Apple’s surge past a $2 trillion market cap this week underlines just how well CEO Tim Cook’s vision works for shareholders. But is this good news for Apple fans?

The first publicly traded U.S. company to hit this milestone, Apple has transformed from one of the world’s dynamic companies into one that can be, well, kind of boring. The strategy that fueled this unprecedented success makes it far less likely that we’ll seen an insanely innovative product coming out of Cupertino in the future.

I realize there’s a conflict here. By any metric, Apple is an enormously profitable business today. And for anyone holding AAPL shares, the stock’s meteoric rise during an economy-wrecking pandemic certainly must feel exciting.

The iPhone — still Apple’s biggest seller — achieved a level of success that comes along once every few decades. As a long-time Apple fan, seeing the Cupertino tech giant do so well brings me no end of joy.

But can anyone honestly say that Apple today is as exciting as it’s ever been? I’d wager probably not.

Is Apple as exciting as ever?

While the prospect of Macs with Apple Silicon inside brightens things slightly, the computer that built Cupertino has remained largely the same for years.

Sure, we got an iMac Pro along the way, but that was nowhere near the drastic shift that, say, Microsoft Surface Studio was. Basically a touchscreen iMac capable of transitioning from desktop all-in-one to giant tablet, the Surface Studio looked like the future in 2016. The iMac still looks much as it has since 2012.

https://www.youtube.com/watch?v=RmVAbB3M-4Y

The biggest change for the MacBook line in recent years was a butterfly keyboard that nearly everyone hated. (Now, Apple has changed the keyboard back to something more reliable.)

The same is true of Apple’s other major product categories. The iPhone is still great, but its days as clearly the best smartphone in the world are perhaps over. Meanwhile, other manufacturers offer compelling new options. They’re the ones innovating when it comes to new form factors and features.

Apple waits to see what works and then, a few years later, introduces its own version. (You can argue that this has always been Apple’s strategy on some level.) Although the iPhone remains a big seller, its peak sales took place half a decade ago in 2015.

The iPad continues to change sizes and has undergone slight design changes. But it still looks fundamentally the same as it always has. And it hasn’t changed computing quite as profoundly as many predicted it would.

It would be crazy to say there haven’t been bright spots, of course. The Apple Watch becomes more compelling year by year. And AirPods have been a revelation both critically and commercially. But these remain small parts of the overall Apple machine.

The second half of the Monopoly game

Today, Apple’s big focus is on services. Like IBM and Microsoft, Apple pulls in an increasing amount of its revenue from recurring subscription revenue.

It seems like the second half of a game of Monopoly, where it’s about steadily accumulating a cash pile as people predictably land on your square. Park Place? Boardwalk? “That’s $400 plus the cost of the hotels, please.” Apple Card, Apple TV+, Apple Music, 2TB of iCloud storage and an iPhone Upgrade Plan? That’s a nice monthly chunk of change. (A possible Apple One bundle could knock off a couple dollars if we sign up for multiple services.)

From Apple’s point of view, it’s easy to see how this transition has been for the best. The new services-oriented strategy might seem more boring. But boring is stable, and stable appeals to shareholders. If Apple took more chances, things would undoubtedly be more turbulent. And the company’s valuation most likely wouldn’t have climbed to $1 trillion in 2018 and $2 trillion in 2020.

During the most exciting years of Apple’s existence, the years when Steve Jobs ran the show as CEO, Cupertino lived or died (mostly lived and thrived) by its superstar products. The iMac G3 was a calling card that announced to the world that Apple was back. The same was true of the iBook, the iPod, the MacBook Air, the iPhone and more. Apple was a tech titan, but it steered like a startup. You couldn’t guess its next move.

