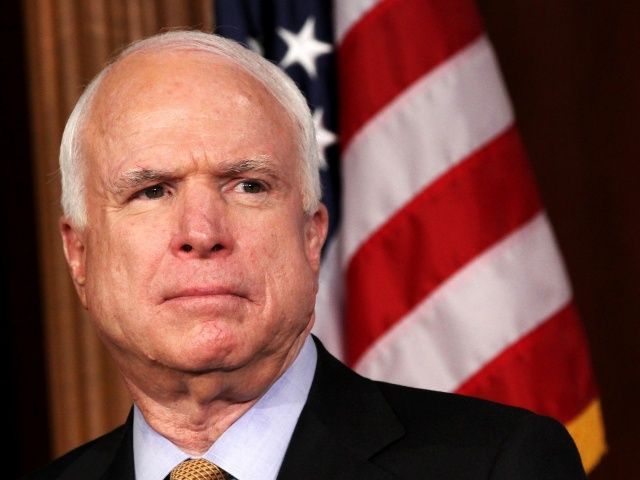

Senator John McCain just laid out his case against Apple in Washington D.C. in a Senate hearing about Apple’s tax rates, and he’s out for blood.

According to McCain, although 95% of Apple’s research and development happens in the USA, they funnel most of their profits through overseas entities that are not tax residents in any country in the world.

Ireland is a big target for McCain here. Ireland has long had liberal tax policies in an attempt to attract foreign companies, but McCain says that Apple paid less than $10 million in taxes on $22 billion in earnings in Ireland, a tax rate of less than 1.20th of 1%.

![Capture the World Around From Your iPhone 4/4S With Dot [Deals] CoM - Dot](https://www.cultofmac.com/wp-content/uploads/2013/05/CoM-Dot.jpg)

![Foxconn Is Already Making iWatches, And They Have OLED Displays [Rumor] Not a real product, yet.](https://www.cultofmac.com/wp-content/uploads/2013/05/Apple-iwatch-Render-2.jpg)

![Five More Ways To Master Siri On Your iPhone And iPad [Feature] Siri couldn't be more excited about the Apple Watch. Photo: Apple](https://www.cultofmac.com/wp-content/uploads/2013/05/130318_siri_0078.jpg)

![Android & iOS Grab 92.3% Of All Smartphone Shipments In Q1 2013 [Report] post-227562-image-d0a6238295ec7afe990328f4af5d1dda-jpg](https://www.cultofmac.com/wp-content/uploads/2013/05/post-227562-image-d0a6238295ec7afe990328f4af5d1dda.jpg)

![Google Announces Google Play Game Services To Rival Game Center [Google I/O] post-227413-image-61ed37cf8ae8f82ece96f7d61940a7df-jpg](https://www.cultofmac.com/wp-content/uploads/2013/05/post-227413-image-61ed37cf8ae8f82ece96f7d61940a7df.jpg)

![Nearly Three In Every Four Smartphones Sold Are Running Android [Report] post-227266-image-186ffb2366352bac8465430a88c7c52d-jpg](https://www.cultofmac.com/wp-content/uploads/2013/05/post-227266-image-186ffb2366352bac8465430a88c7c52d.jpg)

![How The Lumia 925 Stacks Up Against The iPhone 5, Galaxy S4, HTC One [Comparison] post-227244-image-558ac1f60edd5520e53f76f54491b125-jpg](https://www.cultofmac.com/wp-content/uploads/2013/05/post-227244-image-558ac1f60edd5520e53f76f54491b125.jpg)

![Ending Soon: Learn The Secrets To Using Your iPhone And iPad [Deals] CoM - iOS Guru](https://www.cultofmac.com/wp-content/uploads/2013/04/CoM-iOS-Guru.jpg)

![Mastering Passbook On Your iPhone [Feature] passbook_overview](https://www.cultofmac.com/wp-content/uploads/2013/05/passbook_overview.jpg)

![Add Unsupported Passes, Cards, And Tickets To Passbook [iOS Tips] PassSource Passbook](https://www.cultofmac.com/wp-content/uploads/2013/05/PassSource-Passbook.jpg)

![Learn How To Build iOS Apps…With No Programming [Deals] CoM - Build Apps](https://www.cultofmac.com/wp-content/uploads/2013/05/CoM-Build-Apps.jpg)