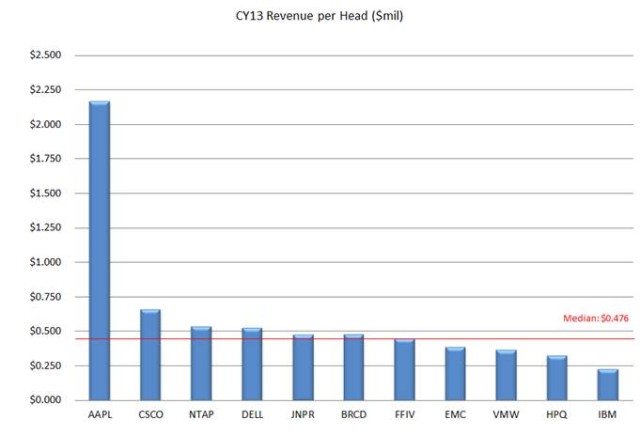

Forget for a moment all the talk about Apple’s recent quarter financials disappointing Wall Street analysts — and instead focus on two “nuggets” from Apple’s recently released 88-page Form 10-K, as picked up by ISI’s Brian Marshall.

In a note to clients sent Thursday, Marshall notes that not only is Apple’s $11 billion in projected capital expenditures for fiscal 2014 a double-digit increase for a company already “the single largest CapEx spender” in his “Big 7 Hyperscale group”, but also that Apple generates “off-the-charts” revenue-per-head metric compared to the other IT and networking companies he covers — which includes Google (GOOG), Microsoft (MSFT), Amazon (AMZN), eBay (EBAY), Facebook (FB) and Yahoo (YHOO).

This, in turn, joins the previously reported news that Apple makes a record $57.60 off every Apple Store visitor, and that Apple Stores are 17 times more efficient at physical sales than the average retailer — pulling in an astonishing $6,000 per square foot of shop space.

“The scale [Apple] is executing on is nothing less than astonishing,” he writes.

Source: ISI Group

Via: CNNMoney