The nattering nabobs of negativism on Wall Street think Apple’s runaway success is over.

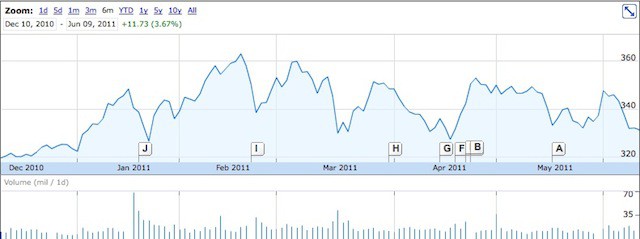

Apple’s stock has been in the doldrums for the last six months, and the reason is that analysts don’t think Apple can keep it up. Here’s what they’re saying:

As noted by Philip Elmer-Dewitt at Fortune’s Apple 2.0, analysts like RBC’s Mike Abramsky don’t think Apple has another big hit like the iPad in the pipe:

Last year investors were excited about Apple’s massive tablet head start and iPhone share gains/market expansion (e.g. the Verizon iPhone),” he wrote by way of explanation. “This year, the multiple has been compressed by the market. Investors appear more restrained than last year, considering the big run in the stock. It reflects market uncertainty regarding what will drive the next leg of growth, how much or not Android will impact Apple, Steve’s health, etc.

His sentiments were echoed by Susquehanna’s Jeff Fidacaro, who thinks that “Apple’s quarters of breakneck growth are largely over,” and BCG Partner’s Collin Gillis, who said Apple’s most recent quarter “was about as good as it gets.”

A year ago, the iPad was a new source of revenue for Apple,” says Gillis. “Growth over zero was tremendous. Now it’s not, and revenue growth has to slow down.

Are they right? Is the iPhone and iPad train slowing down? Doesn’t look that way to me. What about Apple’s expansion into overseas markets, like China?

83 responses to “Wall Street Thinks Apple’s Run Is Over”

iOS isn’t slowing down, but I see what they mean about Apple not having many new products they can release. Like what’s left? We’ll see :)

Apple is in no trouble

Wall Street is clueless about seeing more than a few months out at most. Because they are so busy pecking on their mostly ignored spreadsheets, they don’t understand what Apple is accomplishing right now and the promise it holds for years to come. Apple has superb stand-alone: software, hardware and the best, most scalable operating system. I hold a lot of Apple stock and I will buy more if there is substantial weakness

Those analysts need to look a little deeper. Earnings will continue to be through the roof for the forseeable future with just the products they currently have out much less the upgrades coming. The iCloud will draw more new customers in. Currently I have a Droid and might have gotten another but with the ipad (which I love) and the implementation of iCloud I will definitely be getting an iPhone. And when I’m ready replacing my Dell XPS with an Apple. And we don’t know what else they have up their sleeves. This stock is as good a buy is there is out there.

It is slowing down, at least from a financial markets point of view. There is no way they can see that much growth any time soon without releasing a totally new product with no competition (like the iPad). Their stock literally cannot grow as rapidly as it did without a major new product launch, and a new iphone wouldn’t be that major. It doesn’t mean they are reporting doom and gloom for Apple, just that growth will even out as competitors launch and momentum slows.

Basically, they’re saying that Apple’s innovation machine has ground to a halt. Which I highly doubt. Analysts are the most unimaginative bunch of people. They look at the present lineup of products and then just project numbers from there under the assumption that no new product markets will ever be created henceforth. This might be true for certain one or two-hit wonder companies but if there’s anything any analyst should have learned by now it is that Apple is not a one hit wonder. Just because they cannot conceive of what products Apple might come up with in the future doesn’t mean that Apple has nothing in the pipeline.

As I always say, professional stock analysts are a logical impossibility. The job category only exists because of human irrationality. If an analyst is really so good at predicting a company’s future performance, then that analyst would keep the information to himself and make a killing playing the stock market. There might very well be fantastic stock prognosticators out there who are consistently right but they’re keeping their valuable knowledge to themselves. The natterers we hear from are the dud forecasters.

The article is a little tabloidy. They are simply saying they dont predict the same level of growth that was seen in the last 12 months. There is no way Apple can repeat that without another ground breaking product launch, one that may be a while off. In the mean time, they predict things to level off and become steady.

K, so apple can grow 50-60% a year instead of 100-200%.

Big Freaking deal. Apple has too many room to grow with these iPad, iPhone and App store sales. Earnings will continue to beat the expectations.

When has Wall Street ever been right?

For Wall Street, Apple is always on its last legs. Limited growth potential of iOS due to Android and WP7, loss of innovation for future products, Steve Jobs declining health, wasted cash reserves, etc. Listening to WS makes me think that building a successful company is a huge waste of time and that Apple only has a year or two left as a powerhouse company. WS praises companys like Goldman Sachs and LinkedIn yet considers a company like Apple with a huge loyal consumer base as a flash in the pan. It’s no wonder the American economy is in the dumps with Wall Street calling the shots. Their financial principles are at best, untrustworthy.

