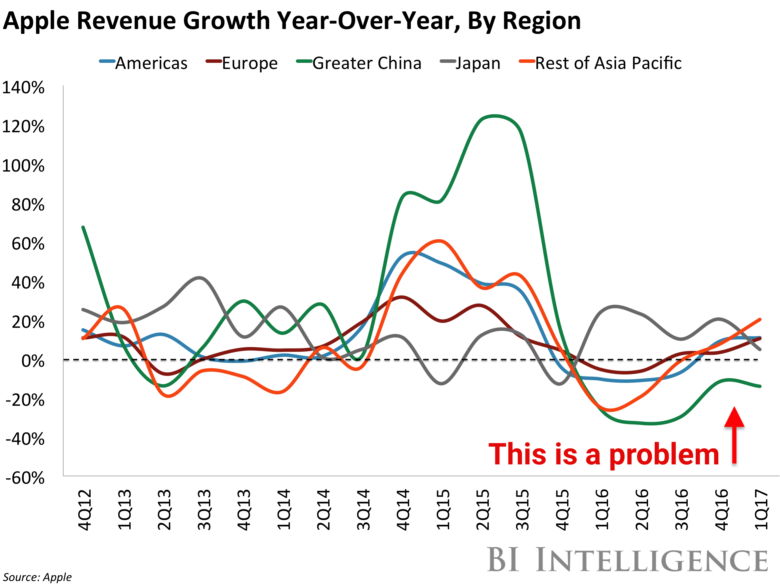

Tim Cook hasn’t been shy about proclaiming China Apple’s future biggest market, but right now it’s causing the most problems.

According to analysts at Oppenheimer, Apple’s “Reality Distortion Field” is fading in China, as iPhone sales drop 20 percent. That’s at least twice as bad as any other market.

In a note titled “Fading ‘Reality Distortion Field,” Oppenheimer analyst Andrew Uerkwitz and his team pins the blame for Apple’s decline in China on a couple of things.

One is the dominance of popular Chinese apps like WeChat, that are fully-functional on Android, but not on iPhone. “That won’t sound like a big deal to people in the West, but in China apps like WeChat are used almost ubiquitously,” Uerkwitz writes. “It has 1 billion users.”

Another is the lack of differentiation between Apple’s hardware and software, and those offered by local competitors such as Huawei, OPPO, and Vivo.

“We recently conducted a series of company meetings in China and Taiwan that focused on the smartphone supply chain,” Uerkwitz writes. “There was general consensus among our conversations that confirms our thesis that Apple’s dwindling market share in Greater China is due to the lack of compelling differentiation among hardware and software. The mobile user experience in China is heavily dictated by Tencent and other local Internet companies, making Apple’s software and services ineffective as key differentiators. That said, we do believe there is pent-up demand for iPhone 8, which is widely reported to make a few major design changes. We expect a temporary rebound in share.”

Despite this, the news isn’t totally bad for Apple. During the recent Q2 earnings call, Tim Cook talked about 20 percent revenue growth for Mac and “double-digit growth” for Services in Greater China, which is a definite positive.

Unfortunately, extrapolating from this and looking at total revenue from China is what gives the indication that iPhone and iPad revenue declined by at least double digits at constant currency.

Oppenheimer does, however, note that there is considerable excitement for the iPhone 8 in China, which is set to be Apple’s biggest iPhone refresh since 2014’s iPhone 6 and 6 Plus.

Photo: BI Intelligence

Challenges in China

Turbulence in China isn’t new for Apple. Although the country has opened up a whole new lucrative market, and has overtaken the U.S. on App Store revenue, it hasn’t always been smooth sailing for Cupertino.

In the past, Apple has been forced to shut down its iBookstore and iTunes Movies in China, as well as been forced to accept the Chinese government’s demands that it run network safety evaluations on all Apple products before they can be imported into the country.

In addition, its products were booted off the list of approved state purchases, along with other Western companies such as Cisco and Intel — in favor of thousands of Chinese-made products. Most recently, Apple ran into problems with internet regulators in China calling on Apple to “tighten its checks” on live streaming apps which appear in the App Store.

Uncertainty over China is previously what caused Apple’s biggest investment cheerleader, Carl Icahn, to sell his AAPL shares — despite making over $3.4 billion investing in Apple. “I don’t think it’s a price point [that would get me to go back into Apple stock],” Icahn told CNBC’s Scott Wagner. “I think it’s my opinion about what is happening in China… I got out because I’m worried about China.”

Via: Business Insider