Not every gamble pays off

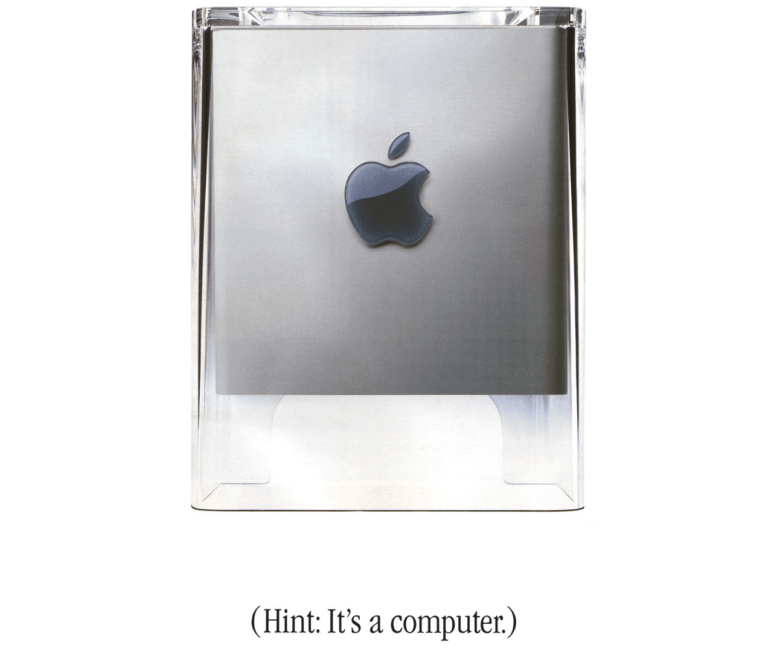

Jobs pulled off this act better than just about anyone. But he wasn’t infallible. He enjoyed some giant hits during his career — more than most people could dream of. But he suffered some big misses, too. The two most spectacular computers he ever oversaw, the NeXT Computer and the Power Mac G4 Cube, both bombed, despite being brilliant.

Photo: Apple

Those ambitious computers illustrated the problem with superstar products: They’re immensely profitable and instantly establish just how far ahead of the competition you are. But they have to pull off the impossible act of thinking different (to put it in Apple’s terms) and appealing to large numbers of everyday users. That’s a strategy you can pull off when you’re brilliant and inclined to take chances. But it becomes harder and harder when you’re running a company that’s worth $2 trillion.

Gambling on the next big thing is great when you’re young. But “gambler” isn’t a synonym for “reliable.” An investor couldn’t look at Apple in 1998, just after the iMac G3, and foresee the company’s next 10 years of existence. But, even without the curveballs that will inevitably be thrown in, you can look at Apple’s business today and see it’s still going to look good a decade from now.

Don’t rock the boat

That’s possible because of Apple’s pivot away from superstar products and toward services, which can safely extract money from customers without much risk. The Mac, iPhone, iPad and other products will get steadily better. But Apple likely won’t roll the dice with a massive reinvention that could blow the bloody doors off the tech industry — or leave people laughing at a misstep.

Meanwhile, the all-pervasive Apple ecosystem, like Hotel California, stops people from checking out. The biggest risks likely will take place lower down the food chain with small gambles like the AirPods.

That said, it’s possible Cupertino will turn the auto industry on its head by releasing a game-changing Apple Car. Or that we’ll all be wearing Apple Glass headgear in a couple of years, with augmented reality seamlessly overlaying our surroundings at all times.

Not rocking the boat has worked very well for Apple financially over the last decade. The stock market likes steady expansion and stability. Knowing that Apple doesn’t need to summon a game-changing product out of nowhere to keep the stock ticking upward is brilliant if you’re holding AAPL in your portfolio.

But from the perspective of a fanboy who fell in love with Apple because it made game-changing hardware that we still talk about decades after it hit the end of its natural lifespan? The perspective of a fan who loved Apple’s unpredictability and willingness to shift forms almost constantly in search of the next superstar product? I feel like those days are over.

![Apple at $2 trillion is amazing for investors, but boring for fans [Opinion] Tim Cook WWDC](https://www.cultofmac.com/wp-content/uploads/2020/06/Tim-Cook-closeup-WWDC-2020-e1597944257184-1536x1051.jpg)