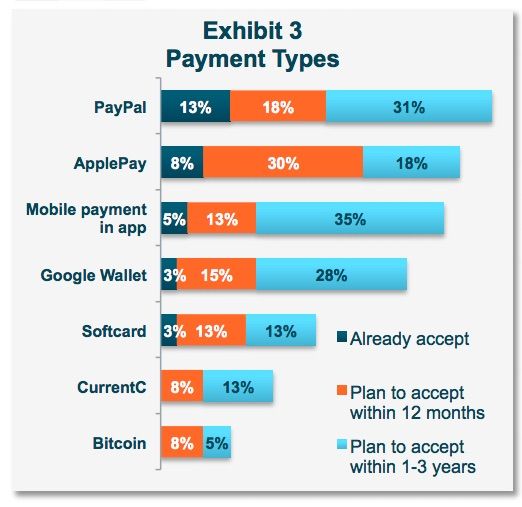

Apple Pay has already become the fastest growing mobile wallet but the only thing holding it back is the limited number of retailers that accept it. A new study has found that PayPal is still leading the mobile payments race with 13% of retailers accepting it more than any other alternative payment type.

Boston Retail Partners surveyed the top 500 retailers in North America and found that only 8% currently accept Apple Pay, but Apple’s mobile wallet is expected to make a big push this year and take the top spot with nearly 40% of big shops in the U.S. accepting Apple Pay by the end of 2015.

Here’s the full breakdown:

Apple Pay is expected to leapfrog PayPal this year, but PayPal could strike back in 2016, with 31% of retailers saying they plan to accept it within 3 years.

Unfortunately for Apple Pay’s big rival CurrentC, only 21% of retailers plan to accept it as a payment type within the next three years. Most retailers are still taking a wait and see approach with mobile payments. By 2018, Apple Pay is projected to be accepted by 56% of retailers, while PayPal could possibly still be in front with 62%.

I suspect we’ll see a the top players start to break away from the rest of the pack by the end of the year, especially once Apple Watch launches and brings Apple Pay functionality to even more customers. No matter who comes out on top, the biggest winners will be consumers. In the next three years, you should finally be able to leave your wallet at home and still be able to buy your skinny jeans with the tap of your hand.

Source: Boston Retail Partners

3 responses to “Apple Pay projected to crush PayPal at big box stores in 2015”

Maybe retailers will be more receptive if Apple gave them a copy of U2’s latest album…

ApplePay is getting so much “buzz” in the press, through commercials from Chase, B of A, Amex, etc., that over time, more and more of the millions of US iPhone 6 and future Apple Watch owners will begin to understand the security and convenience benefits and start using it, and its user statistics will start to grow. This movement will be greatly accelerated when masses of retailers will begin to install more and more NFC enabled POS machines around the shift to EMV card availability in the US by this next October.

Apple Pay will become increasing popular for ONLINE payments when shoppers become wary of having to send out their CC numbers, expiration dates, security codes, and billing addresses out to potentially rogue merchants or “men-in-the-middle” hackers out over the internet.

Apple’s 64-bit tech enables keeping CC info safe in the iPhone’s “secure enclave”. This technology also makes Apple Pay so convenient because the transaction happens without any apps being opened and without the iPhone even waking up.

A former Motorola exec mentioned they had hoped to employ the fingerprint scanning tech into their phones, but found that all the good patents were tied up with the AuthenTec company which Apple purchased and is using to enable ApplePay.

I suspect the extra authentication and convenience Apple Pay offers will lead consumers to push for it, even if retailers are reluctant – which they may be given the reduced access to customer personal details that Apple Pay offers through the nature of the transaction. That end to handing over name, credit card details etc is for me personally the biggest incentive, given retailers current mining of the personal info and habit of being hacked for the details. Its overdue that we regain control over our data, and handing over personal details is once more a choice rather than a routine necessity of each transaction unless you resort to cash. A bit of a no-brainer really.

CurrentC on the other hand, offering none of the advantages, is likely to be a non starter.