Apple might be a hardware first company which creates software only to drive sales of its physical devices, but that doesn’t mean it can’t earn a bit of money from its services, right?

According to a new Bloomberg report, Apple will earn a fee every time its newly-announced Apple Pay service is used to make a purchase.

The deals were reportedly brokered by Apple with each bank individually and will give Apple a sizeable share of the $40 billion generated by banks each year from so-called swipe fees for credit card payments. JPMorgan, Bank of America and Citigroup have not yet disclosed the terms of the deal.

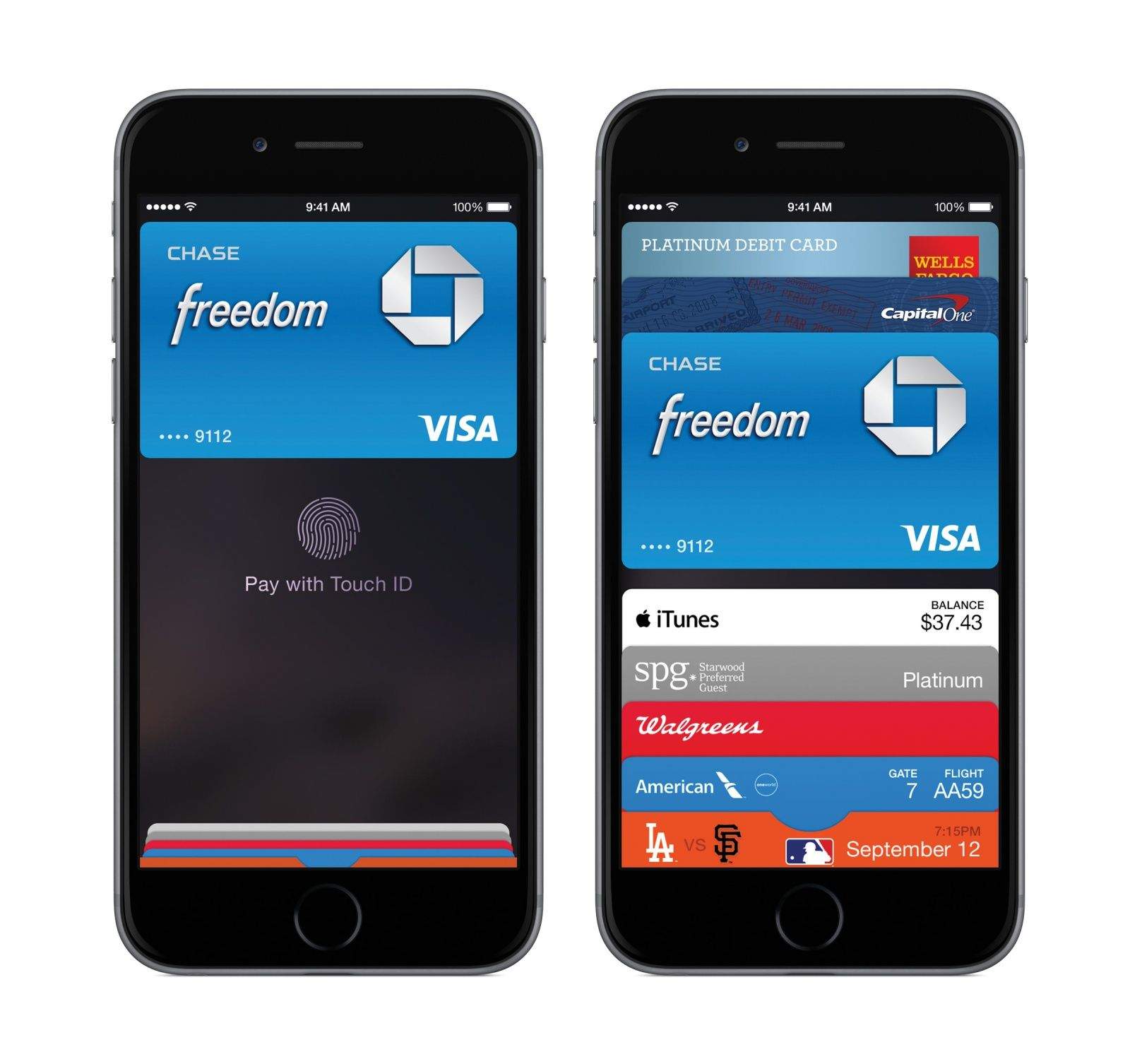

Apple Pay was announced yesterday by Tim Cook, based on a long-time patent by Apple for NFC payments. It will add an additional element of security to payments by way of a dynamic security code (a process called “tokenization”) which replaces the static data on the magnetic strip of a typical credit card.

“Having a partner like Apple really was like catching lightening in a bottle,” Visa’s head of innovation tells Bloomberg. “Given their ability to effectively manage their platform, and get folks across multiple industries, merchants, banks and networks to cooperate really was the thing that catalyzed the whole thing.”

Source: Bloomberg