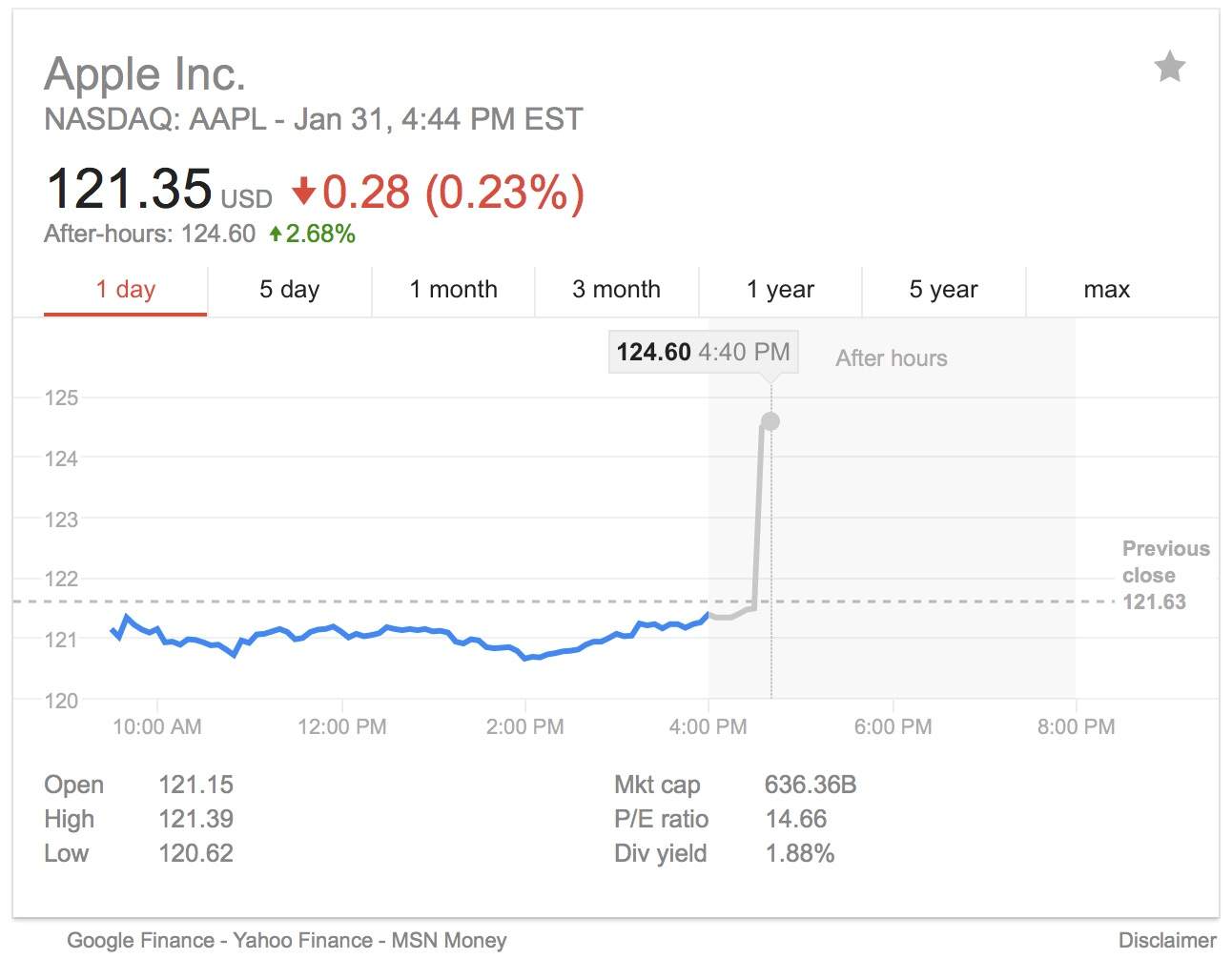

Apple stock slid 1.9 percent in pre-market trading today, after President Donald Trump laid out plans for new tariffs to be placed on the iPhone.

Overall, AAPL is trading down 20 percent this month. This latest blow comes after six weeks of declines for Apple, which became the first publicly traded U.S. company to pass a $1 trillion valuation earlier this year.