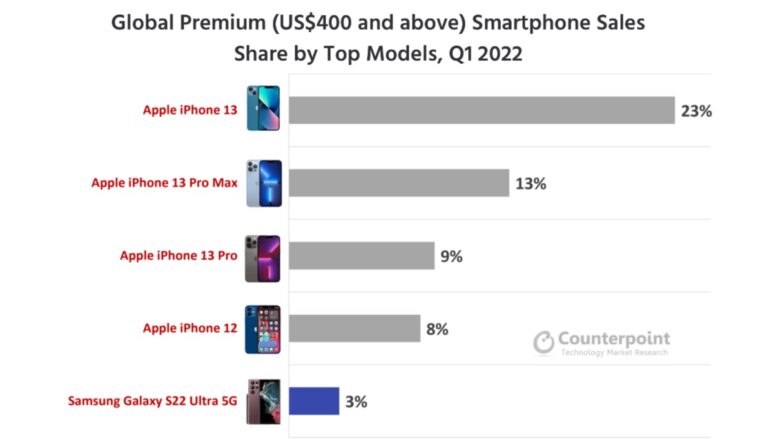

High-end Android models sell in much smaller numbers than iPhones, according to a market research firm. Apple handsets that cost over $400 outsold all Androids in that price range almost two-to-one.

The data shows that while Androids with cutting-edge features like folding screens and very high-res camaras draw a lot of attention, they don’t attract many buyers. But pricier iPhone models do sell well.

iPhone 13 leads global sales

The Android vs. iPhone battle matters for more than bragging rights. Software developers decide which platform to support based on their relative popularity. The same goes for accessory makers. And globally, Android outsells iPhone. But the situation is more complex than that one piece of data.

Anyone who paid more than $400 for a handset during Q1 2022 was probably buying an iPhone, according to Counterpoint Research. Apple pulled in 62% of global smartphone sales in that price range during that quarter. That’s a year-over-year increase of ten percentage points.

Apple’s dominance comes from strong sales of the iPhone 13 series. “The iPhone 13 has been the best-selling model globally each month since October 2021,” noted Counterpoint’s Varun Mishra.

Chart: Counterpoint Research

Android struggles to go head-to-head with iPhone

In the same three months, Samsung had just 16% of the $400+ market, down two percentage points annually. The combination of the Chinese handset-makers Xiaomi, Oppo and Vivo was only able to hit 15% of the global market in this price range.

Apple does not make a handset that competes in the under $400 category. Its cheapest model is the $429 iPhone SE. In other words, the category Android dominates is the one Apple doesn’t compete in: cheap handsets.

And developers of apps and accessories expect people who paid more for their handset to be also willing to spend more on add-ons. Which is why there’s no shortage of third-party iPhone software and cases.