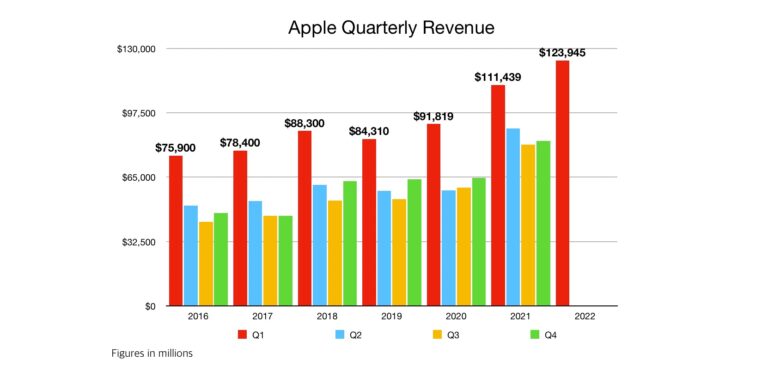

Apple raked in $123.9 billion in revenue during the last three months of 2021. That’s a year-over-year increase of 11%. More importantly, it’s significantly higher than financial analysts had predicted.

All that revenue led to quarterly earnings per diluted share of $2.10. Again, that solidly beat expectations.

Apple had its best quarter ever

Wall Street had expected Apple to have raked in $118 billion in revenue during the October-through-December period. The company surpassed that by 5%.

That made for an all-time revenue record, sailing past the previous record of $111 billion taken in during the 2020 holiday quarter.

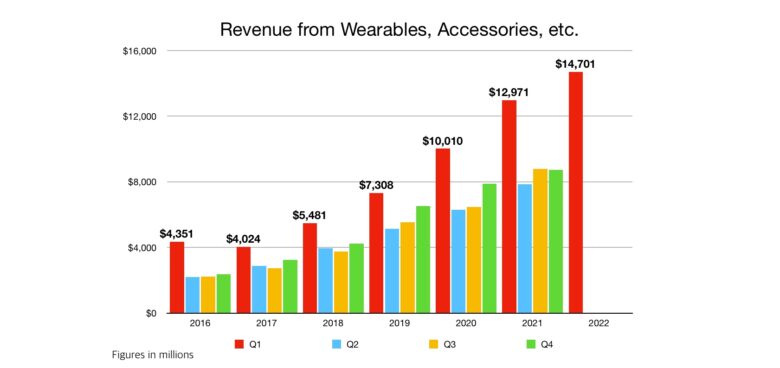

Chart: Ed Hardy/Cult of Mac

Analysts had also predicted that earnings per share would hit $1.88 for last quarter. Apple surpassed that by almost 12%.

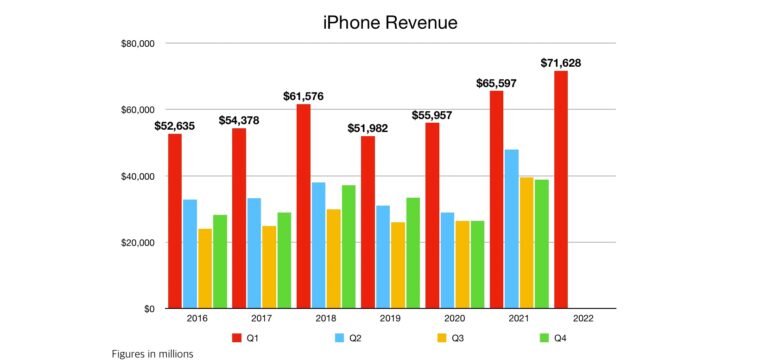

Growth for iPhone, Mac, wearables and services

iPhone is Apple’s leading product, and revenue from handsets totaled $71.6 billion. That’s a 9% year-over-year increase. The iPhone 13, which debuted last fall, is selling well.

Note that the October-through-December period is (confusingly) Apple’s Q1 2022 financial quarter.

Chart: Ed Hardy/Cult of Mac

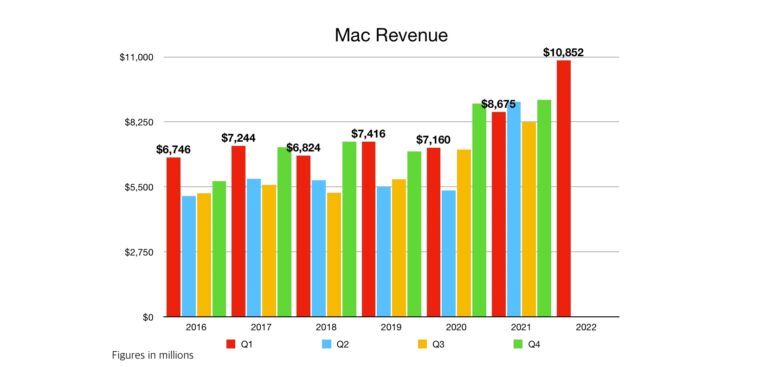

Revenue from Mac sales hit $10,852 in the December quarter. That’s a whopping 25% increase over the same period of the previous year. Macs running powerful M-series processors are driving sales, according to Apple executives.

Chart: Ed Hardy/Cult of Mac

Apple’s Wearables, Home and Accessories category added plenty to the revenue total. It hit $14.7 billion in the holiday quarter. That’s a 13% year-over-year increase.

The company does not break out how much money comes in from each product in this “catch-all” category, whether it’s Apple Watch, AirPods, HomePod or other accessories.

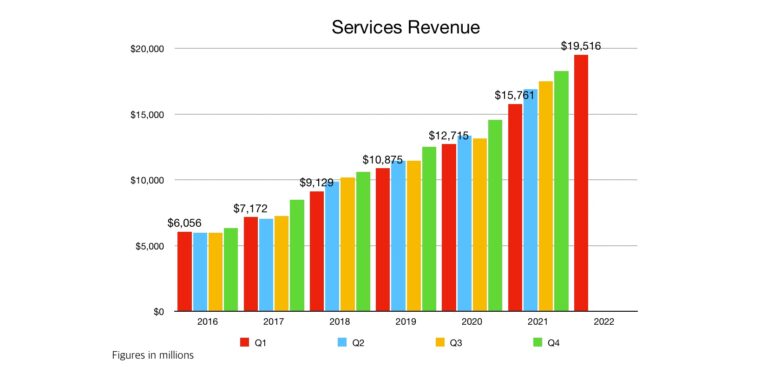

Chart: Ed Hardy/Cult of Mac

Services like the App Store and Apple Music totaled $19.5 billion. That’s a 24% year-over-year increase. Note that Apple takes in more revenue from services than any product but iPhone.

Unfortunately, Apple also does not break out how much revenue each service brings in. So there’s no way to track growth in, for example, Apple TV+.

Chart: Ed Hardy/Cult of Mac

Music to investors’ ears

Wall Street is already reacting positively to these results. That’s because the company exceeded analysts’ predictions for revenue and EPS.

Wall Street investors judge the value of companies like Apple based on these predictions and other financial details. Even if Apple had announced record revenue that didn’t reach the prediction, it would have reflected negatively on the company. There likely would have been a sell off. That is what occurred in October 2021 when Cupertino announced the results from its August-through-September quarter that were up but short of the predictions.

But not this time. Today’s financial announcement came after Wall Street closed, but AAPL shares are up over 5% in after-hours trading.

Source: Apple