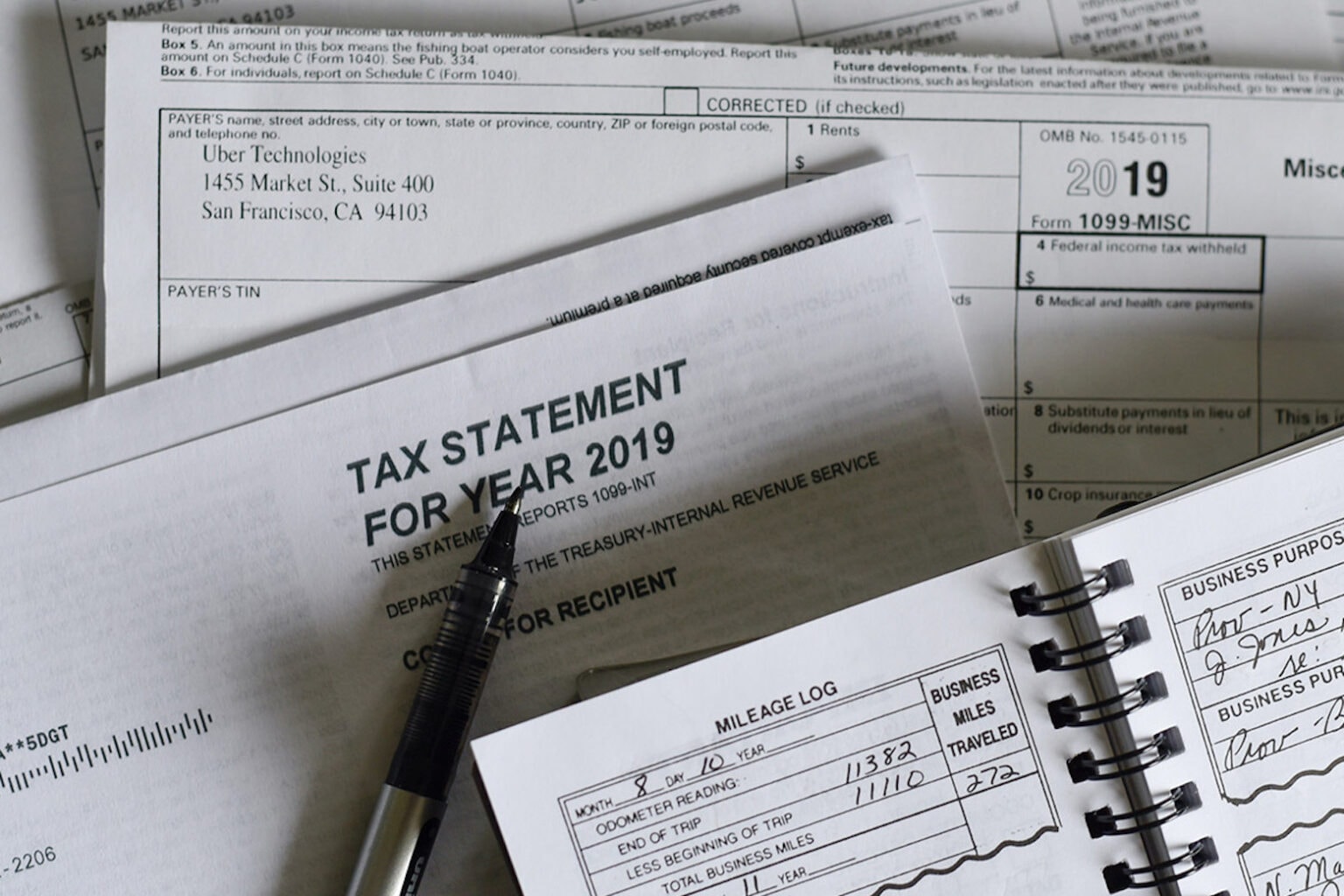

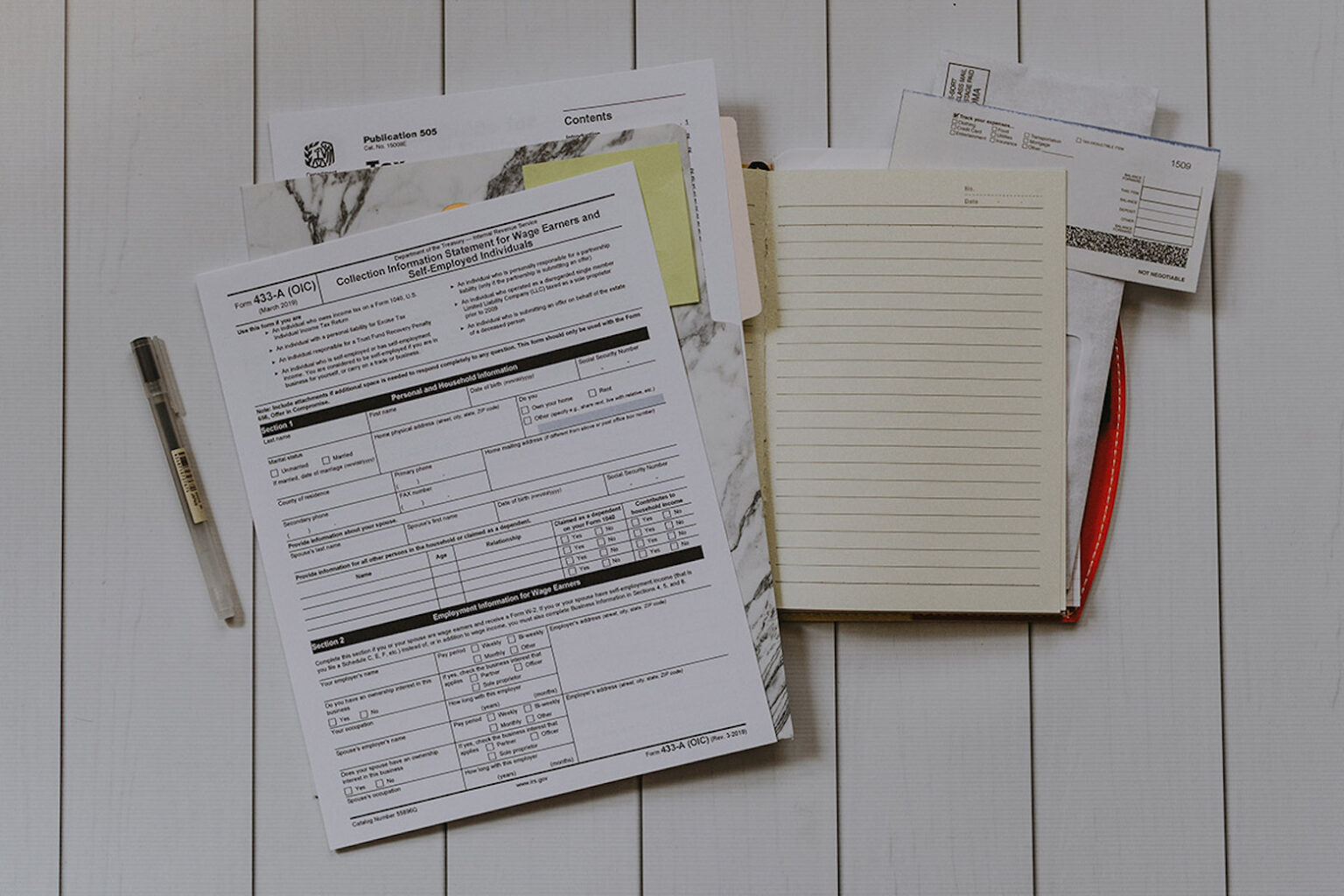

When it comes time to deal with tax season, the amount of required documents can quickly become overwhelming. You could always attempt to collect and protect paper printouts like some kind of hoarder. But the smart move in this modern era is to digitize all your documents with an iPhone scanning app.

With all your documents scanned, you will benefit from a major shortcut when filing taxes. And you can streamline the scanning process by picking up a discounted lifetime subscription to the highly rated iScanner app. Normally priced at $199, you can get this iPhone app for only $31.99 with code ENJOY20 for a limited time.

![Get your maximum tax refund with the deluxe edition of TurboTax [Deals] TurboTax](https://www.cultofmac.com/wp-content/uploads/2020/05/TurboTax-1536x768.jpeg)

![Get the help of a CPA and make filing taxes easier with Visor [Deals] Visor offers a new way to do your taxes, using a convenient app to connect with expert advisors.](https://www.cultofmac.com/wp-content/uploads/2019/01/Visor-Tax-Updated.jpeg)