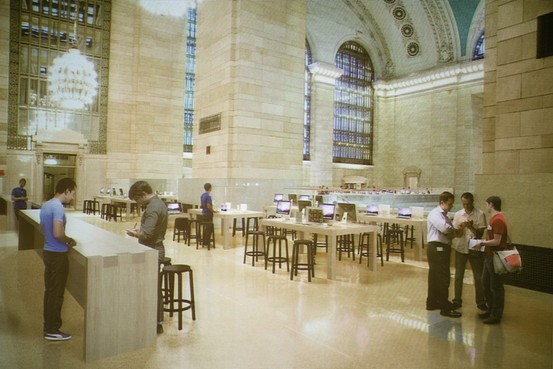

New York State regulators are investigating whether Apple got a ‘sweetheart deal’ when it leased space for its largest store in the city’s Grand Central Station. Reportedly, Apple paid the city’s MTA $60 per square foot for space that normally leases for more than $200. Did Apple throw around its marketing muscle to gain preferential treatment? Politicians are up in arms as Apple preps the the location for a Saturday unveiling.

Following a report that the tech giant paid less than a burger joint for the 23,000 square-foot spot amid the iconic Grand Central site, State Comptroller Thomas DiNapoli announced he plans “to make sure that the MTA hasn’t given away the store.” New York State Senator Tony Avella told local CBS 2 he is calling for an investigation into what he described as a “sweetheart deal.”

Apple also is not required to share any of its store’s profits with the city, something all other Grand Central businesses — except a Chase bank ATM — must do, reports the New York Post, which obtained copies of the leases.

In its defense, an MTA spokesman said Apple had paid $5 million to get restaurant Metrazur to vacate a northeast balcony the Cupertino, Calif. iPhone maker planned for the large retail space. After quadrupling the rent, Apple is “effectively paying $180 per square foot over 10 years of the lease, almost 10 times the previous tenant.”

Apple reportedly makes about $400 million at its 10,000 square-foot 5th Avenue store in New York City, a site that is half the size of the Grand Central store. The company is seen as a ‘must-have’ for malls and other retail complexes. Indeed, the MTA has said the Apple Store at Grand Central will “generate significant new traffic” for neighboring retailers.

The uproar over Apple’s new location has political roots to the past. Struggling with its own budget trouble, the MTA recently increased subway rates. Additionally, DiNapoli took the MTA to task in 2010 over another Grand Central tenant. That tenant was Metrazur, the restaurant Apple paid $5 million to move. Last year, the State Comptroller slammed the MTA for not investigating Metrazur’s lease provision requiring the space be kept at a certain temperature.

While the investigation is likely to gain some headlines and provide fodder for local politicians, the city is unlikely to reject Apple’s lease at this late date and turn down a company now seen as a retail star.

25 responses to “New York State Is Investigating Apple’s ‘Unique’, Dirt Cheap Grand Central Station Deal”

Considering the huge tax revenue the store will generate when compared to a “burger joint”, I think the sweetheart deal is warranted.

Call it an “appearance fee” and it makes economic sense. The Apple Store immediately converts GCS from a commuter station, busy for 5 or 6 hours a day, to a shopping magnet, busy 12 hours a day. As the traffic increases the MTA can charge the other tenants more on their rents or attract other mainstream retailers (wouldn’t H&S or Abercrombie love to be there?), skewing to a younger demographic, generating more revenue than just renting the space at “market” rates to another me-too commuter-centric bookstore or Subway sandwich shop.

What’s funny is that the city and state aren’t doing this because they want to be fair to the other tenants. They are worried about how much money they might be making or not.

Keeping in mind that many shops never reach the income sharing level in their lease or if they do it’s one or two months out of the year, Apple’s cheaper rent for a very large space and the traffic that store could bring to everyone could end up being way more than what was being made before. And then there is the huge amount of sales tax income that those $1000 computers and $500 and + iPads will bring to the state and city

That is, assuming that the Post (which is basically a rag that no respectable New Yorker would wrap fish in much less read) is actually reporting the correct information

Actually MTA won’t raise the rents. Because that would push folks out (not to mention long term leases tend to prohibit it).

But you are correct that it will bring in more money by triggering the income sharing part of the less for more stores more often

” Reportedly, Apple paid the city’s MTA $60 per square foot for space that normally leases for more than $200. “

” After quadrupling the rent, Apple is “effectively paying $180 per square foot over 10 years of the lease, almost 10 times the previous tenant.””

So which is it, $60 or $180 per square foot.

@readers:disqus my buddy’s sister-in-law made $228892 so far just working on the computer for a few hours. Here’s the site to read more… http://y.ahoo.it/OjyKK

They are paying the MTA $60/sq foot. BUT…they had to pay the restaurant $5mil to vacate. So it is, in effect, costing Apple $180/ sq foot.

It just depends on whose side you are looking at it from

not to mention more fares of people wanting to stop there and specifically go to that station.

It’s called Grand Central Terminal.

Grand Central Station is a post office

Actually it’s not. Capital vs operational costs come from different accounting buckets. Apple knows what it’s doing. NYC will end up better off with the Apple Store there than a few restaurants/shops.

Oh, they’ll raise the rents – that’s likely part of their calculation. As Apple generates more traffic, the value of the other spaces increases, and they can negotiate higher rents each renewal. And they probably have the ability to force current tenants “meet or beat” letters of intent on a periodic basis.

The other tenants will likely increase their revenue from the added traffic that the Apple store brings (not that GRAND Central isn’t already flooded with traffic). I’m sure I’m not the only person who has ever driven out of the way to go to an Apple store, only to stop and grab dinner at a restaurant close by that I otherwise wouldn’t have driven to.

hey there, we are selling unlock-iphonesoftware (.com) contact me please [email protected]