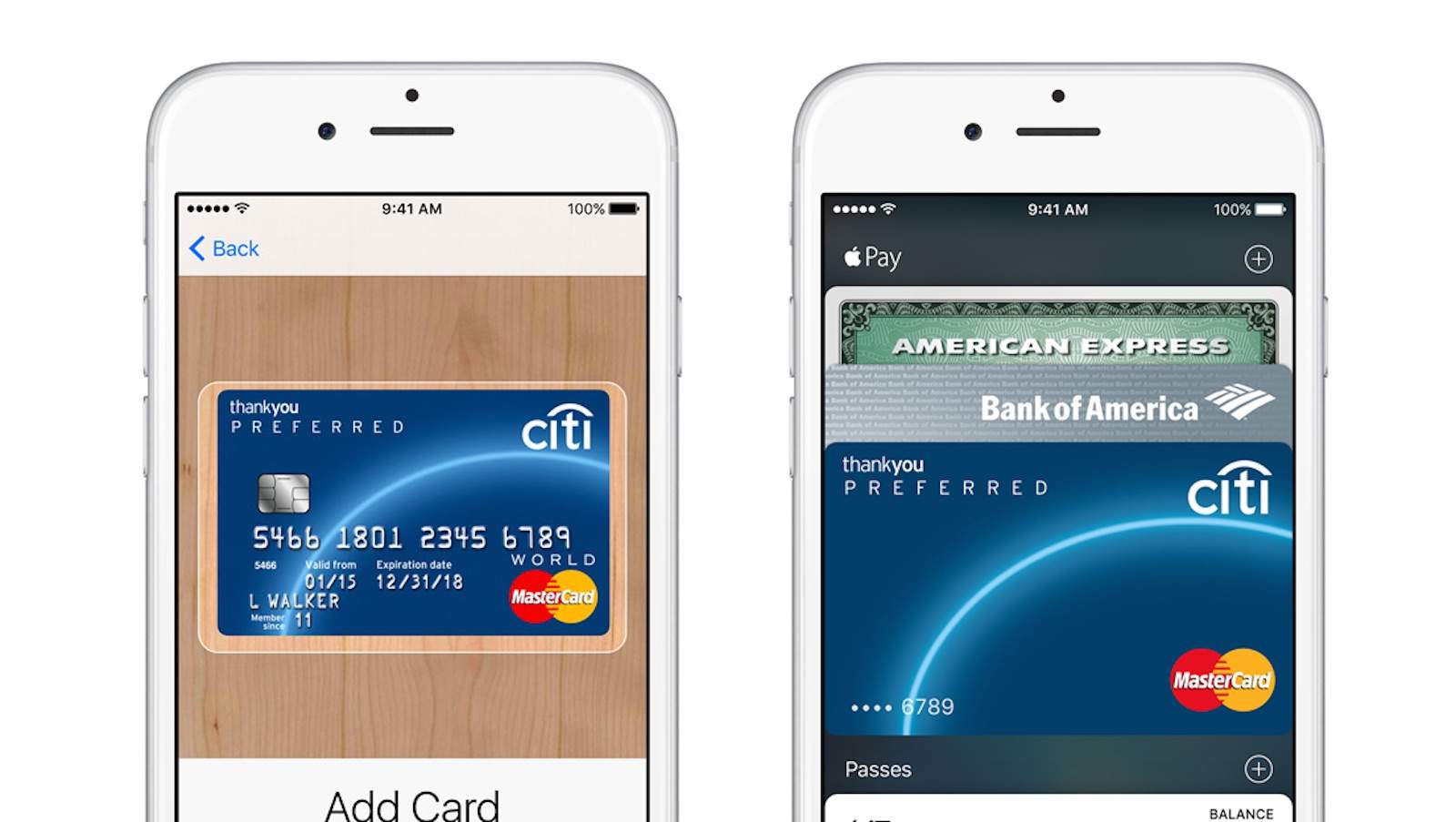

Apple Pay has finally made its way to iPhone and Apple Watch users in the Land Down Under, but only if they’re using American Express.

One day after the mobile payments service launched in Canada, Apple has flipped the switch for Apple Pay in Australia, allowing iOS device owners to make payments at any retailer that accepts Amex contactless payments.

Here are some of the stores participating in the launch:

- David Jones

- Myer

- McDonald’s

- K-Mart

- Harvey Norman

- Telstra

- Coles

- Woolworths

- Target

- Harris Farm

- Starbucks

- Officeworks

- Hoyts

- Zara

- Bunnings

- Shell

Online retailers like Kogan will also accept Apple Pay starting today. Amex currently has about 17 per cent market share in credit cards in Australia, with 6.8 million cards in circulation. Only cards issues directly by Amex will be eligible for use with Apple Pay.

More banks and cards will start supporting Apple Pay in Australia soon. The service is expected to launch next in Spain, Hong Kong and Singapore in early 2016.

Source: Sydney Morning Herald

4 responses to “Apple Pay says ‘G’day’ to Australia”

I hope that the other banks get over their insane lust for profit and sign up. It would probably be enough to make me buy an iPhone (I have never owned a mobile phone).

Might have to switch banks, clearly the Australian banks don’t get it, people want this now.

The big 4 banks in Australia charge the lowest transaction fees to begin with, so adopting Apple Pay won’t benefit them, it will actually cost them, which is why they’re still negotiating charges. Talk is the big 4 are working on their own system to rival Apple Pay anyway. Don’t expect it to happen any time soon.

This was my point, our banks are too greedy. It’s a cost for a reason, it is secure unlike PayPass or having a physical card to swipe. This in return will make payments more secure with less chance of fraud, in turn reducing their overall costs. This is about what the consumer wants, not what the banks want. If they’re working on a payment system it will be rubbish, just like all their mobile apps. Why not just adopt it and get onboard? I’d like to stop carrying my decades old credit cards and just carry my phone. Is it really too much to ask?