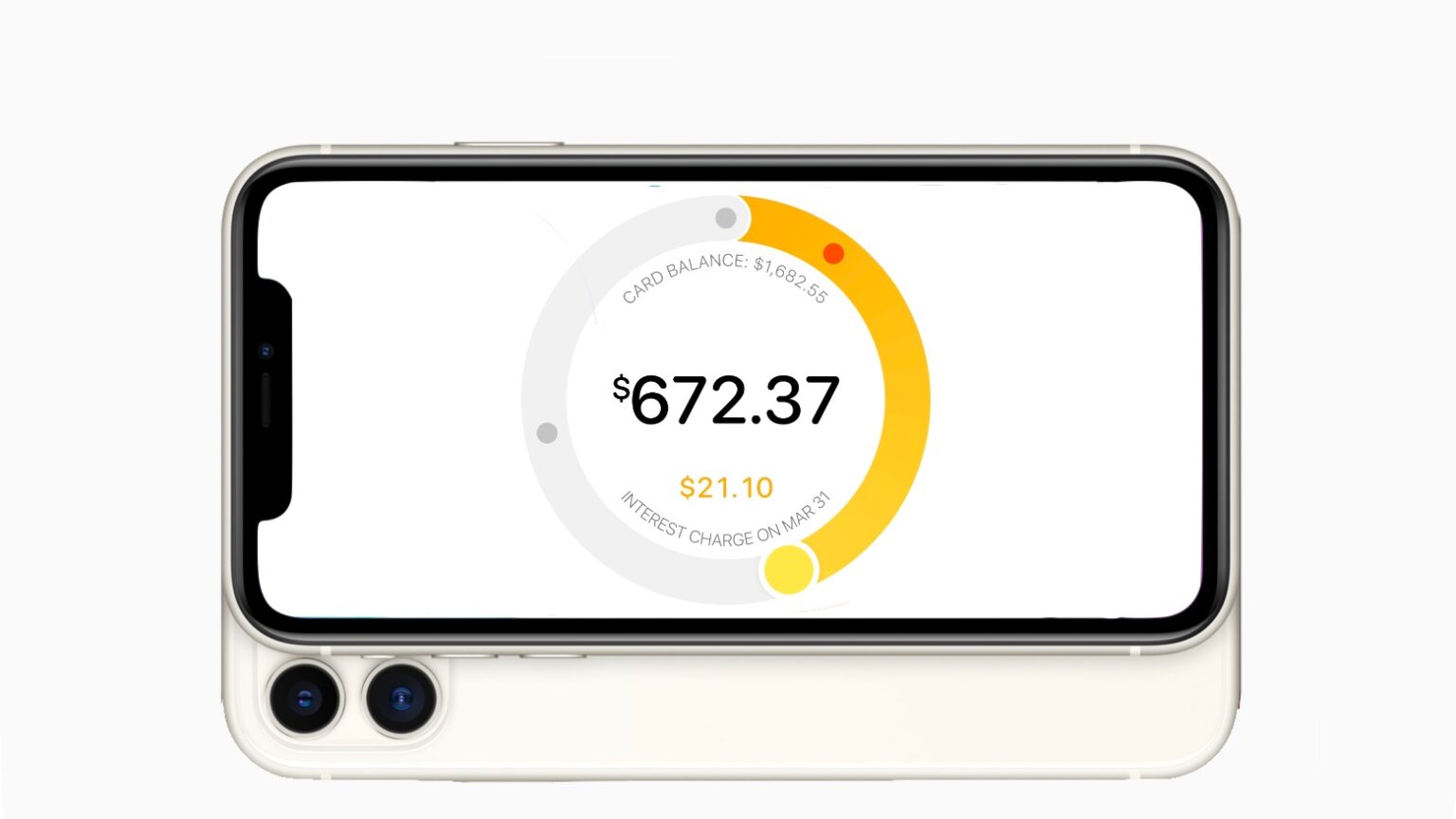

The same day that Apple unveiled the Apple Watch Series 6 and Apple Watch SE, the company expanded its 0% Apple Card financing service to cover its line of smartwatches.

Apple launched its 0% Apple Card financing option for iPhone back in December. This June, it expanded it to cover Mac, iPad, AirPods Pro, AirPods, and Apple Pencil — although Apple Watch was strangely MIA.