Apple’s stock is as good as gold, right? Perhaps, but that doesn’t mean that it’s value can’t be manipulated. Writing for Fortune, Philip Elmer-DeWitt makes a shocking accusation: Apple’s share price is being manipulated by a mysterious cabal who are “pinning” the stock below its strike price and no one seems to be doing anything about it.

As proof, Elmer-DeWitt offers this recent trading example, which he describes as a “sickeningly familiar turn of events, one that has its own language and terms of art.”

It was 3:48 p.m. on Friday April 29 and traders who had purchased Apple (AAPL) April 29 $350 “calls” — options that gave them the right to buy Apple shares in blocks of 100 for $350 per share — were sitting pretty. The stock was trading around $353.50 and those calls were worth more $350 apiece (the difference between the price of the stock and the so-called “strike price” of the option times 100).

Then, in an extraordinary burst of trading — exacerbated by the rebalancing of the NASDAQ-100 scheduled for the following Monday — more than 15 million shares changed hands and the stock dropped below the $350 strike price just before the closing bell. Result: The value of those calls disappeared like a puff of smoke.

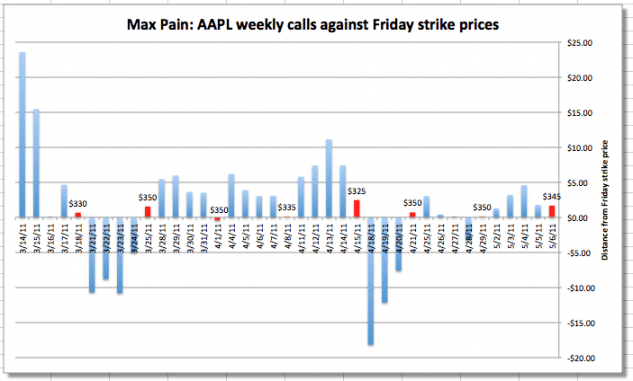

Elmer-DeWitt then goes on to show using a number of graphs and charts that historically, the pattern in which Apple’s stocks have tended to fall recently indicate illegal manipulation.

“How is this manipulation being accomplished? Who is doing it? And why aren’t they being punished?” Elmer-DeWitt asks.

Frankly, I just don’t know enough about the stock market to answer those questions, or even if Elmer-DeWitt is right… but if he is, this is a story that’s about to blow up.

We’ll keep our eye on it, but in the mean time, we’d love to hear the perspective of more learned minds than ours in the comments. What do you think?

34 responses to “Fortune Thinks Apple’s Stock Price Is Being Illegally Manipulated”

I know nothing about this kind of stuff either – would be interesting to know who actually “gains” from this behaviour, as that might be a clue as to the bigger picture.

And I think gas stations illegally manipulate the price of gas. Ever see gas at the pump increase on the weekend? Talk about fishy…

“its value,” not “it’s value.” I’m going to keep hammering at this grammatical laziness until writers start paying attention!

Seems pretty cut and dried and well explained by Elmer-DeWitt with Sec 9h. He shows that it’s not just the calls, but also the puts, which is where you’re forced to buy at a predetermined price.

@twitter-104279571:disqus – the gains are made by the people at the “losing” end of a call or put contract, who try to force the other person to cancel their option. If I had the foresight to buy a contract that can force you to sell me a million shares of $355 stock for $350 at the end of the day, you lose 5 bucks a share versus what the market would pay. But if you can sell a few shares to make it look like the true market price is $345 I won’t make you sell it to me. When the market reopens you won’t be selling your shares on the cheap and the price goes back to $355 – where you’ll sell them. I have the option to exercise their contract or cancel it. If you can buy or sell some shares to make an “artificial” change in the value of the stock – it’s artificial because the only cause is your targeted trades, not any real business reasons – you can make it less attractive to exercise those options and protect yourself from a loss – at the cost of the my legitimate gain. It may have cost you 2 million dollars in value for the shares you sold, but you’d make 3 million back the next day. A net profit versus giving up 5 million.

@ctt1wbw:disqus – Do gas stations manipulate the price? Undoubtedly. But raising the price because it’s the weekend isn’t illegal, it’s just a way to maximize profits. Heck, around here they DROP the price a dime on Sundays! Is that illegal price manipulation? It would only be illegal if a group of local owners got together and decided they would ALL raise prices on the weekend, so no one has any advantage.

