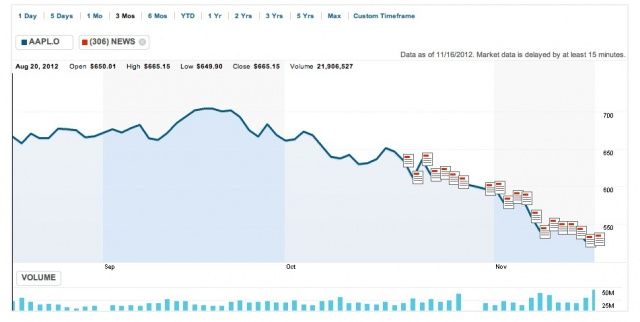

What goes up must come down, in physics and in investment. Stock prices for Apple have hit a low recently, down about a fourth of it’s value. Analysts believe that upcoming taxes on capital gains and investment dividends have stock holders rushing to get rid of as much as they can to avoid record tax hikes.

“No individual investment can defy gravity,” said the deputy chief investment officer for Wells Fargo, Erik Davidson.

Apple hit a high of $705.07 per share last September, according to Reuters, but now is running at around $526 per share, an even larger decline than the one seen in the S&P 500, which is down about 7 percent for the same period of time.

“Some of the selling is being driven by these tax decisions, but the flip side is there is not a lot of buyers because the buyers are procrastinating to see how the negotiations come out,” Bucky Hellwig, senior vice president at BB&T Wealth Management, told Reuters. “You probably have an inordinate effect to the downside because of these tax strategies.”

While the declines have taken Apple market capitalization down a little more than the full value of Coca-Cola (about $170 billion), Apple is still worth about $493 billion, which is $100 billion more than the second place Exxon Mobil.

With a highly valued stock like Apple’s, many investors may be feeling insecure about possible future hikes to the capital gains tax as part of the US government’s move to avoid what’s being called the fiscal cliff. Because Apple’s stock gained so much value very recently, many Apple stockholders will possibly face steep taxes on their capital gains from this past year.

Currently, the tax rate on dividends or capital gains is at 15 percent. It’s possible that successful investors might see a rate of up to 35 percent if the tax cuts expire and revert back to being taxed as ordinary income at the end of this year.

“If you’ve got all these gains – which a lot of Apple investors have because it’s done very, very well – then you’re going to see selling in the likes of Apple and other companies that have had good runs,” said Well Fargo’s Davidson.

Source: Reuters