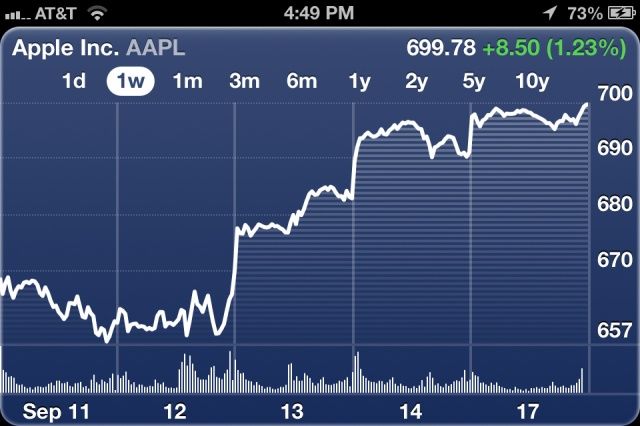

Earlier today, we reported that the Wall Street consensus was that Apple’s profit in this last quarter probably shrank for the first time in a decade, and that results will be even more dire next quarter, with iPhone sales units being extremely low.

But Wall Street’s pessimism in regards to Apple is, as usual, nuts. For Apple to perform as low as Wall Street thinks it will next quarter, Apple would have to show zero growth in the iPhone market compared to the same spring quarter a year ago. This would rank it as one of the smartphone industry’s worst disasters ever. Which is crazy, because Apple’s selling more iPhones than ever.

![Apple Is “Likely” To Buy Stock Back Or Issue More Dividends In Coming Months [Report] ap120611114097](https://www.cultofmac.com/wp-content/uploads/2013/03/ap120611114097.jpg)

![Apple Might Borrow Money To Double Dividend Paid To Investors [Rumor] Tim Cook, Phil Schiller and others sold Apple stock at a time when it was hitting record highs.](https://www.cultofmac.com/wp-content/uploads/2013/02/apple-money-logo.jpg)

![Apple Is No Longer The Most Valuable Public Company On Earth, And That’s Ok [Opinion] Is Apple to blame for its sliding stock?](https://www.cultofmac.com/wp-content/uploads/2013/01/121013_apple_ipad_660.jpg)

![5 Things Steve Jobs Would Have Been Proud Of At Apple In 2012 [Feature] What would Apple's late CEO be impressed with this year? (AP)](https://www.cultofmac.com/wp-content/uploads/2012/10/Steve-Jobs.jpg)

![Apple Stock Will Hit $1000, Says Gene Munster [Report] I'd dance, too, if I still owned all those AAPL shares I had in the 90s](https://www.cultofmac.com/wp-content/uploads/2012/05/Munster-Apple-Bullish.jpg)