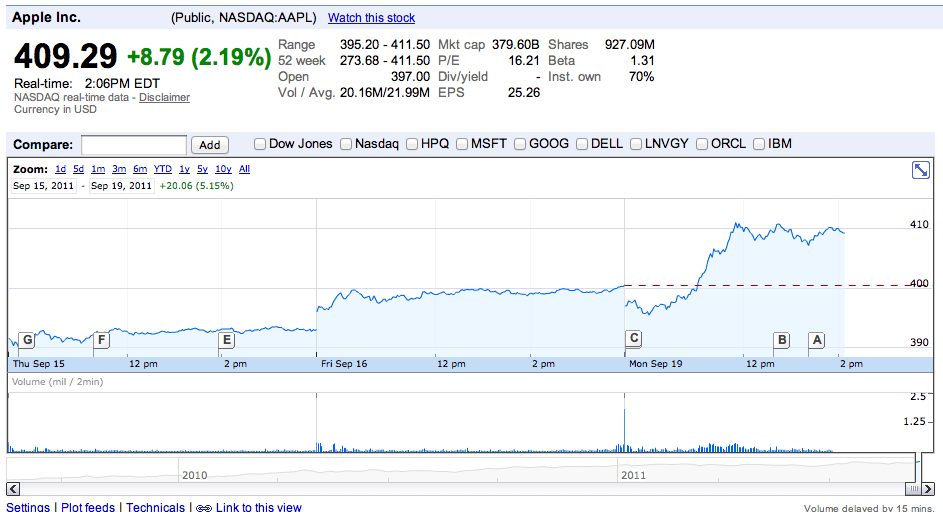

Wow. As of writing, Apple is hovering above $410 a share, with a market share $25 billion ahead of Exxon Mobil, the world’s second most valuable company. This all without Steve at the helm. How high will it go?

Holy Cow! Apple Stock Soars Over $410 A Share

32 responses to “Holy Cow! Apple Stock Soars Over $410 A Share”

sky high! over 1000 $ just question of time.

The real news, people, is that there is still no APPL stock buyback on the horizon to boost earnings per share. And no dividends either. Morgan Stanley and stockholders are getting anxious for cash. Morgan Stanley, especially. Now, of course Apple may be right in keeping all this cash to itself. But let’s see how long this will last before greedy Wall Street says something.

I hate to look a gift-horse in the mouth, but I really wonder what caused Apple shares to run counter to the rest of the market and increase as much as it did. There was no news that I read about but I had read there were some speculation that there was a stock split for Apple coming. $410 is still a large gap from $500 or $600, but I’ll settle for $450 this year. It seems like iPad sales are going to go through the roof with high demand in the education sector and the Brazil plant starting to produce iPads in December. Anyway, I very thankful for today’s price rise for Apple and I hope it can hold over $400 in the coming weeks if Greece goes bankrupt.

Stock buybacks and especially dividends are a thing of the past for the most part.

They do nothing for the company or the customers of the company, and operate mostly as a way of giving even more money to stockholders (who are already making a fortune), and bleeding needed funds from the company itself.

Try to keep up with 21st century business practices. :)

Liked your first sentence. Second one just Obamalike rant.

Check volume. Several big buys today spiked it up. And, Sat was options expiration. Was artificially held down to 400. Hum, smacks of market manipulation.

Yes, I’ll take $600 for AAPL, Alex.

I’m an Apple stockholder, where’s my fortune?

John, you mean “market cap(italization)” not “market share”.

It would never happen. Apple would split before it got there..

But then again, Google never split so who knows…

21st century business practices is a great idea. But try to send that memo to Morgan Stanley, or any investing body in Wall Street. See how wide they smile.

“All this without Steve Jobs at the helm.” LOL…Who do you think got Apple to where it is now. Jobs’ absence will come into play when it’s time to come up with the next new product that (hopefully/ideally) “everyone” will want. To have two white hot items in the iPhone and iPad, it will take a while for this to slow down as the annual incremental updates will continue to strengthen Apple’s hold on the smartphone and tablet market.

Oh yea, and I hear they make notebooks to boot. :D

“market share of $25 billion”… I’ve said it before, and today again. Tech bloggers should stick to Apple news and leave APPL graphs alone. Clearly not a compentency for Cult of Mac.

I don’t totally disagree Prof, but the question then is, when is enough enough? How much does Apple need to bank? 100 billion? 200 billion? More?

At some point, and I don’t know when that will come, but at some point it will not make any sense at all for Apple to continue to hold cash for a +/- 1% return.

At that point, let it rain :)

Most can barely construct a grammatically correct sentence with proper spelling so asking for them to be competent in reading graphs is just too much to ask.

People who owned shares prior to the last two splits could see their holdings as descendants of shares that would today be worth – what? $1684+- (4x$421). It’s just another way of understanding share history.

As for Brownlee, he’s the only thing that is high in this article. Apple is going higher.