Pointing out grammatical errors in the comments, over and over, without success, should tell you that you’re doing the wrong thing.

Emailing the author is the best way for the author to see your advice.Shouldn’t you have learned this by now, jayjaytee?

That honestly couldn’t be more farther from what the article is talking about. Gas stations are privately owned, they can set whatever price they want, its not illegal.

Keep on ’em, jayjay! Unlike what dcj001 retorts, your comments are very appropriate and worthy of public consumption. Such words should not be hidden from view in the form of private emails to the authors. Ten to fifteen years ago, perhaps, but no longer.

I cannot help but feel that informal email communication through the years, coupled with the more recent “terse and coded” forms of communication on Twitter and FaceBook, have contributed to a gradual “dumbing-down” of English speakers worldwide. A good number of my associates on FaceBook don’t know how to put a sentence together (or they just don’t care, which is worse than mere ignorance). If this trend continues, I doubt we’ll even be able to understand what’s written in so-called “English” ten years hence.

I would also encourage eagle-eyed folks such as yourself to participate in the AppleInsider forums. I often feel like the lone voice of reason over there, imploring the authors to fire up a spelling checker for all of 5 seconds. The grammar and spelling errors there, even in the very “titles” of their articles, are absolutely atrocious!

It sounds like a bunch of very short term manipulations that have no effect on investors who buy and hold for a reasonable amount of time.

http://www.appleturns.com/

This has been a running joke for as long as I have been reading Mac related blogs. I guess now that all the people who made their fortunes from buying M$ stock are depending on Apple saving the US economy (and their 401ks) are losing money day trading, it’s finally a problem.

I like your article and it really gives an outstanding idea that is very helpful for all the people on the web

Share Tips

The real money to be made by a writer (seller) of an option is the premium the writer charges the buyer of the option. So the 2 million dollars of value given up would prevent a loss of 3 million (less the premium). The beauty of the scam is, the writer does not need to give up 2 million of value if the writer sells the stocks to “himself”.

I absolutely adore reading your blog posts, the variety of writing is smashing.This blog as usual was

educational, I have had to bookmark your site and subscribe to your feed in ifeed. Your theme looks

lovely.Thanks for sharing.

Stock Tips

I checked out your blog. Really cool stuff. I also spent a few minutes on their blog.

Thanks for sharing.

regard:

Commodity Market

I checked out your blog. Really cool stuff. I also spent a few minutes on their blog.

Thanks for sharing.

regard:

trade4target

It was a awe-inspiring post and it has a significant meaning and thanks for sharing the information.Would love to read your next post too……

Thanks

Regards

Trade4Target

It was a awe-inspiring post and it has a significant meaning and thanks for sharing the information.Would love to read your next post too……

Thanks

Regards

Trade4Target

It was a awe-inspiring post and it has a significant meaning and thanks for sharing the information.Would love to read your next post too……

Thanks

Regards

Trade4Target

This type of price action is very common, in lots of stocks, not just apple. If a large player has sold these options to another and they are currently in the hole for 3.50, they have 2 options. Option 1 is that they quickly acquire these shares so that they can fulfill the terms of the contract/option… the buyer has the right to buy the shares at the strike price at or before the time of expiration. But what does quickly aquiring these shares do to the price of the stock? It rises, making a bigger loss for the big boy… The seller of the option. Option 2 is that they sell short some shares (borrow shares from someone then sell them on the open market with the obligation to later buy shares on the open market and return them to the original owner) to push the price down to 350. This way the buyer of the option will not choose to excercise his right to buy at 350 because they coyld only sell those shares at the same price. Following options expiration, the seller can slowly cover his short position without dramatically affecting prices.

Basically, its not a conspiracy that we should freak out about. It’s normal market dynamics that the average serious investor is aware of. It’s too little of money for someone to go all out legal on them, but enough money to take advantage of once a month.

I read your post . it was amazing.Your thought process is wonderful.The way you tell about things is awesome. They are inspiring and helpful.Thanks for sharing your information and views.

share tips

That’s just foul play at its worst. I will give Apple the benefit of the doubt, but I really hope this isn’t true.

binary options trading