Apple is in the process of upgrading Apple Pay fraud prevention features for cards stored in the Wallet app on iPhone and Apple Watch, starting with Visa cards.

Some users have already started noticing a new “Enhanced Fraud Prevention” alert badge.

Apple is in the process of upgrading Apple Pay fraud prevention features for cards stored in the Wallet app on iPhone and Apple Watch, starting with Visa cards.

Some users have already started noticing a new “Enhanced Fraud Prevention” alert badge.

Security researchers have discovered a major flaw in Express Transit on iPhone that allows hackers to steal money from a user’s Visa card. They say the problem can be easily fixed, but neither Apple or Visa seem interested.

The flaw makes it possible for iPhone’s contactless payment system, designed to make it easier and faster to pay for public transport, to be charged arbitrary transactions by a device that imitates a transport terminal.

Apple is working with Goldman Sachs to release a credit card, according to an unconfirmed report. This will apparently take the place of the company’s current Rewards Visa.

The card will be offered under the Apple Pay brand. Goldman Sachs will allegedly replace Barclays as Apple’s partner for credit cards.

Apple is again working to deliver its own Venmo competitor that will allow fans to transfer money to one another using their iPhones, according to a new report.

Multiple sources familiar with the company’s plans expect the service to be unveiled later this year.

Apple Pay is now available in Ireland with support from Boon, KBC and Ulster Bank.

Users with Visa and MasterCard credit and debit cards can use Apple Pay to pay for goods in “tens of thousands” of stores, including Aldi, Boots, Burger King, Harvey Norman and Lidl.

Like the Borg, Star Trek‘s race of cybernetically enhanced humanoids, Swiss watch maker Swatch is attempting to have the best of both worlds as it rolls out a partnership with Visa to bring Apply Watch-style contactless payment to its new line of analog timepieces.

Swatch announced the deal today, and the program will roll out early next year.

Samsung’s new phablets aren’t the only thing we got out of its Unpacked event in New York City today; the South Korean company also announced a launch date for its new mobile payments service. Samsung Pay will be coming to take on Apple Pay in the U.S. on September 28.

