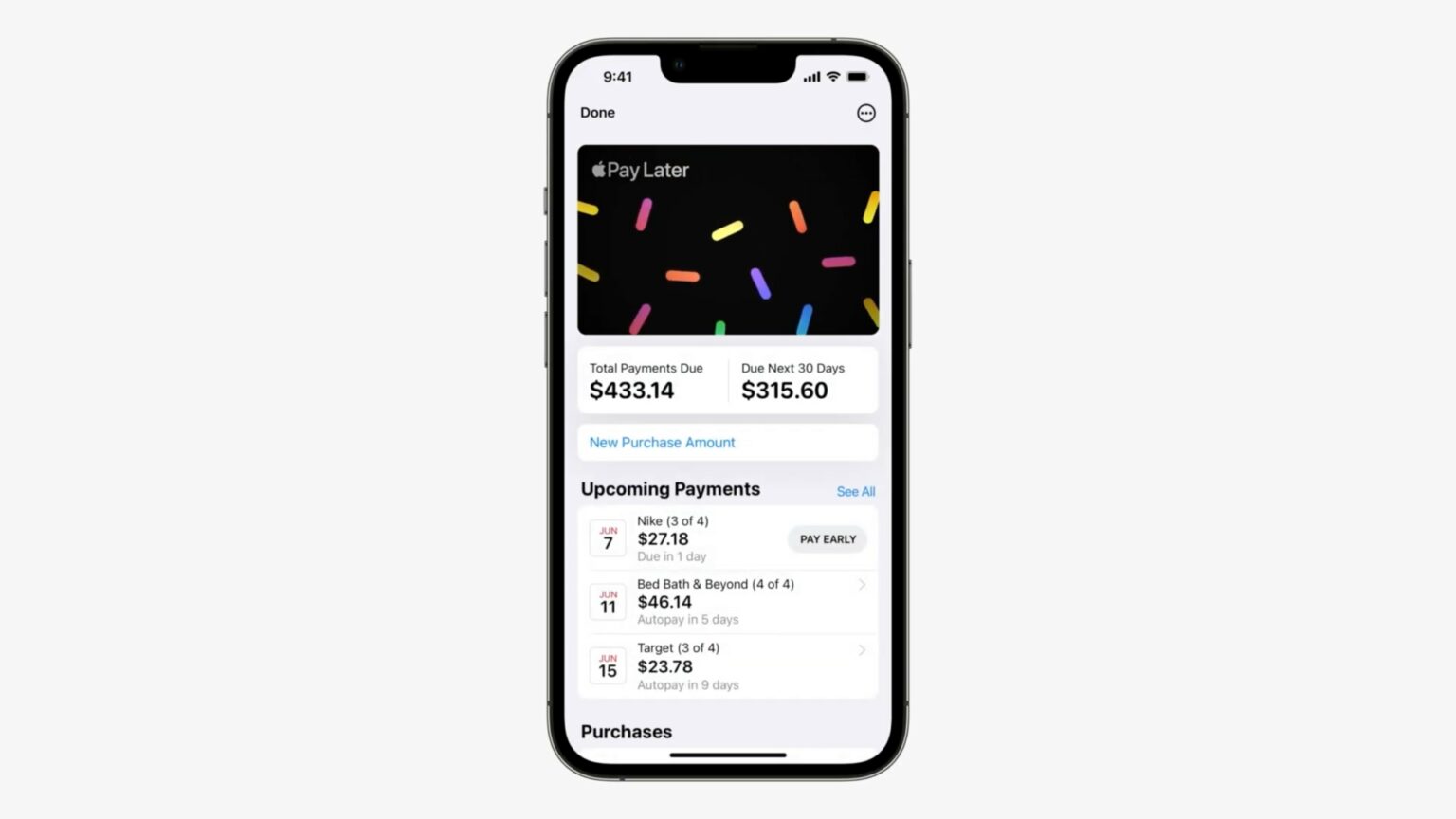

Image: Apple

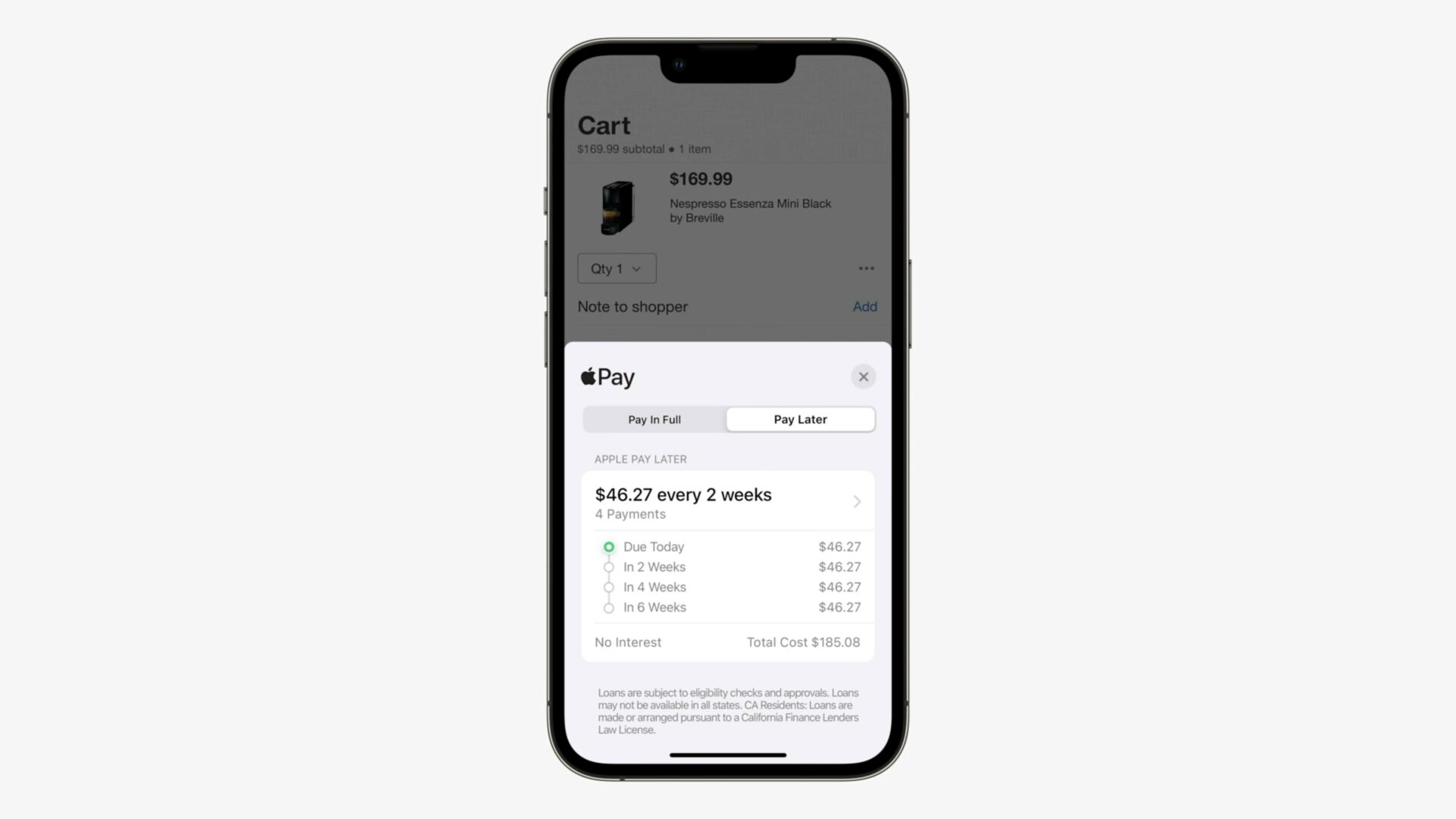

Buy now, pay later services, aka BNPL programs, prove popular with consumers because they offer short-term, interest-free loans. That means people can plunk down a portion of a product’s overall price (typically around 25%), then pay the rest off in scheduled installments over the next few weeks or months. Leading BNPL apps like Affirm and Zip offer users options for making purchases they can’t afford to — or don’t want to — pay off immediately.

Apple Pay Later approval process

Apple’s BNPL service could make it easier for people to buy the company’s products. However, getting approved might not be so simple for the average consumer. Tuesday’s Bloomberg report lays out the approval process for Apple Pay Later. While the feature is just as easy to use as Apple Pay, behind the scenes, Apple checks everything it can ascertain about your financial history:

- How many Apple devices you own

- Whether you’ve applied for the Apple Card

- Other cards you use for Apple Pay

- Your spending habits in Apple Stores

- App Store purchases and subscriptions

- Apple Cash payments to friends and family

- Your transactions using Apple Pay

- Financial history with your Apple Card

In certain cases, Apple may even ask for:

- A picture of your ID

- Your entire Social Security number