As for innovation, analysts said Apple would run out of ideas and momentum after the iPod, the iPhone and now the iPad. You can tell their vision is shortsighted, at best. What WS seems to be saying is that nearly every company is a dead end in growth to some degree but only the future decides that, not a bunch of shortsighted analysts.

The fallacy in this is to have believed that the price of the stock had anything to do with the company to begin with. What Apple stock has done in the last several years is the exact same thing that Intel stock did in the 1990’s. Yet, Intel for the last 2 or 3 quarters has made more money than ever before, more profit than ever before and has the highest market share than ever before, yet the stock hasn’t moved a whit based on that. In the 90’s, that would have caused a doubling and a split.

The game is rigged, folks. The “insiders” ran up Apple stock in the effort to create a mini-bubble. They justified the bubble based upon good news that could be spun in a way to make the bubble’s growth seem reasonable.

But now the bubble is very big. All that is needed now is for some theoretical “bad” news to come out, and the insiders will flee, taking their profits with them, and the rest will crash. A new message of Steve’s “poor health” will be used to justify the crash (even though his supposed “bad health” didn’t affect it before). They will then move that money to a new bubble (Facebook IPO or something).

Neither the run up, nor the inevitable crash that will occur, are in anyway a reflection on Apple. Their fundamentals were the same before, and will be the same after. The only change will be where the gamblers with the huge bets have decided to place those bets.

Unfortunately, we are seeing yet another Internet bubble spring up. The IPOs that have launched recently are eerily similar to the IPOs starting in 1994/1995 that caused the first Internet boom. When that crash happened, all the gamblers moved their money into real estate. That bubble has burst, and absent any effort by the government to stop this kind of gambling, the gamblers were going to put the money somewhere. They first did it with oil and gold, so it is time to move to the next one.

As for innovation, it seems the one doing the most innovating was Nokia.. … the settlement today proves that pretty well :)

Basing their assertions on hardware alone is pretty telling, considering that the reason that Apple has been so successful is the peerless combination of superior hardware, software and services. Sure, Apple’s position as a hardware leader may wane for a bit, but they have a solid position as a provider of rock-solid OS and service options, and they are not sitting on their laurels with respect to those.

Apple should just buy back all their stock with all that cash and take the company private. Wall Street is messed up, and they need their heads examined, that is why this country has gone down the toilet, because the crooks in the financial industry wield their power and control corporate America to the point where even if your company makes a billion dollars in profit, it’s NOT GOOD ENOUGH?? So Much greed… squeezing every last drop of blood out of the middle class and the poor.

Apple should just buy back all their stock with all that cash and take the company private. Wall Street is messed up, and they need their heads examined, that is why this country has gone down the toilet, because the crooks in the financial industry wield their power and control corporate America to the point where even if your company makes a billion dollars in profit, it’s NOT GOOD ENOUGH?? So Much greed… squeezing every last drop of blood out of the middle class and the poor.

Possible lack of new product can’t be the reason. The iPhone has shown big year over year growth since 2007 and so will the iPad. New major products have been released by Apple every 3 year (2001 iPod, 2004 Nano, 2007 iPhone, 2010 iPad), so the next big thing (possibly a TV screen product) can wait for a few more years. Meanwhile the iCloud will support the whole Apple ecosystem and kill the PC (at least partially).

The real reasons could be overvaluation, Steve Jobs health risk and general tech stock slowdown.

Samsung Galaxy S2. Nuff said!

Very well said. Bravo.

I think fundamentally, WS still doesn’t understand the brand-drivers that keep record profits rolling in. Why do they need another home-run product RIGHT NOW when the iPad is just starting and seems to be unstoppable for some time to come?

Case in point. Sitting at the Reston Apple store Genius bar last week, for a total of 40 mins in two visits. On a slow afternoon, I saw 4 iPads (Loaded 3Gs mind u), 1 iMac, a Time Machine, and a Mini get sold, and that was just because some of their mobile checkouts weren’t working. My second visit on a Saturday (all of 5 mins), I saw a single couple buy 4 MacBook Pros. Four. $8000 of computers in a blink of an eye.

Have we ever witnessed this kind performance in a consumer product company? Probably not since the Walkman. Yet, Apple can’t catch a break on share price. Shortsighted and stupid.

One exception to your point, however. Apple isn’t in any kind of bubble by traditional valuations, trading at something like a P/E of 16, while others trade in the 70s/80s. In the 90s a P/E of less than 20 was dirt cheap, as Apple is now. (Sorry, had to edit P/E numbers…got them wrong)

Leander, I don’t think you read the same Wall Street as I do. One or two analyst don’t make Wall Street. And if those people don’t always understand Apple challenging the traditional business model as they see it, some of them can see a good business deal when they see one.