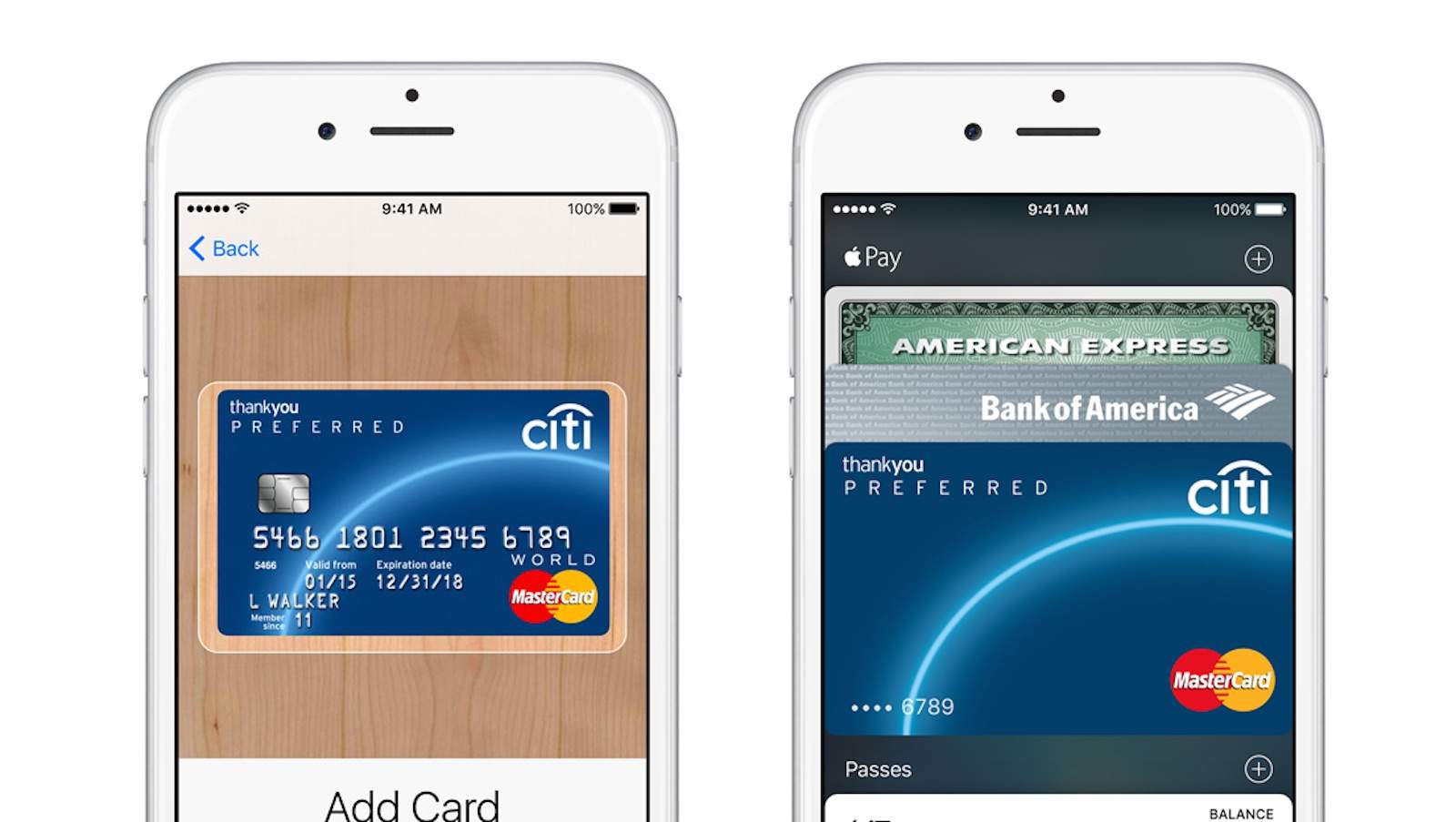

Apple wasn’t kidding when it said Apple Pay would transform mobile payments. Built around easy of use and security, Apple Pay is the industry’s first solution that benefits users and banks.

The security aspect of Apple Pay has been especially crucial to its early success, and now the big credit card companies have been spurred to follow suit. Today both Visa and MasterCard announced new security initiatives to protect against cyberattacks. Visa in particular has borrowed one of Apple Pay’s key ideas: tokenization.

Frequent Apple Store shoppers will love the company’s latest credit card partnership with Barclaycard and Visa. Like rewards cards from Amazon and others, you earn points when you spend that add up to free money.

“The Barclaycard Visa with Apple Rewards” card also offers special financing deals for new Apple product purchases.

Critics are fond of saying Apple doesn’t innovate any more. But Apple’s new electronic payment system, Apple Pay, is innovation of the highest order. After a relatively smooth rollout this week, I honestly believe Apple Pay is the future of payments.

Even so, Apple Pay must clear some big hurdles if it’s to become the universal standard. For now, it’s limited to Apple’s latest iPhones and a relatively small number of retail partners, but the basic system — using your fingerprint to validate a purchase on your mobile phone — is the way we will pay for goods and services in the future.

Once again, Apple has shown the world how things should be done.

Amazon added Apple Pay support today for its Amazon.com Rewards Visa.

Since Chase, the Amazon rewards card issuer, was an Apple Pay launch partner, some speculated that Amazon intentionally opted out of Apple’s mobile payments system. But Amazon quickly confirmed this week that it was working on adding support for its credit card in the near future. Now it’s followed through.

![Samsung’s At It Again, Announces Passbook Clone Called Wallet [MWC 2013] post-217687-image-e359062382a6190d7d7ec7061f7939c7-jpg](https://www.cultofmac.com/wp-content/uploads/2013/02/post-217687-image-e359062382a6190d7d7ec7061f7939c7.jpg)

BARCELONA, MOBILE WORLD CONGRESS — During a Samsung developer conference here at Mobile World Congress this morning, the Korean company unveiled a new service called Samsung Wallet, which lets Samsung smartphone owners turn tickets, coupons, membership cards, boarding passes, and more into digital cards that they can store in a virtual wallet.

BARCELONA, MOBILE WORLD CONGRESS — During a Samsung developer conference here at Mobile World Congress this morning, the Korean company unveiled a new service called Samsung Wallet, which lets Samsung smartphone owners turn tickets, coupons, membership cards, boarding passes, and more into digital cards that they can store in a virtual wallet.

The service probably sounds familiar, and it is — Samsung Wallet is basically Apple’s Passbook, but for Samsung phones. It works in almost exactly the same way, and looks very similar, too.

httpvhd://www.youtube.com/watch?v=of2GBIqP9eA

If you need to take the G Train in New York City or pay for a cab you’re jumping uptown, you now have a new way to pay for your ride: with your iPhone.

Visa has just announced that they have inked deals with the New York City subway to let you simply display your iPhone in front of a kiosk or turnstile in select locations as part of a trial of their payWave system.

What’s payWave?It’s essentially just Visa smart chip circuitry that allows you to wave a credit card or payWave-equipped device in front of a cash register, no signature or pin codes required.

Since the iPhone doesn’t have payWave circuity installed by default, if you want to use it with your iPhone, you need to use a specially designed payWave case to graft the functionality onto your handset.

If you’re willing to pick up one of those, though, you can start helping VIsa test out the service Think of the possibilities! While all those other suckers wait in line to recharge their Metro Cards, you’ll be able to breeze past the turnstiles with an Obi-Wan-style wave of your iPhone.

Pretty neat, but eventually, you can probably expect your iPhone to handle this sort of thing natively. Apple’s been doing some hiring and some research into Near Field Communications, and that, more likely than not, means that a few years down the line, you won’t need a special case: your iPhone will be your credit card.