A credit card is a departure from Apple’s usual computers and accessories, but the Apple Card is just as gorgeous and the associated software every bit as easy to use as an iPhone or Mac.

I’m among the first cardholders, so here’s what it’s like to carry an Apple Card.

Apple Card review: As good as you hoped

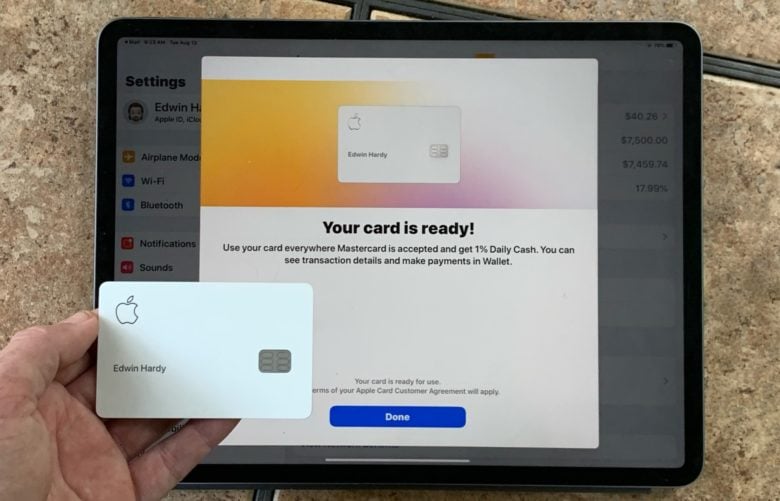

This company makes solid products built to last, and its credit card is no different. No flimsy plastic here; the Apple Card is a slab of titanium painted white.

And it feels like it, too. You can’t call something that’s only 0.6 ounces heavy, but that’s twice the heft of a plastic credit card.

On the front is the cardholder’s name, the Apple logo, and the electronic chip that’s embedded into the metal. The back has the Mastercard logo, and the one for Goldman Sachs, the bank that’s backing this financial instrument.

There’s a magnetic strip on the back of the Apple Card, though it’s somewhat camouflaged. This stores one of the account numbers associated with each card. This isn’t embossed into the metal because the cardholder is supposed to make online purchases with a second card number, which can be easily deactivated and switched to a new one without needing to change cards. This dual card number setup is one of the security features, and it’s not something users have to worry about — it’s happening behind the scenes.

Getting your first card is free and, despite surely costing considerably more than a bit of plastic, Goldman Sachs says there is no charge to replace a lost Apple Card.

Shopping with Apple’s credit card

In real-world use, I found the Apple Card to be just like any other credit card. There weren’t any problems using it in any of the retail locations I tried. I slid the card into the Point of Sale reader, waiting for it to get approved, then went on with my day.

Photo: Ed Hardy/Cult of Mac

I also used it at a restaurant, and the server didn’t even blink when I handed her a titanium card rather than a plastic one. Metal isn’t unusual for top-tier credit cards.

Every transaction results in an immediate pop-up notification on my iPhone. This is clearly a theft-prevention measure — if fake purchases start showing up, the current online card number can be deactivated and a new one applied. A new physical card won’t be necessary unless it’s the number stored on the magnetic strip that’s been stolen.

Obviously, the Apple Card can also be used for online shopping from sites that don’t take Apple Pay, like Amazon. I tested this and it works.

Don’t forget the this physical card was created as a companion to Apple Pay, not a replacement. Keep using wireless payments too because they offer twice as much Daily Cash back for most transactions.

Clearly, there’s nothing special about buying items with Apple’s credit card. The difference comes afterward.

Wallet app

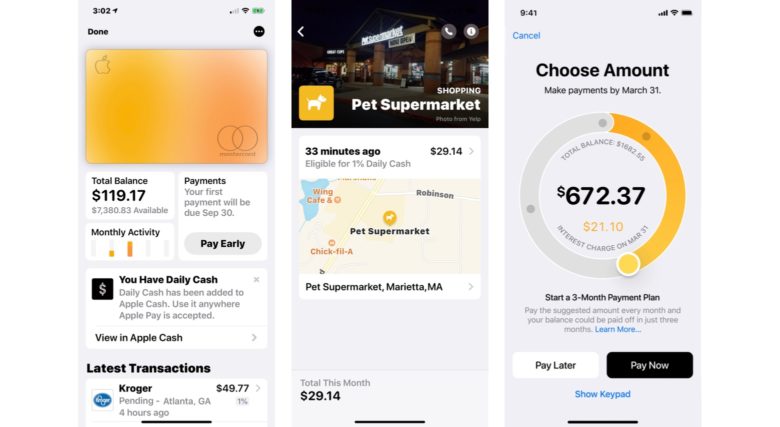

Apple’s Wallet app lists all transactions made with this card in as clear a manner as possible. Tapping on the location of a purchase usually even displays the store or restaurant on a map.

All transactions are color coded, and Apple gives the cardholder a bar graph shaded in these colors to indicate how money is being spent. It’s a very graphical way of showing if someone is spending too much on entertainment and not enough on essentials.

To further emphasize this, the image of the Apple Card in the Wallet app changes colors to reflect the types of purchases being made.

