Apple has more to lose than just about anyone from a U.S. trade war with China.

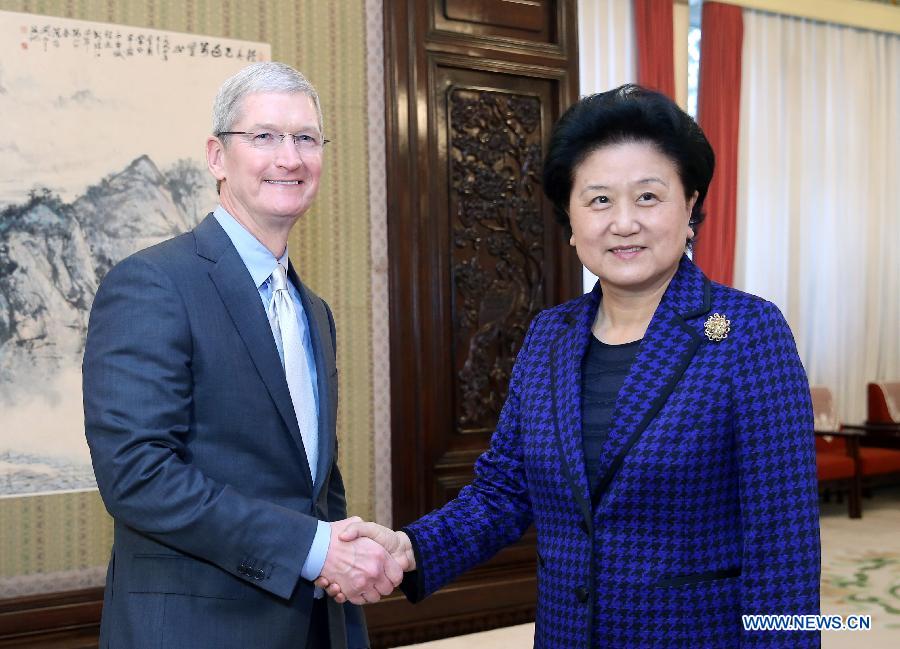

The country — which Tim Cook has made clear is Apple’s future biggest market — currently represents nearly 20 percent of Apple’s revenues. Last year, it shipped more than 41 million iPhones into China, as well as having 40 stores in the country, and a reliance on Asian manufacturers. In other words, the escalating trade war is pretty darn worrying!

“Apple is most exposed,” Neil Campling, co-head of global thematic group at Mirabaud Securities, told CNBC in an article published today. Although Tim Cook has had assurances from President Trump that iPhones assembled in China won’t be affected by impending tariffs, this still poses a risk in the event that trade wars ramp up.

China, for instance, could clamp down on Apple suppliers, triggering delays, some experts suggest. It could also ban Apple services, as it has done in the past with the banning of the iBooks Store and iTunes Movies.

Apple is seemingly concerned, since it is stockpiling inventory, including components for future devices. The evidence for this is that Apple’s inventory stockpile totaled $4.4 billion in the three months ending December 30, and increased to $7.6 billion in the March quarter.

How do Apple’s U.S. rivals fare?

On the other hand, tech giants like Google, Facebook, Netflix and Amazon do relatively little business in China — thereby making them somewhat more insulated.

“We continue to strongly believe that, given the primarily services nature of traditional FANG (read: mega-cap high growth stocks Facebook, Amazon, Netflix and Google) names and very internationally distributed from a revenue perspective with China representing negligible revenue/growth, that Facebook, Amazon, Netflix, and Google/Alphabet are ‘primarily insulated’ from tariff worries and a potential retaliatory trade war with China if negotiations fail to result in a path to an agreement over the coming weeks,” Daniel Ives, head of technology research at GBH Insights, wrote in a note to clients published today.

Concerns about China are nothing new for Apple. In 2016, activist investor Carl Icahn got out of the Apple investing business because of concerns about China. This was despite his belief that Apple shares are grossly undervalued, and making over $3.4 billion investing in Apple in a relatively short time.

“I don’t think it’s a price point [that would get me to go back into Apple stock],” Icahn told CNBC’s Scott Wagner. “I think it’s my opinion about what is happening in China… I got out because I’m worried about China.”

Source: CNBC