Despite meteoric iPhone sales, a hot new watch, and a music service coming soon, Apple’s stock price has stalled the last few months, and its massive pile of cash could be a big reason why.

Apple analyst Neil Cybart explained on Above Avalon that while you’d think having $200 billion in the bank wouldn’t be considered a problem, all that money is causing Wall Street to seriously devalue how much AAPL is worth.

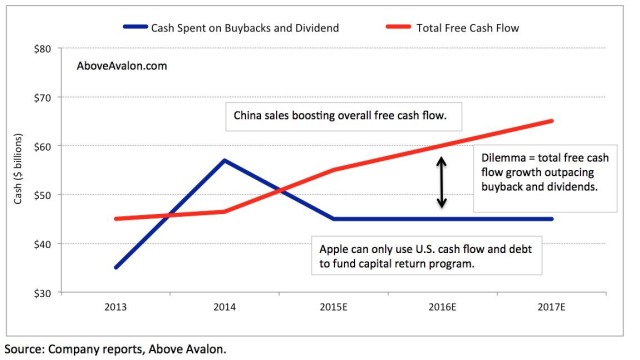

“Unless foreign cash is brought back to the U.S. in order to boost the magnitude of share buyback, Apple’s excess cash will continue to grow, and the valuation metric that the market is giving Apple will continue to be suppressed.” writes Cybart.

Apple has $194 billion in cash but it doesn’t need all of it to run its business, according to Cybart. Theoretically, the company could repurchase 30 percent of itself, except most of it is held overseas, making it subject to a heavy tax if it were brought back to the U.S.

Now that Apple’s cash creation machine is generating more money internationally than its able to spend on stock repurchases and cash dividends in the U.S., investors are more likely to undervalue Apple’s stock. It’s highly unlikely that trend will stop anytime soon now that China is the biggest iPhone buyer.

This puts CFO Luca Maestri in a tough spot to please investors, and Cybart says there are really only three options:

- Lobby for U.S. Tax Law Changes/Holiday

- Continue Issuing Debt to Fund Capital Return

- Do Nothing

Apple will probably just keep using debt to fund its buybacks because it’s so dang cheap, but it sure would be nice to see Apple bring that money back to the U.S. and invest it back into the country it professes to love.

Head over to Above Avalon for the in-depth analysis on Apple’s cash problem.

8 responses to “How Apple’s massive cash pile is holding back its stock price”

This what is wrong with major investors today. Instead of investing for the long term where the increased value of the company drives the stock, they invest driven by what the stock can do for them over the short term. That is why high frequency trading, the ultimate short term investment, is ruining the market. Economies are driven by long term corporate growth and ruined by short term profit gains such as the subprime bubble of 2005-2008. Companies are are forced to make short term decisions such as stock buybacks instead of innovating for the long term. Investors punish companies like Apple who keep their cash and continue innovating. When the majority of economic activity is short-term trading in financial products, the economy stops producing real goods and breaks down causing most to become poorer.

Maybe they can loan that Chinese Apple cash to USGovt to fund the debt.

Have any other American companies received tax holidays since this focus on Apples cash started?

“How Apple’s massive cash pile is holding back its stock price”

Hmmm, I really don’t think Apple is hoarding its cash. Development, advertising and and fulfillment of the Apple Watch… in multiple countries, development, advertising and distribution of an all-new Macbook, the on-going construction of a gigantic new, state-of-the-art campus, more products under development than we know about… etc. etc. No, I rather think people who believe they know better than Apple about how to spend its cash simply don’t understand the business of the world’s most popular and successful electronic company. It’s a juggernaut, and with that comes complexity, including financial complexity, that most of us can’t grasp.

Okay, start calling me a fanboy and all the rest, but it’s Apple’s money, and they can damn well spend or not spend it as they see fit. A few years ago, predictions of non-Apple fans where that under Tim Cook, the company would crash and burn. Seems like Apple is making pretty good decisions.

The analyst just said, in so many words, “if Apple cannot sustain its stock buyback program because the cash it needs is mostly overseas and it is costly to repatriate that cash, then AAPL will become undervalued.” Think about that statement. If that is true, than AAPL valuation is currently overvalued because the stock price is dependent on the artificial demand for the stock created by the stock buyback program.

Furthermore, seems to me the so-called analyst just advanced the proposition that “the more cash you accumulate, the poorer you get”.

Bull-effing-shite.

fmac………. < Start working at home with Google! It’s by-far the best job I’ve had. Last Wednesday I got a brand new BMW since getting a check for $6474 this – 4 weeks past. I began this 8-months ago and immediately was bringing home at least $177 per hour. I work through this link, < www.Netcash9.Com

There is, of course, a fourth option:

– repatriate the money and pay the taxes owed.

And, yes, I’m an Apple shareholder.

I’m an Apple shareholder and I agree with you, but if Apple did that the majority of shareholders, especially institutional investors, would go ballistic and claim Apple was “throwing away” money to the federal government. They really are in a trap, along with many other companies who have a similar problem. This should be resolved with some kind of repatriation tax break, preferably a permanent one.