Once I started my review of the ScanSnap iX500 document scanner, the new model in Fujitsu’s hugely popular line of top-tier ScanSnap scanners, it didn’t take long to see this machine was going to earn its pedigree.

Category: Document Scanners

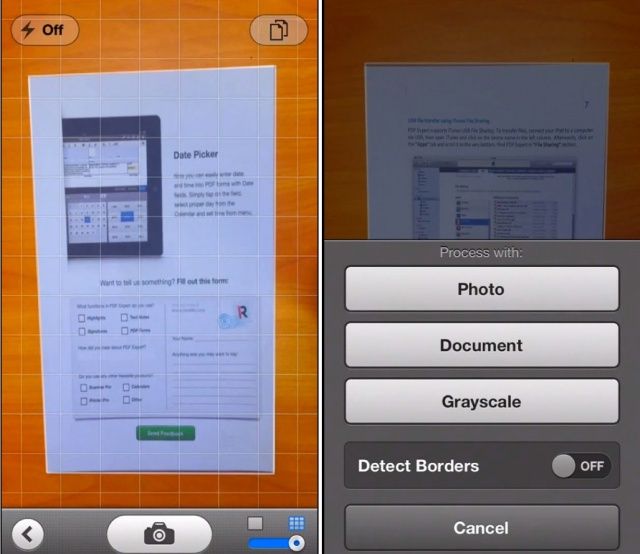

Works With: Mac, iPhone, iPad

Price: About $430 online

With a small footprint, dashing good-looks, scanning direct to an iOS device, and progressional-grade intake rollers, the iX500 actually makes digitizing papers easy, and dare I say, maybe a little sexy. Its included software suit also makes sense of doing something with all those scanned docs.

There’s a reason many consider Fujitsu’s ScanSnaps the finest scanners around, and the iX500 continues in that legacy with some useful new features.

![The iX500 Scanner Sends Your Digitized Docs To Your Mac or iDevice [Review] Looking like a prop out of Star Trek: the ScanSnap iX500.](https://cdn.cultofmac.com/wp-content/uploads/2013/05/fujitsu-ix500-document-scanner-1.jpg)

![Learn How To Master Your iPhone Camera With The iPhone Photography Video Course [Deals] CoM - iPhone Secrets](https://cdn.cultofmac.com/wp-content/uploads/2013/05/CoM-iPhone-Secrets.jpg)

![Here’s What A Waterproof iPhone 6 With Wireless Charging Could Look Like [Video] iphone6concept](https://cdn.cultofmac.com/wp-content/uploads/2013/05/iphone6concept.jpg)

![Tim Cook Shoots Hate Rays At Experts Testifying Against Apple About Tax Dodging [Image] Screen Shot 2013-05-21 at 11.07.51 AM](https://cdn.cultofmac.com/wp-content/uploads/2013/05/Screen-Shot-2013-05-21-at-11.07.51-AM.jpg)

![Dogfight From Your Mac To iPhone With Sky Gamblers: Air Supremacy [OS X Tips] Sky Gamblers](https://cdn.cultofmac.com/wp-content/uploads/2013/05/Sky-Gamblers.jpg)