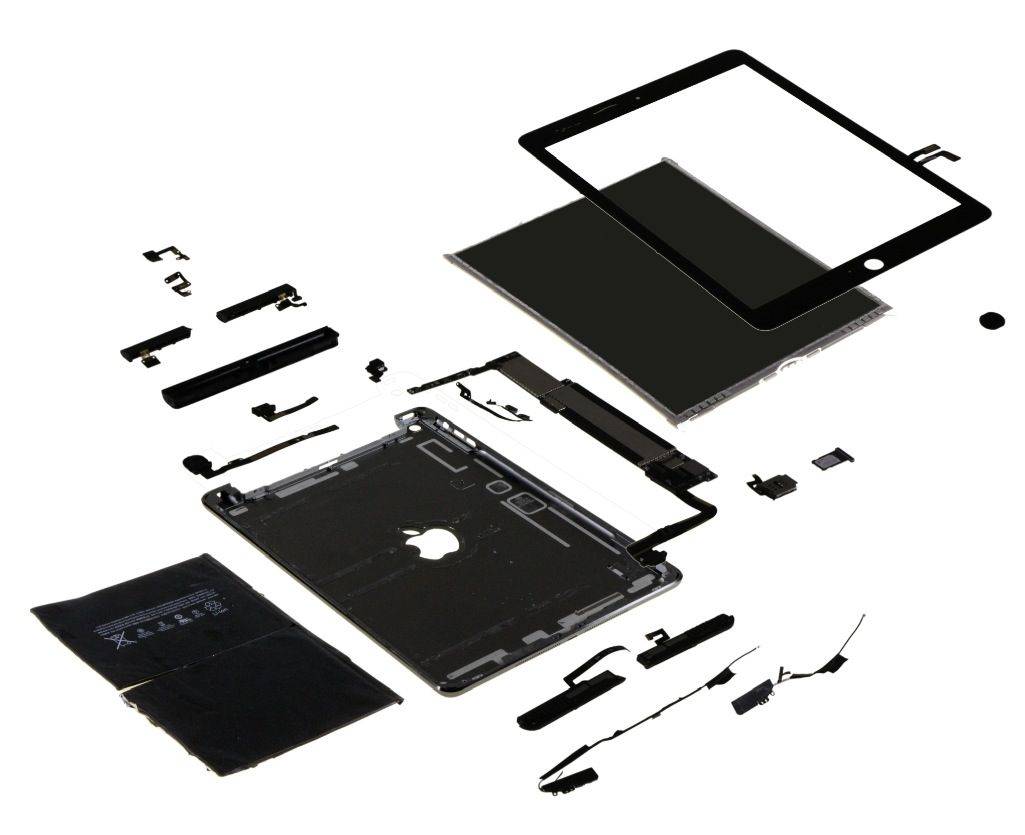

The iPad Air might be the lightest iPad yet, and a true glimpse of the future of tablets, but Apple’s still managing to make a healthy profit on each tablet sold. In fact, iHS iSuppli pegs the build price of each iPad Air is just $274 for a 16GB WiFi-only model. Apple sure does know how to make a margin, doesn’t it?

According to IHS iSuppli (speaking to All Things D), the build cost of an iPad Air is between $274 and $361, depending on the model. Considering that the iPad Air in a 128GB LTE configuration costs $929, that’s a heck of a profit margin Apple is looking at, even after accounting for the hidden costs of shipping, manufacturing, and so on.

What’s even more surprising is that the iPad Air manages to be this profitable despite a touchscreen that costs more.

The biggest changes he said were with the display and touchscreen assembly. For one thing, it’s thinner and has fewer layers in the combined assembly than in previous models. But at an estimated combined cost of $133 (About $90 for the display and $43 for the touchscreen parts.) it’s a lot more expensive than before, he says. South Korean electronics companies LG Display and Samsung are both thought to be suppliers of the display, he says.

IHS iSuppli also says that Apple is using far few LED lights to power the display. Previous iPads used 84 LED lights to light up the screen, but the iPad Air gets away with only 36. How’d Apple manage this? iSuppli assumes more efficient LEDs, which may be partially true, but the true answer is probably Sharp IGZO technology. To read more about how the iPad Air utilizes Sharp IGZO tech, read my article about it here.

Source: All Things D