The lone dark spot in Apple’s otherwise bright Q4 earnings report was iPad. And analysts are out with their estimates of how bad the damage was, with Apple’s quarterly tablet shipments possibly dropping as much as 21% year over year.

The only good news for Apple is that the drop off wasn‘t because of low demand. It couldn’t get the necessary parts to make sufficient devices to meet demand.

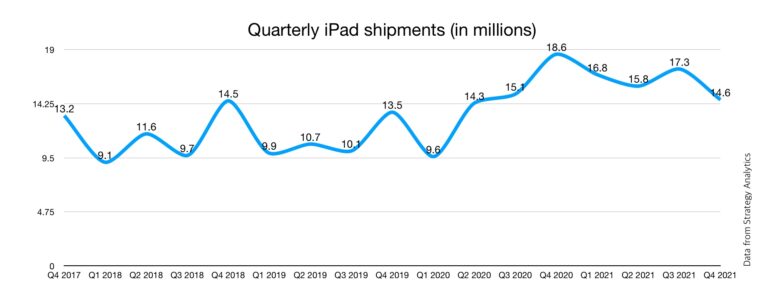

iPad shipments drop in Q4 2021

Apple doesn‘t reveal how many iPad units it ships each quarter, but market-analysis firms make their own estimates. IDC reports that 17.4 million iPadOS models shipped during the October-through-December period. Rival Strategy Analytics has a lower estimate: 14.6 million.

While the two analysis companies don’t agree on exact numbers, they concur that the total was a year-over-year decline. IDC says the drop was 8.6%, while Strategy Analytics says a whopping 21%.

Chart: Ed Hardy/Cult of Mac

These estimates don’t come out of the blue sky. Analysts base them partially on Apple’s revenue figures, and the company admitted recently that iPad revenue was down 14% year-over-year during the last three months of 2021.

What’s the problem with iPad?

But after announcing the revenue decline, Apple execs were quick to point out that the drop wasn’t because of low demand for tablets. CEO Tim Cook said, “The issue with iPad — and it was a very significant constraint in the December quarter — was very much on these legacy nodes that that I had talked about. Virtually all the problem was in that area.”

When he says “legacy nodes,” Cook means processors that go into iPad other than the primary one. Computers use a collection of these, and the global chip shortage has put some of the ones that iPad needs in short supply. That means that some people who wanted to buy tablets just couldn’t because they weren’t available.

Apple stays on top of the iPad market

Other tablet makers also do not reveal how many units they ship, but the market-analysis firms estimate these, too.

According to IDC, Samsung was in second place in the global tablet market in Q4, shipping about 40% as many units as Apple. Its shipments dropped significantly as well. Lenovo is next, followed by Amazon.

Another area where the two analysis companies diverge is Strategy Analytics’ assertion that Microsoft shipped enough Surface tablets units to break into the top 5.