The consensus on Wall Street seems to be unanimous: for the first time in decade, Apple will report lower income this quarter than it did the year before. But don’t panic: even Wall Street doesn’t think Apple’s era of profitability and innovation is at an end.

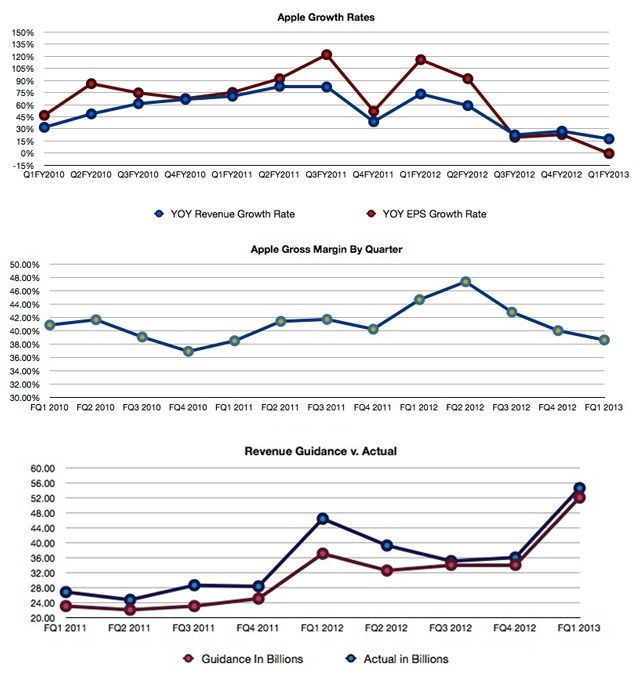

Fortune reports that the current consensus on Wall Street is that Apple’s estimated earnings per share for Q1 2013 will be around $10.18, down from $12.30 in Q2 2012. If you want to know why Apple stock just keeps plummeting, there’s your reason

(although Fortune’s Philip Elmer-Dewitt says “the smart money has been pouring back into the coimpany for the past three weeks.”)

Why are earnings per share projected to be down? Well, mostly, it has to do with the fact that Apple refreshed pretty much every product it had in Q1.

The problem for Apple is not that its business is collapsing. Indeed, the projected revenues of $41 to $43 billion Apple offered analysts in its quarterly guidance would represent another record second quarter for the company.

Rather, it’s what analysts call a “tough compare” in terms of gross margins — a measure of the efficiency with which a company turns revenue into profits. Last year at this time Apple’s gross margin peaked at an extraordinary 47.37%. This year, following the introduction of a slew of new products — including new Macs, iPhones and iPads — it is projecting gross margins somewhere between 37.5% and 38.5%. That’s what’s driving the income down. Wall Street seems to be betting that in the next six to 12 months, those numbers have nowhere to go but up.

In other words, Apple is innovating so quickly and releasing such advanced products across the board at such an aggressive rate that it’s maximizing profit on them less quickly than a year ago. If Apple had a more staggered release schedule right now, their earnings-per-share would still be pretty high, if not higher than a year ago.

The good news here is that the landslide of AAPL share price might soon be at an end… following the release of a slate of new and exiting 2013 Apple products.

Source: Posts at Eventide

Via: Fortune