December 12, 1980: Apple goes public, floating 4.6 million shares on the stock market at $22 per share. The Apple IPO is the biggest tech public offering of its day, and more than 40 out of 1,000 Apple employees become instant millionaires.

December 12, 1980: Apple goes public, floating 4.6 million shares on the stock market at $22 per share. The Apple IPO is the biggest tech public offering of its day, and more than 40 out of 1,000 Apple employees become instant millionaires.

As Apple’s biggest shareholder, 25-year-old Steve Jobs ends the day with a net worth of $217 million. However, the big payday triggers internal tensions as it highlights Cupertino’s class divide.

Apple IPO: The biggest of its day

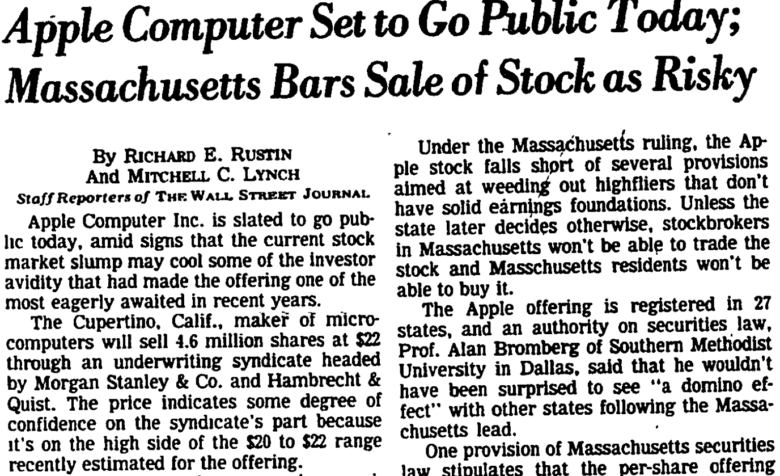

Like the IPO of a modern tech giant, Apple’s public offering was hotly anticipated in the press. “Not since Eve has an Apple posed such temptation,” read an article in The Wall Street Journal.

One Merrill Lynch analyst commented that even her brother “who invests in the stock market only on Tuesdays in leap years” had called her to ask what was going on with the hot little computer company from Cupertino.

Unlike some other tech companies that went public and achieved disappointing results, the Apple IPO proved a smash hit. It became the biggest IPO since the Ford Motor Company’s public offering in 1956, a year after Jobs’ birth.

The Apple IPO was underwritten by Morgan Stanley and the firm Hambrecht & Quist, with Apple stock filed to sell at $14 per share. However, it opened at $22 — and sold out within minutes. That day alone, AAPL rose 32%, with a closing value of $29 and a total valuation of $1.778 billion.

Apple IPO yields instant millionaires

Photo: WSJ

Inside Apple, the atmosphere was as jubilant as you’d expect. Then-CEO Mike Scott wheeled in several crates of champagne to celebrate. Meanwhile, a few employees rigged up a mock thermometer in the road separating Apple’s two main buildings. They used the prop to mark notches of “heat” as the stock rose throughout the day.

Plenty of other people aside from Jobs got rich off the Apple IPO. Scott made $95.5 million. Mike Markkula, the venture capitalist who helped turn Apple into a “real” company, received a return on his investment to the tune of $203 million. So did fellow VC Arthur Rock, whose $57,600 gamble netted him $21.8 million.

Apple co-founder Steve Wozniak took home $116 million after giving a percentage of his stock options to Apple employees who otherwise would not have qualified for them.

Rod Holt, the chain-smoking Marxist engineer who built the Apple II power supply, found himself sitting on a socialism-challenging personal fortune of $67 million. And so on.

A wild time at Apple

A few Apple employees I’ve spoken to from this time recall the general craziness of seeing their net worth soar as their stock options made them rich. Because options couldn’t be cashed in right away, people had to endure the roller coaster ride of watching their personal finances rise and fall until they were able to vest the options in question.

“I went through a year of being totally whacko because my mood was entirely tied to the Dow Jones,” user interface guru Bruce Tognazzini once told me.

An IPO is a milestone for any company, but for Apple it triggered some big changes. With the awarding of stock options, a class divide started to simmer in Cupertino. Salaried employees (such as engineers) received stock options, while hourly, unqualified employees (such as technicians) did not.

When some people got insanely rich and others got nothing, some relationships were tested — like that between Steve Jobs and his former friend Dan Kottke, with whom he had traveled around India.

Big changes follow Apple IPO

That was just the tip of the iceberg. Two months later, Wozniak was involved in a plane crash. In the aftermath, he began to extricate himself from Apple. At around the same time, Mike Scott fired a large chunk of Apple employees. The justification for the move was that the company — growing too big, too quickly — had hired a lot of lesser workers. (Scott called it a “bozo explosion.”)

Scott didn’t last much longer as Apple CEO, either, quitting just six months after early 1981’s mass layoffs. A few years later — curiously enough, on December 12, 1985 — Jobs also left Apple to start a new company called NeXT. Around the same time, Jobs invested in a computer graphics company called Pixar. The animation studio’s later public offering would make Jobs a billionaire.

In short, it was a strange time to be at Apple. But a historic one, without question.