Even with all that information, Apple is lending the money conservatively. While the feature is being tested internally among Apple employees (who are paid pretty well, mind you), Bloomberg’s Mark Gurman writes that “many testers are seeing loan approvals for $1,000 and under.” Apple only sells two Macs for less than $1,000: the base Mac mini and the old MacBook Air.

But in the interest of privacy, Apple doesn’t keep a record of Apple Pay Later transactions — only Goldman Sachs and MasterCard, its partners for the feature, do. Considering the vast swath of financial information Apple evidently already has on its customers and the questionable-at-best reputation of both of the company’s partners, this knowledge will hardly put privacy advocates at ease.

Apple Pay Later, coming later

Photo: Apple

Apple Pay Later was announced last June at WWDC after being rumored for nearly a full year before that. As Gurman reported earlier this very week, it was supposed to debut in September alongside iOS 16, but has been pushed back for nearly five months so far.

Apple is struggling to get its financial services off the ground. The company talked up a high-yield savings account program that has yet to see the light of day. And two other services that haven’t been announced are also in the works: a subscription to get the latest iPhone hardware every year, and an upgraded version of Apple Pay Later that will allow monthly payments over longer stretches (with interest) instead of interest-free payments in only six weeks.

Meanwhile, the Apple Card, a credit card that iPhone users can apply for in the Wallet app to get cash back on Apple Pay purchases, was released nearly four years ago and is still exclusive to the United States.