Apple shipped 58.6 million iPhones and captured 18.2% of the global smartphone market, the company’s “best results ever in a July quarter,” according to new data from the International Data Corporation. The iPhone nearly matched Samsung’s 19% market share.

Demand for innovation, like new artificial intelligence features, plus aggressive trade-in programs, helped fuel the surge, despite tariff woes, IDC said.

Demand for AI features helps drive robust iPhone 17 sales

The impressive results come from robust demand for the iPhone 17 lineup, IDC said in a report published Monday. Apple’s newest handsets launched last month with preorders surpassing those of the iPhone 16 generation. Apple’s 2.9% year-over-year growth came despite persistent economic uncertainty and ongoing tariff challenges that many analysts expected would dampen consumer spending.

Premium devices and AI features drive upgrades

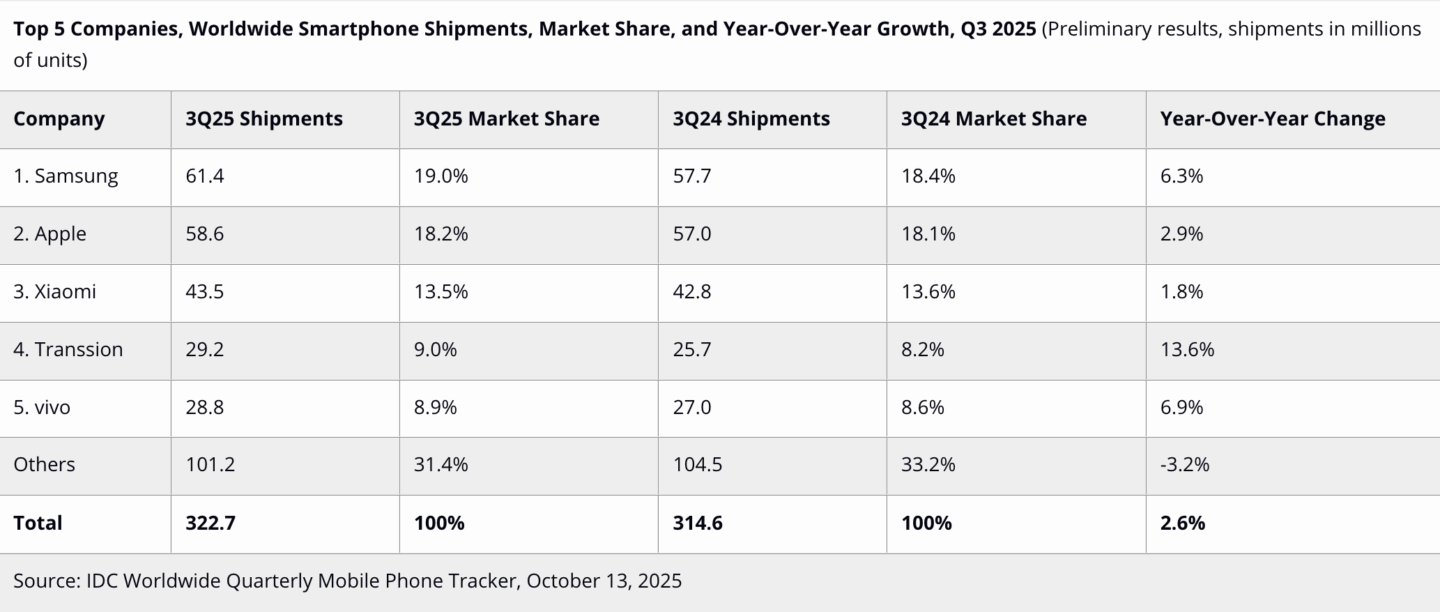

Global smartphone shipments increased 2.6% year-over-year to 322.7 million units in the third quarter of 2025, with the premium segment leading the recovery, IDC said. The market momentum reflects consumers’ willingness to upgrade to devices offering innovative features. In particular, AI-enabled capabilities are becoming increasingly accessible across price points.

“The smartphone industry continues its upward trajectory, posting solid growth — a remarkable achievement given persistent economic uncertainty and tumultuous tariff dynamics,” said Nabila Popal, senior research director for worldwide client devices at IDC.

How Apple convinced users to upgrade

Image: IDC

Industry analysts point to Apple’s sophisticated approach to removing purchase friction as a key factor in the company’s success. The combination of cutting-edge hardware and software innovation, paired with financing options like the iPhone Upgrade Program and aggressive trade-in deals, has made upgrading to premium devices ranging from $800 to nearly $2,000 a more accessible decision for consumers.

“OEMs have mastered the art of innovation not only in hardware and software to entice upgrades but also in removing purchase friction,” Popal said. “They have flawlessly combined cutting-edge devices with innovative financing models and aggressive trade-in programs that make the upgrading decision a ‘no brainer’ for consumers.”

Competitive landscape remains tight

While Apple nearly closed the gap with Samsung, the Korean electronics giant maintained its top position. Samsung shipped 61.4 million units, representing 6.3% growth compared to the same period last year, IDC said. Samsung’s success was bolstered by strong performance from its Galaxy Z Fold 7 and Galaxy Z Flip 7, which outperformed all previous foldable models.

Behind the top two manufacturers, Xiaomi captured 13.5% of the market, followed by Transsion with 9% and Vivo with 8.9%. The remaining 31.4% of the market was divided among other manufacturers, including Oppo, Honor, Motorola and Google.

IDC maintains a positive outlook for the remainder of 2025. It anticipates that increased demand for AI-enabled products, aggressive pricing promotions, and robust product portfolios will lead to a strong finish for the year.