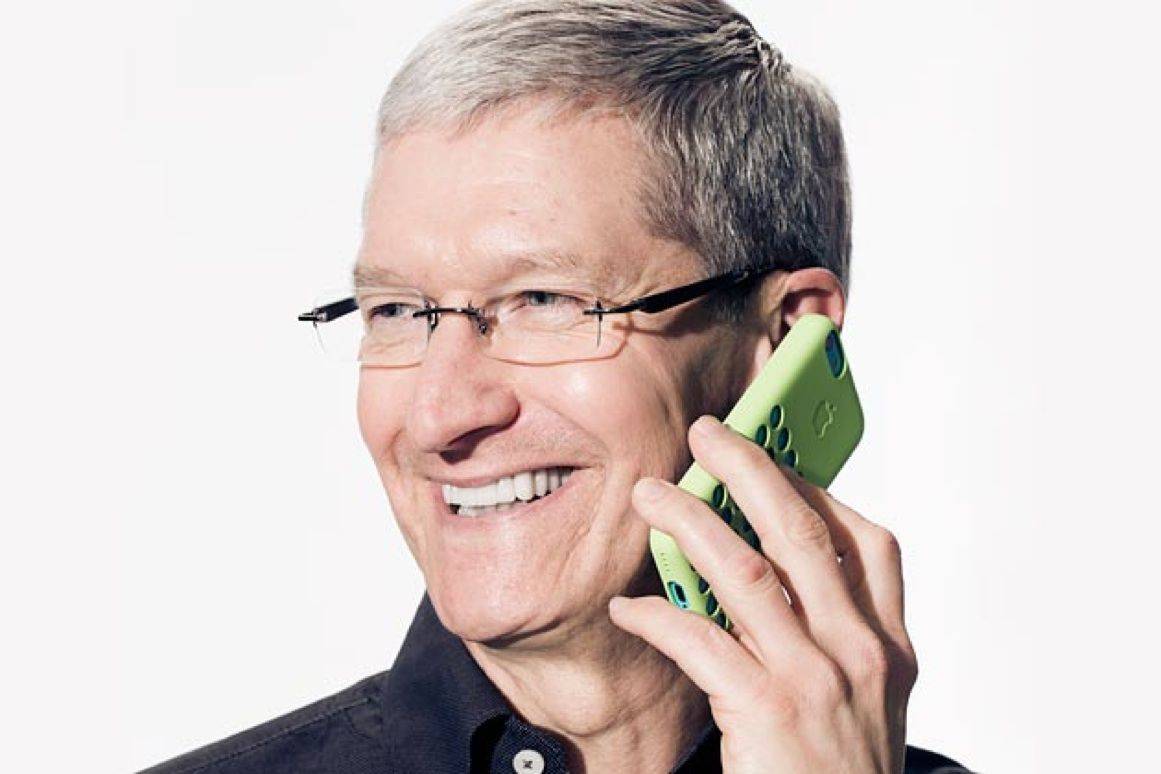

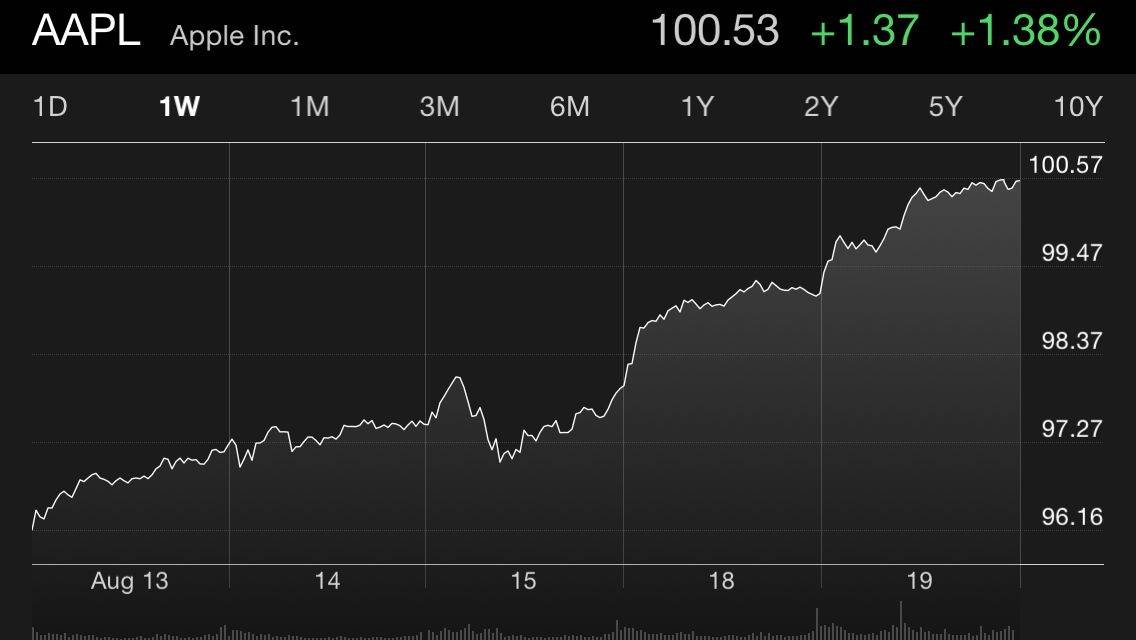

Apple stock plummeted Monday morning before Tim Cook stepped in by emailing Mad Money‘s Jim Cramer to reassure investors that all is well for Apple in China. The move quickly turned Apple’s stock price around, but Cook might have violated Securities and Exchange Commission rules in the process.

Tim Cook’s Mad Money email might have violated SEC rules

Photo: Jim Merithew/Cult of Mac