There’s no iPad version of Wallet, but tablet users can still access the same Apple Card info by going to Settings > Wallet & Apple Pay > Apple Card. Payments can be made from here, too.

Photo: Ed Hardy/Cult of Mac

My current credit card from a rival bank lists all my transactions on a web site, but with less detail. And at the beginning of each year I get charts and graphs showing how I spent my money in the previous 12 months. I can request these at any time, though that’s somewhat buried on a website. Apple’s offering comes out ahead in this department.

Daily Cash

One of the highlights of the Apple Card is almost immediate cash back rewards, called Daily Cash. Most transactions pay 1%, while buying anything from Apple bumps that up to 3%.

Remember that the 3% rate is not for Apple products bought anywhere. An iPad purchased from Target gets only 1% cash back, for example. Purchases have to be directly from Apple, though the Apple Loan Program reportedly applies as well.

And Daily Cash lives up to its name, with Apple paying this every day, not at the end of the month or quarter or year. My experience confirms this; I’ve already received my 1% for everything I’ve bought.

This money is deposited into Apple Pay, where it can be used to make wireless payments. Or it can be easily transferred to a bank account. It’s not some tricksy phantom cash no one can actually spend.

A rival credit card gives me 1.5% cash rewards on all purchases, though I can’t collect this until I’ve accumulated $20. I can earn an additional 1% in extra rewards from shopping at specific places, like the Walmart website. A lower rate for everyday transactions means the Apple Card comes out in second place in this area.

Paying off an Apple Card

Apple seems genuinely concerned that everyone pay as little in interest fees as possible. The Wallet app prominently displays when the next payment is due, how much it is, and how to avoid any fees.

Tap on the Pay button on the Apple Card screen in Wallet to display a wheel to dial in how much you want to pay. Crank it up to the max to pay off the entire balance, or slide it back to make the minimum payment.

The wheel clearly shows exactly how much interest is due for each amount set, down to the penny. If the full amount is paid, there are no fees. Goldman Sachs doesn’t charge anything for just using an Apple Card.

Photo: Cult of Mac/Apple

Payments can be scheduled for a later date, so cardholders don’t have to remember to pay off their balance later if they can’t send the money immediately.

Money to pay off an Apple Card can come from an Apple Pay account, but a checking or savings account is more likely. This done through electronic funds transfer. Setting this up is a bit of hassle hunting down routing numbers and such, but Apple makes this as easy as it can be.

If a balance is carried to the next month, interest fees are added. Interest rates vary between 12.99% and 23.99%, depending on the cardholder’s credit history. I have an excellent credit rating and still didn’t get anywhere near the lowest interest rate, so don’t plan for something too low.

My current credit card, which I get through another bank, makes it clear when my next payment is due, but gives me no help on how much interest fees I’ll be hit with if I don’t pay the full amount. And my interest rate is 1% higher than Goldman Sachs offered.

Be aware that everything about billing and payment for this credit card happens in the Wallet app. Goldman Sachs is not going to mail you a monthly statement on paper. If you want a paper copy, you’ll need to print one out from the Wallet app.

Also, it’s not possible to mail this bank a check. The only way to pay off a balance is through the Wallet app. Unfortunately, there’s not an alternative web interface for this, so a device signed into the associated Apple ID is required.

Apple beats my current card in this area, though I’m going to miss getting a monthly statement in the mailbox.

For any further questions, read our guide to How to pay off your Apple Card.

Photo: Ed Hardy/Cult of Mac

Some extra details

If you need your credit card number, it’s kind of hidden. Go to Settings > Wallet & Apple Pay > Apple Card > Card Information. This same screen also lists the expiration data and security code, details you might need to make online purchases.

It’s not possible to get the full card number stored on the magnetic strip. Remember, this is different from the one for online purchases. Apple will only tell the card holder the last four digits because you’re not supposed to tell it to any one.

I recommend you immediately reject the Apple Card’s arbitration provision. This will allow you to benefit from any class-action lawsuits brought against Goldman Sachs, the bank backing this card.

I’ve contacted this bank’s customer service several times, both via phone and iMessage. The have been unfailingly helpful and polite.

Apple Card final thoughts

Let’s be honest, an Apple Card is going to be a badge of honor for Mac and iPhone fans. Fortunately, it’s about as easy to use as a credit card can be.

And it tries very hard to help you control your finances. Every transaction is easy to see, and there are visual reminders about spending more heavily on fun than on necessities.

However, the cash back rewards are relatively low. Most transactions are 1%, and rival cards offer 1.5% or even 2.0%. You might have to buy quite a bit of Apple gear to make this up.

Pricing

The Apple Card is free to receive, and to replace. There are no annual fees for using this credit card. The only cost is interest, and that can be avoided by paying off your balance each month.

Goldman Sachs provided Cult of Mac with a review unit for this article. See our reviews policy, and check out more stuff we recommend.

![Apple Card is as friendly as a credit card can be [Review] Apple Card](https://www.cultofmac.com/wp-content/uploads/2019/08/6EF1FABD-552E-47C4-ACE5-6D25E1AA1492.jpeg)