Check out Dr. Osman Gulseven analysis of APPL potentialhttp://seekingalpha.c… At Eventidehttp://seekingalpha.co… Elmer-DeWitthttp://tech.fortun…

Didn’t they say this even before the iPad was announced? They said before the iPhone was announced too. They even said it before the iPod was announced. And I know they said it (and worse) before the iMac was announced.

end of the truncated message:

Dr. Osman Gulseven analysis of APPL potential at http://seekingalpha.com/articl… OR Posts At Eventide at http://seekingalpha.com/articl… OR Philip Elmer-DeWitt at http://tech.fortune.cnn.com/20….

Agreed. In fact, I think the analysts are actually creating self-fulfilling prophesy by saying such things; They want the stock to drop. They will sell short during the selloff until the price hits their strike price at which time they will laud the company for all of its advancements and foresight and buy back in at the lower price laughing to and from the bank. It’s the small investor who suffers really.

Spot in, Joe.

Why isn’t Wall Street in jail? Are these the same people who didn’t see the collapse of the American economy coming? Just askin’

This is the same Wall Street that drove the global economy off the cliff, got a bailout, and yet, you expect me to believe that what they say that Apple doesn’t have anything left to release or in the works? Wall Street, there is a great saying….It goes like this: “It is better to be thought of as a fool, than to open your mouth and remove all doubt.” Abe Lincoln.

Currently the company is seeing restraint of supply, not restraint of demand. However without scaling supply chains, they won’t be able to meet demand. Apple can get into emerging markets like South America, India, and China but they will still be constrained by supply. Also emerging markets do not have have the income ratio to support users buying a new device every couple of years. These are things that these analysts look at.

Is it the end of Apple? Probably not. Microsoft has a lot more to worry about unless they can really jumpstart their mobile device production. However Apple’s year over year growth may slow down. It won’t be just Apple though. Google through Android will also reach saturation and it will come down to upgrading devices and not selling new ones. This is why the PC market is slowing. Both desktops and laptops are powerful enough that they only need to be replaced when they stop working. This is much different than a decade ago. With mobile devices, each new generation brings tremendous new capabilities but that won’t last. In 5-10 years, they will meet or surpass current Desktops in power and functionality. Then people won’t replace them until they die.

What will it take to be revolutionary instead of evolutionary I the future? We’ll have to see. However whoever gets full voice command and dictation working will make a lot of money. And I am talking about Star Trek level voice command here.

And Amazon which has a P/E of 75!!! How do they explain that one?!

Mike Abramsky couldn’t forecast Apples quarters if he was given the financial statement personally by Tim Cook two days before they reported. He’s been as wrong on Apple as Steve Ballmer.

I disagree. I actually think it’s a very good time to buy AAPL. iCloud is big news, I just got to know that 50% of iPhone owners don’t sync their phones. iCloud will solve that, which I think will lead to more people buying iPhones and other iOS devices. iOS 5 is big news as well, it will strengthen the whole ecosystem, which will have a positive effect on revenues from people buying more content for their devices. Let’s not forget about the updated Macbook Airs, and iPhone 5s. I think iPhone 5 is no less important than the iPad, if not more important. Also, internationally, Apple has just started focusing, supporting, and providing the products that were provided abundantly in the U.S. but not enough or late in many other countries that have millions of Apple products’ lovers. I don’t know how technical wall street is, but I can tell you as a user, I can clearly see that Apple is just getting started.

The Economist just predicted that Apple would be one of the few tech companies that will still be around in 100 years, and I agree with that. I think the keys to this longevity and the reasons I believe Apple is just getting started:

1. iCloud

2. iOS 5

3. iPhone 5

4. Content

Right now we are in summer doldrums. I’m holding my stake and may add more if it dips.

It is a shame that i can only like your comment once!

I always see Wall Street as a bunch of people fluent in economics but clueless about how individual industries run.

I’m amused by analysts spouting the law of large numbers. Apple’s dollar figures are high, but check out Apple’s worldwide market share for its devices. Five percent? Ten percent? Still plenty of room to grow.

If economists tip AAPL, sell.

Wall Street has no clue where Apple is headed. They are just parasites. Apple is just getting started.

I agree with you regarding economists, and very interesting other contributions. This is actually though my personal opinion. I really think it’s solid, the products, the eco system, the content, man I still believe they’ve just started. In the sense that they’ve sold a lot of stuff but just now almost completed setting up the whole eco system with iCloud.

Don’t forget the core product, the Macintosh. There are still zillions of people using MS Windows, and many or even most of those will be switching to Mac over the next decade, as Windows falls more and more behind the curve and the Mac keeps improving.

The stock market as a whole hasn’t been performing well the last six months. Even Apple isn’t immune to that.

Agreed. If the Samsung Galaxy is the best the competition can offer, Apple has NO worries whatsoever.

Yeah, we should listen to the same clowns that said the housing bubble will never bust and the stock market/bank fiasco wasn’t that bad. Do me a favor Wall Street and SHUT THE HELL UP!!!

Absolutely.