Concerns about the U.S.’s trading relationship with China is hitting Apple shares.

AAPL’s share price has been steadily sliding since President Donald Trump took to Twitter to talk trading tariffs. It’s currently trading at $189.15, down from its high of $211.75 earlier this month.

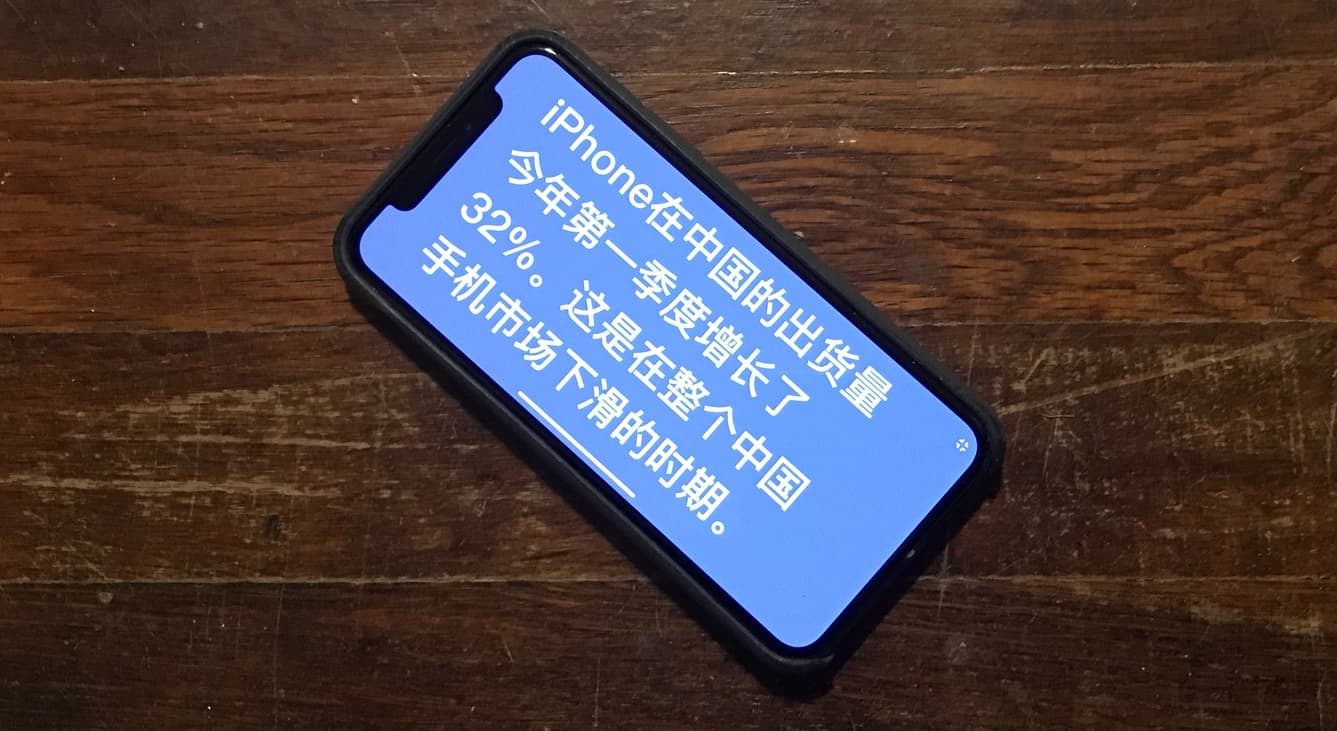

Uncertainty in China

“Apple has one of the most significant exposures to Chinese exports to the U.S, given final assembly for many of its consumer devices is located in China,” Morgan Stanley analyst Katy Huberty wrote to clients recently. “Given the reliance on China’s established, low-cost labor force and expertise in manufacturing/tooling, a large-scale move out of the country would not only be costly, but could take multiple years to complete, potentially raising the odds of execution risk.”

As a company which does a lot of its manufacturing in China, Apple’s share price is very susceptible to fluctuating with trade concerns. This is one of the reasons AAPL crashed late last year, although it has since recovered.

In a recent tweet, Trump said that China has, “taken so advantage of the US for so many years.” The U.S. more than doubled tariffs on $200 billion Chinese goods on Friday. This marked a dramatic escalation in the nations’ trade war.

What me worry?

Recently, the company was wrongly reported as having recaptured its $1 trillion market cap. The reason for this confusion was uncertainly about how many outstanding shares AAPL has. This was as a result of its aggressive share buyback program. That program is significant because the number of outstanding shares dictates a company’s market cap.

So should investors be concerned? It really depends on who you ask.

“Some loyal AAPL owners may not worry about a decline to the $180-$170 area, but I do,” Real Money technical analyst Bruce Kamich said. “In a weak market, a bearish price target could be overrun and chart support can disappear. AAPL looks like it is going to pull back. And if I find it attractive at a lower level, I’ll have no problem re-buying it.”

On the other hand, investor Gene Munster has suggested that Apple stock is set to rocket up 70% in the next two years. If he’s accurate, this would make Apple a $1.5 trillion company.

Source: The Street